|

|

|

|

|||||

|

|

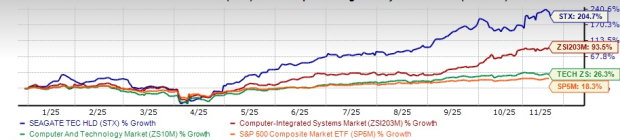

Seagate Technology Holdings plc’s (STX) shares have rallied 204.7% in the year-to-date period, outperforming the Zacks Computer-Integrated Systems industry’s growth of 93.5%. The stock has also outpaced the Zacks Computer & Technology sector and the S&P 500’s growth of 26.3% and 18.3%, respectively.

The company has also surpassed its competitors in the storage space, like Western Digital Corporation (WDC), Pure Storage (PSTG) and Micron Technology (MU). WDC, PSTG and MU have gained 163.5%, 36.7% and 181.5%, respectively, during the same time frame.

Western Digital is a diversified storage company offering a broad portfolio of HDD and NAND-based SSD solutions used across desktop PCs, servers, NAS devices, gaming consoles, DVRs and other consumer electronics. Micron manufactures and markets high-performance memory and storage technologies, including DRAM, NAND flash memory, NOR Flash, 3D XPoint memory and other technologies. Its solutions are used in leading-edge computing, consumer, networking and mobile products.

Pure Storage is redefining enterprise storage by delivering innovations designed to meet the demands of modern data workloads, especially in areas like AI, containerization and high-performance computing.

With AI transforming how data is created, stored and consumed, Seagate is becoming one of the most strategically positioned players in the global storage ecosystem. It reported a strong fiscal first quarter, achieving 21% year-over-year revenue growth and exceeding its guidance for non-GAAP EPS. Management emphasized the company’s solid execution and the increasing demand for high-capacity storage across cloud and enterprise environments. As cloud service providers (CSPs) and hyperscale companies accelerate their infrastructure buildouts, STX’s ability to efficiently scale production and meet customer demand is working in its favor.

Seagate’s advances in areal density continue to drive a clear total cost of ownership (TCO) advantage for hard drives, especially as AI workloads fuel demand for efficient, high-capacity storage. Customers are embracing higher-capacity HAMR drives as the most cost-effective solution to meet accelerating data needs. The production of its 24–28TB PMR drives has scaled significantly, making them its top-selling line by both revenue and exabytes. The company shipped more than 1 million HAMR-based Mozaic drives in the September quarter. As the only drives offering 3TB per disk, Mozaic products are in high demand, with five major global cloud providers already qualified and the remaining three expected by the first half of 2026.

Seagate is also qualifying its Mozaic 4+TB-per-disk platform (up to 44TB) with a second large CSP, with volume ramping in early 2026. The company remains on track to reach 50% exabyte crossover to nearline HAMR in the second half of 2026. Beyond that, Seagate is developing 5TB-per-disk technology for early 2028 and targeting 10TB-per-disk lab demonstrations around the same timeframe. Progress in media and photonics underpins these advancements. Mozaic HAMR represents STX’s competitive moat, positioning the company to dominate the next generation of data-infrastructure growth.

Seagate’s strategic business transformation and robust product pipeline position it for long-term success. It has restructured its revenue streams across two key markets — Data Center, encompassing nearline products and systems sold to cloud, enterprise and VIA customers and Edge IoT, covering consumer and client-focused segments, including network-attached storage. In the September quarter, data center revenues made up 80% of Seagate’s $2.1 billion total, rising 13% sequentially and 34% year over year.

Demand from global cloud providers remains strong, supported by a steady recovery in enterprise OEM markets. Seagate expects these trends to continue, with cloud growth leading. As AI shifts from training to large-scale inferencing, high-capacity storage needs are accelerating, driven by checkpointing and massive dataset requirements.

Amid tight supply, Seagate is working with data center customers to speed up qualifications of its high-capacity Mozaic HAMR drives. Most major cloud providers are now qualified, and production is ramping to meet demand. Strong data center growth offset softer Edge IoT performance, which contributed 20% of revenue at $515 million. It anticipates seasonal improvement in Edge IoT in the December quarter, supported by VIA, Edge and consumer products. High-capacity nearline production is primarily committed under build-to-order contracts through 2026, and long-term agreements with global data center customers give STX solid visibility into 2027, sustaining the demand trajectory.

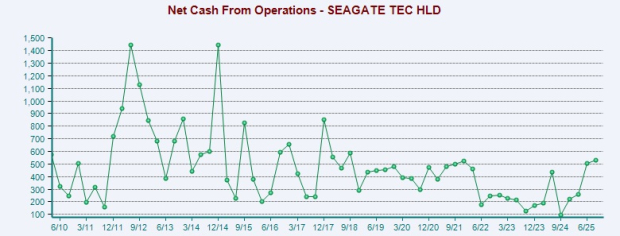

Moreover, its business model changes and strong product pipeline position it well for better profitability and cash flow in fiscal 2026. With solid cash flow, management gets the opportunity to invest in product innovations, acquisitions and business development. At the same time, the company has historically returned significant cash through a combination of share repurchases and dividends to reward its shareholders with risk-adjusted returns. Its focus on reducing its debt load by $684 million during fiscal 2025 while still maintaining generous shareholder returns shows a balanced approach to capital allocation.

For the fiscal first quarter, it reported $532 million in cash flow from operations and $427 million in free cash flow. During the quarter, Seagate returned capital to shareholders through a mix of dividends and share buybacks. The company paid $153 million in dividends and repurchased 153,000 shares for about $29 million. It anticipates stronger free cash flow generation in the December quarter.

Anchored by the growing adoption of its high-capacity nearline products and the continued execution of pricing initiatives, STX delivered a record gross margin of 40.1%, improving nearly 680 basis points year over year. Going ahead, management projects higher revenue and margin expansion as customers adopt its next-generation storage solutions. For the fiscal second quarter, it expects revenues of $2.7 billion (+/- $100 million). At the midpoint, this indicates a 16% year-over-year improvement. At the midpoint of revenue guidance, non-GAAP operating margin is projected to increase to approximately 30%.

However, Seagate faces several headwinds, including exposure to currency swings, fierce competition across the data storage market and ongoing macro and supply chain uncertainty. Its heavy debt burden increases financial risks, limiting flexibility for dividends, buybacks and acquisitions. Together, these pressures could constrain growth and weigh on long-term performance.

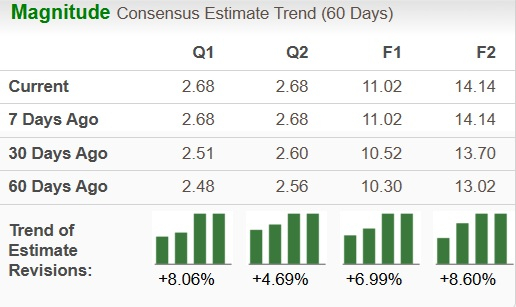

STX is currently witnessing an uptrend in estimate revisions. Earnings estimates for fiscal 2026 have increased 7% to $11.02 over the past 60 days, while the same for fiscal 2027 has gone up 8.6% to $14.14.

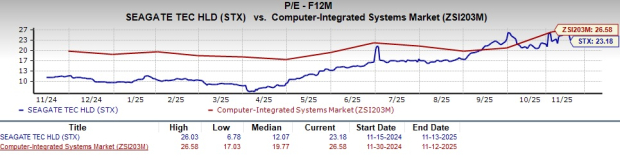

From a valuation standpoint, STX appears to be trading relatively cheaper compared with the industry but trading above its mean. Going by the price/earnings ratio, the company shares currently trade at 23.18 forward earnings, lower than 26.58 for the industry but above the stock’s mean of 12.01.

Seagate is benefiting from major multi-year tailwinds, including explosive AI-driven data creation, expanding cloud storage needs and rising demand across Edge and video ecosystems. Its next-generation HAMR-based HDDs are driving market share gains, supported by strong guidance and a breakthrough technology roadmap. Together, these factors position Seagate for near-term momentum and sustained long-term value creation.

Strong cloud-driven demand and growing HAMR traction helped Seagate start fiscal 2026 on a high note, posting robust performance and record margins. Boasting a Zacks Rank #1 (Strong Buy) at present, STX seems to be a good investment bet. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours |

Pure Storage Stock Jumps After Newly Rebranded Everpure Posts Earnings Beat

PSTG +8.62%

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite