|

|

|

|

|||||

|

|

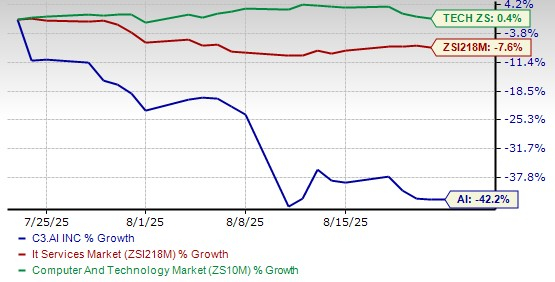

C3.ai, Inc. AI stock has experienced a significant decline, declining 42.2% over the past month. In fact, AI stock fell around 24% since it released its preliminary results for its fiscal first quarter, which ended on July 31, 2025. Recent news indicates challenges for the company, including quarterly revenue falling below expectations, which has impacted investor confidence.

The current stock price is around $16.86, with a 52-week high of $45.08 and a low of $14.70. The stock has been volatile, with a weekly volatility of about 12%, higher than most U.S. stocks.

1-Month Share Price Performance

Revenues are now expected to be in the range of $70.2 million to $70.4 million, well below both analysts’ expectations and the company’s own guidance given in May. GAAP operating loss is estimated to be in the range of $124.7 million to $124.9 million, while non-GAAP operating loss is predicted to be between $57.7 million and $57.9 million.

C3 AI’s CEO, Thomas Siebel, admitted the quarter’s sales performance was “completely unacceptable.” Siebel pointed to the company’s reorganization and his own health challenges as the primary reasons for the weak results.

The company closed the quarter with $711.9 million in cash, cash equivalents and marketable securities, underscoring a strong liquidity position despite the wider losses.

In late July, Siebel announced his intention to step down as CEO once a successor is found, citing serious health challenges, including an autoimmune diagnosis and vision impairment. This announcement, coupled with the abrupt results miss, heightened investor anxiety about the company's leadership and near-term trajectory.

The Zacks Consensus Estimate for fiscal 2026 and 2027 loss per share has widened to $1.39 and 47 cents from a loss of 42 cents and 16 cents in the past 30 days, respectively. The estimated figure indicates a widened loss for fiscal 2026, as you can see below.

Despite the rough preliminary first-quarter fiscal 2026 report, several underlying positives suggest that C3.ai may still be set up for a potential rebound.

First and foremost, the company boasts a robust financial cushion. As of late July 2025, C3.ai held approximately $711.9 million in cash, cash equivalents, and marketable securities, only modestly down from its April balance of $742.7 million. This sizable liquidity gives the firm a significant runway—even as it continues to operate at a non GAAP loss.

Second, management is taking serious action. The poor fiscal first quarter outcomes were openly attributed to the disruptive effects of reorganizing its sales and services functions, along with CEO Tom Siebel’s health-related absence from sales processes. However, these leadership and operational changes are now complete, with the company having installed a team of seasoned, enterprise sales executives across key roles. The restructuring brought in several industry veterans, including Rob Schilling as executive vice president and chief commercial officer and John Kitchingman as general manager for EMEA. The company also added Jeff Cosseboom as group vice president for North America East Sales and Lars Farnstrom as group vice president for the Nordics.

Third, the firm’s strategic positioning in key growth areas remains compelling. C3.ai’s ongoing expansion into diverse industries beyond its core oil and gas sector also contributes positively, with emerging traction in manufacturing, life sciences, and state and local government markets. Their AI solutions have been adopted by prominent customers such as the U.S. Air Force, Shell, SK, and the State of California, highlighting practical value and return on investment. They have introduced generative AI applications for government programs that improve constituent services and operational efficiency.

Finally, the firm's market positioning remains unique. C3.ai differentiates itself from other enterprise AI providers by offering industry-specific, prebuilt AI applications and a full-stack, low-code development platform—enabling quicker deployments across sectors like defense, healthcare, energy, and beyond. These capabilities, paired with strategic alliances—such as go to market relationships with Microsoft MSFT, Amazon’s AMZN AWS, Alphabet’s GOOGL Google Cloud, PwC, and McKinsey QuantumBlack—continue to bolster C3.ai's market reach and credibility.

In summary, even in the face of a dismal quarter, C3.ai retains several positive undercurrents: a strong cash reserve, a refreshed sales leadership structure aimed at operational stabilization, growing traction in high-value AI segments like generative and federal contracts, and optimistic investor projections suggesting meaningful upside if execution improves. The company’s success over the remainder of fiscal 2026—and its ability to reach positive free cash flow by the fiscal fourth quarter—will be pivotal in determining whether these positives can translate into a real rebound.

AI stock is priced at a discount relative to its industry. It has a forward 12-month price-to-sales ratio of 5.44, which is well below the industry average.

P/S (F12M)

C3.ai operates in a vibrant and highly competitive enterprise AI landscape, with key challengers ranging from tech behemoths to specialized AI innovators. Major cloud and AI players like Microsoft, Amazon, Google, and NVIDIA frequently appear in comparisons due to their substantial investments and robust AI platforms. Again, Palantir and DataRobot challenge C3.ai in enterprise analytics and AI solutions. Consulting and IT service providers like Accenture, Infosys, and Wipro also compete in large-scale enterprise AI deployments. Additionally, data-focused platforms such as Databricks, Snowflake, and Alteryx offer alternative machine learning and AI environments. This mix of cloud leaders, AI specialists, and IT integrators makes the competitive landscape highly dynamic.

C3.ai’s steep 42% monthly decline, wider-than-expected losses, and leadership uncertainty signal heightened risk for investors. The CEO’s pending departure, weak revenue outlook, and volatility underscore operational instability, while downward estimate revisions highlight deteriorating fundamentals. Despite a solid cash position and potential in enterprise AI, execution challenges and lack of near-term visibility outweigh the positives. With a Zacks Rank #4 (Sell) and mounting investor skepticism, C3.ai’s risk-reward profile remains unfavorable. For now, investors would be better served exiting positions rather than betting on an uncertain rebound.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 47 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Nvidia Beats Back Bubble Fears With Record $68 Billion in Sales in Fourth Quarter

AMZN

The Wall Street Journal

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite