|

|

|

|

|||||

|

|

On Aug. 22, Fed Chairman Jerome Powell, in his speech at the central bank’s annual Jackson Hole Symposium for Economic Policies, gave a tepid indication of possible interest rate cuts in the rest of 2025. The Fed’s next FOMC meeting is scheduled for September.

Despite a lukewarm hint, the CME FedWatch currently shows a 75% probability of a 25 basis-point cut in the benchmark lending rate in September and a 71% chance of two rate cuts of 25 basis points this year. The existing Fed Fund rate is in the range of 4.25-4.5%.

The immediate effect of Powell’s speech was seen on Wall Street. On Aug. 22, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — rallied 1.9%, 1.5% and 1.9%, respectively. The small-cap benchmark — the Russell 2000 — jumped 3.9%.

The 30-stock Dow — popularly known as Wall Street’s blue-chip index — climbed 846.24 points to close at 45,631.74. This marked its new closing high in history. During intraday trading, the index touched a new all-time high of 45,757.84.

At this stage, it will be prudent to invest in blue-chip stocks with a favorable Zacks Rank. Five such stocks are: JPMorgan Chase & Co. JPM, The Goldman Sachs Group Inc. GS, Johnson & Johnson JNJ, The Walt Disney Co. DIS and Microsoft Corp. MSFT.

Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The anticipation of a Fed rate cut and extremely high valuation of the technology sector compelled market participants to shift from technology to other rate-sensitive cyclical sectors, such as utilities, industrials, financials, energy, materials and health care.

Dow is more inclined toward cyclical stocks. Technically, at its current level of 45,631.74, the Dow is well above its 50-day and 200-day moving averages of 44,116.75 and 43,033.36, respectively. The 50-day moving average line is generally recognized as a short-term trendsetter in financial literature, while the 200-day moving average is considered a long-term trendsetter.

Historically, it has been noticed in the technical analysis space that whenever the 50-day moving average line surges ahead of the 200-day moving average line, a long-term uptrend for the asset (in this case, the Dow Index) becomes a strong possibility.

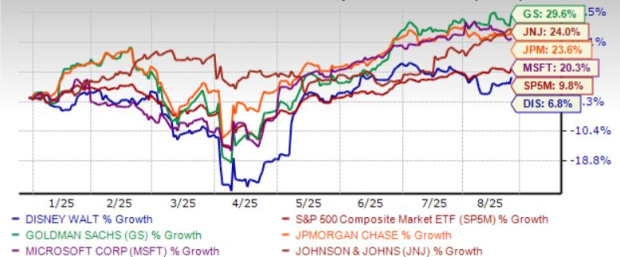

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 JPMorgan Chase’s business expansion initiatives, loan demand and relatively high interest rates should drive net interest income (NII) growth. We project NII to witness a CAGR of 2.9% by 2027.

While normal deal-making activity is tied to the health of the economy, JPM’s solid pipeline and leadership have generated continued growth in the investment banking business thus far.

A solid pipeline and market leadership continue to support investment banking (IB) business, though capital markets volatility and high mortgage rates will likely weigh on fee income. JPM emphasized the importance of AI in boosting efficiency and noted that its technology budget is $18 billion this year, up roughly 6% from last year.

JPMorgan Chase has an expected revenue and earnings growth rate of -0.2% and -1.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% in the last 30 days.

Zacks Rank #1 The Goldman Sachs Group has been benefiting from solid growth in the Global Banking & Markets division. Its refocus on the core strengths of investment banking (IB) and trading businesses through restructuring, along with acquisitions and expansion in private equity credit, is expected to boost global presence and diversify revenues. After clearing the 2025 Fed stress test, it raised dividends.

GS maintained its leading position in announced and completed mergers and acquisitions (M&A) in the second quarter of 2025, reinforcing its strength in Global Banking & Markets. After a slowdown in 2022-2023 due to weak M&A activity, investment banking revenues rebounded in 2024.

Although 2025 began with optimism, market sentiment briefly dipped following Trump’s tariff plans announced on 'Liberation Day.” Still, M&A activity has regained momentum, and GS’ IB revenues continued to grow in the first half of 2025. A strong deal pipeline and GS’ leadership position signal further upside as macro conditions improve.

The Goldman Sachs Group has an expected revenue and earnings growth rate of 6.3% and 12.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.3% in the last 60 days.

Zacks Rank #2 Johnson & Johnson boasts a major MedTech division (Johnson & Johnson MedTech) focused on medical devices and diagnostics. JNJ applies AI technologies for surgical robotics, digital surgery analytics and imaging. The company has developed an AI-enabled ecosystem called Ottava, its next-gen robotic surgery platform.

JNJ has also developed the Caresurgical/VELYS digital surgery systems, which use data and AI for procedure planning. Its Polyphonic Digital Ecosystem connects operating rooms, allowing surgeons to share live video and data with remote peers. The AI in this system helps identify significant events in the surgery video feed for discussion.

Johnson & Johnson has an expected revenue and earnings growth rate of 5.2% and 8.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Zacks Rank #2 The Walt Disney is benefiting from strength in Domestic Parks & Experiences revenues driven by growth at domestic parks, Disney Vacation Club and Disney Cruise Line, partially offset by decline at international locations including Shanghai Disney Resort and Hong Kong Disneyland Resort.

As of June 28, 2025, Disney+ had 127.8 million paid subscribers compared with 126 million as of March 29, 2025. Domestic Disney+ average monthly revenue per paid subscriber increased 0.4% sequentially to $8.09 as higher advertising revenues were offset by the impact of subscriber mix shifts.

International Disney+ (excluding Disney+ Hotstar) average monthly revenue per paid subscriber rose 2% sequentially to $7.67 due to increases in prices and subscriber mix shifts. Hulu SVOD Only average monthly revenue per paid subscriber increased 0.3% sequentially to $12.4, as higher advertising revenues were offset by the impact of subscriber mix shifts.

In the fourth quarter of fiscal 2025, Disney expects total Disney+ and Hulu subscriptions to increase by more than 10 million from third-quarter fiscal 2025, with the majority of this growth coming from Hulu as a result of an expanded Charter deal. For Disney+ subscribers specifically, the company anticipates a modest increase compared to third-quarter fiscal 2025 levels.

DIS provided comprehensive guidance for fiscal 2025, projecting adjusted earnings per share of $5.85, representing an 18% increase over fiscal 2024. For the Entertainment segment, the company expects Direct-to-Consumer operating income of $1.3 billion and double-digit percentage segment operating income growth overall. The Sports segment is projected to achieve 18% segment operating income growth, while the Experiences segment is expected to deliver 8% segment operating income growth.

The Walt Disney has an expected revenue and earnings growth rate of 3.9% and 17.7%, respectively, for the current year (ending September 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Zacks Rank #2 Microsoft has been capitalizing on AI business momentum and Copilot adoption, alongside accelerating Azure cloud infrastructure expansion. Strong Office 365 Commercial demand has been propelling Productivity and Business Processes revenue growth. ARPU (average revenue per user) is increasing through the E5 and M365 Copilot uptake across key segments.

Microsoft delivered exceptional growth across its Azure, AI and Copilot platforms during the fourth quarter of fiscal 2025, demonstrating its leadership in the AI transformation. MSFT added more than two gigawatts of new capacity and made every Azure region AI-first, with all locations now supporting liquid cooling for enhanced performance and flexibility. Despite stiff competition in the AI-powered cloud space, Azure holds approximately 20-24% of the global cloud market share.

The AI momentum extends beyond infrastructure, with Microsoft's Copilot products achieving significant traction. The company reported that its AI assistants, including Microsoft 365 Copilot for commercial customers and the consumer Copilot in Windows, have reached 100 million monthly active users. This rapid adoption demonstrates MSFT’s ability to monetize AI investments through practical applications that enhance productivity across its ecosystem.

Microsoft's differentiated approach, focusing on hybrid cloud solutions and enterprise integration, continues to resonate with customers. The company's ability to deliver consistent growth while operating at such a massive scale demonstrates the sustainability of its competitive advantages and the effectiveness of its strategic investments.

Microsoft has an expected revenue and earnings growth rate of 13.9% and 12.5%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| 27 min | |

| 45 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite