|

|

|

|

|||||

|

|

In the ever-competitive beverage industry, a few matchups are as intriguing as The Coca-Cola Company KO and Monster Beverage Corporation MNST. Coca-Cola, the global soft drink titan, commands an unrivaled market presence with a portfolio spanning sparkling sodas, juices, teas, coffees, and water brands. Monster Beverage, in contrast, has carved out a dominance in the high-growth energy drink segment, building a loyal consumer base that thrives on brand identity and bold marketing.

While Coke’s strength lies in scale, global reach and brand heritage, Monster Beverage’s edge comes from category leadership in a niche that continues to expand at double-digit rates worldwide.

The face-off is more than just one of size versus specialization; it is a clash of strategies. Coca-Cola’s diversified beverage empire gives it resilience and steady cash flows, but it has long eyed energy drinks as a critical growth lever in a slowing soda market. Monster Beverage, despite being a fraction of Coke’s size, holds a commanding share in energy drinks, a category expected to outpace broader non-alcoholic beverages in the coming years. The relationship is further complicated by Coca-Cola’s stake in Monster Beverage, making them partners in distribution but rivals in capturing consumer dollars.

As investors and industry watchers weigh the prospects of both, the battle lines are drawn around market share, positioning and business models. Does Coca-Cola’s breadth of categories and global penetration make it the safer bet, or does Monster Beverage’s focused dominance in a high-octane segment offer a more compelling growth story? This face-off pits legacy against agility, scale against specialization, in a contest shaping the future of refreshment.

Coca-Cola remains one of the strongest consumer goods companies in the world, commanding a global market share that makes it a cornerstone of the non-alcoholic beverage industry. With $30-billion brands across sparkling soft drinks, hydration, nutrition, dairy and coffee, Coca-Cola’s breadth enables it to capture diverse consumer occasions and demographics.

In the second quarter of 2025, the company posted 5% organic revenue growth and marked its 17th consecutive quarter of value share gains. However, unit case volume fell 1% due to weather and uneven consumer demand. Brands like Coca-Cola Zero Sugar, Sprite and fairlife stood out, showcasing KO’s ability to blend the strength of its core portfolio with on-trend innovations.

The company is advancing its “all-weather strategy,” adapting to local market dynamics while leveraging global scale. Innovation remains central, Sprite + Tea and an upcoming cane sugar Coke highlight how KO is meeting consumer demand for differentiated, premium experiences. At the same time, digital tools and AI-powered revenue management are enhancing pricing, distribution and consumer engagement. Marketing activations like “Share a Coke” demonstrate KO’s ability to combine cultural relevance with digital scale.

Financially, Coca-Cola is navigating tariff and trade headwinds with agility. Second-quarter 2025 operating margins expanded 190 basis points (bps), supported by productivity initiatives and pricing power. With 2025 guidance calling for 5-6% organic revenue growth and 8% currency-neutral EPS growth, KO offers resilience, innovation-driven momentum and strong shareholder value.

Monster Beverage continues to cement its position as a powerhouse in the global energy drink sector, with second-quarter 2025 net sales reaching a record $2.11 billion, up 11.1% year over year. The company commands a strong share of the fast-growing energy drink category, wherein household penetration is rising across geographies.

With 41% of sales now generated outside the United States, Monster Beverage’s global footprint is expanding rapidly, particularly in EMEA and the Asia-Pacific. According to Nielsen, MNST is the seventh-largest FMCG brand by value in Western Europe, underscoring its growing relevance within the wider consumer goods industry.

The company’s brand portfolio, led by its flagship Monster Energy line and the billion-dollar Ultra family, continues to thrive through innovation, premium positioning and demographic appeal to younger, lifestyle-driven consumers. The latest launches, like Ultra Wild Passion, and collaborations, such as the McLaren Formula 1 Zero Sugar edition, highlight its ability to blend product innovation with cultural relevance.

Strategic pricing adjustments, alongside a balanced mix of premium and affordable offerings, reinforce Monster Beverage’s value proposition and strengthen its competitive moat. Digital engagement, viral campaigns, and sponsorships in sports and music festivals are further elevating its brand equity and consumer resonance.

In second-quarter 2025, Monster Beverage delivered robust performance with EPS of 52 cents, a 21% increase, and the gross margin expanding to 55.7%, thanks to pricing actions and supply-chain optimization. While tariff-related pressures, particularly aluminum costs, remain a modest headwind, the company’s localized production and hedging strategies mitigate broader impacts.

By combining strong international growth, a resilient innovation pipeline, and effective margin management, Monster Beverage positions itself as one of the most compelling long-term investment cases in the consumer staples sector.

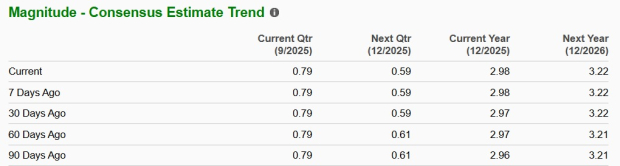

The Zacks Consensus Estimate for Coca-Cola’s 2025 sales and EPS implies year-over-year growth of 3.2% and 3.5%, respectively. The EPS estimates have moved up by a penny in the past 30 days.

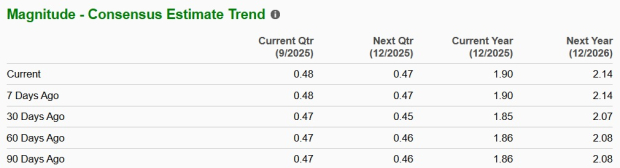

The Zacks Consensus Estimate for Monster Beverage’s 2025 sales and EPS suggests year-over-year growth of 7.7% and 17.3%, respectively. EPS estimates have moved up 2.7% in the past 30 days.

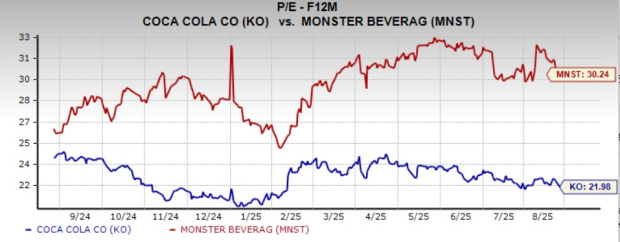

Coca-Cola currently trades at a forward 12-month P/E ratio of 21.98X, which is above the Zacks Beverages - Soft drinks industry average of 18.24X. However, KO trades at a lower multiple than that of MNST’s 30.24X, making it the more value-oriented pick among the two.

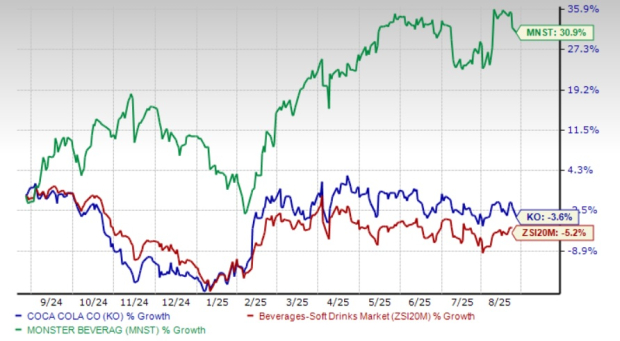

Despite KO being the more value-oriented option based on valuation alone, investors pay up for MNST because it consistently delivers stronger returns. In the past year, Monster Beverage’s stock has rallied 30.9% against KO’s decline of 3.6% and the broader industry’s fall of 5.2%. While KO offers a lower valuation, Monster Beverage’s stronger stock performance and solid growth trajectory give it the edge.

In weighing Coca-Cola against Monster Beverage, investors face a classic trade-off between stability and growth. KO offers unmatched scale, an extensive portfolio and steady cash flows, making it a cornerstone of the consumer goods space. Monster Beverage, however, stands out with its ability to consistently deliver stronger stock returns, underpinned by rising analyst confidence and upward estimate revisions.

Monster Beverage’s dominance in the high-growth energy drink category, global expansion and innovation-led strategy give it an enviable position in the marketplace. While MNST trades at a higher multiple than its larger rival, investors appear willing to pay a premium for its faster growth trajectory and category leadership. With a Growth Score of B and bright prospects ahead, Monster Beverage edges out Coca-Cola in this matchup.

Both KO and MNST carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite