|

|

|

|

|||||

|

|

Nabors Industries Ltd. NBR is a global leader in drilling and drilling-related services for land-based and offshore oil and natural gas wells. Operating through four segments — U.S. Drilling, International Drilling, Drilling Solutions, and Rig Technologies — the Hamilton-based company combines scale with advanced technologies to strengthen its market position. Nabors’ portfolio includes managed pressure drilling, tubular running and torque monitoring services. Complementing its fleet of land and platform rigs, the company manufactures and sells critical drilling equipment — top drives, wrenches, catwalks and robotic systems — while providing aftermarket support. This diversified mix of services, technology and global presence positions Nabors as a key player in the energy sector.

In today’s dynamic market environment, making the right call on a stock can significantly impact an investor’s portfolio. With shifting economic indicators, evolving industry trends and company-specific developments, investors must continually reassess their positions. Let us take a closer look at Nabors’ current standing and outcomes and decide whether it is the right time to invest, exit or adopt a "wait-and-watch" strategy.

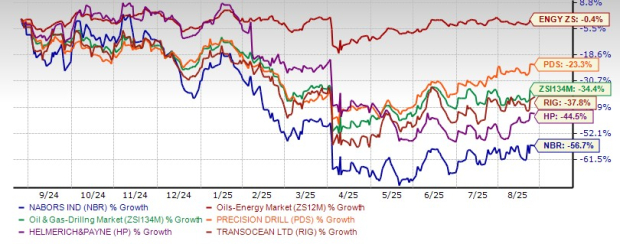

In the past year, Nabors’shares have plunged 56.7%, underperforming the Oil & Gas Drilling sub-industry’s decline of 34.4% and the broader oil and energy sector's modest fall of 0.4%. Peer comparison further highlights the weakness, where Precision Drilling Corporation PDS, Helmerich & Payne, Inc. HP and Transocean Ltd. RIG fell 23.3%, 44.5% and 37.8%, respectively.

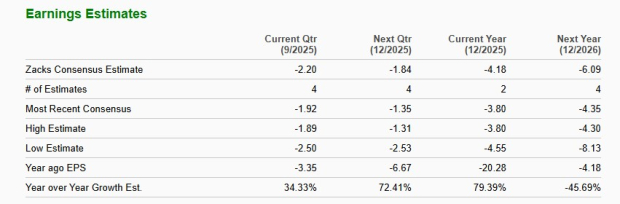

For 2025, the Zacks Consensus Estimate projects Nabors’ loss to narrow from $20.28 per share a year ago to $4.18, reflecting a 79.4% year-over-year improvement. Moreover, the consensus mark for revenues is also pegged at $3.2 billion for 2025, implying a 10.6% year-over-year rise. The Zacks Consensus Estimate for Precision Drilling and Helmerich & Payne’s (fiscal year ending on September 2025) 2025 earnings indicates a 17.5% and 65.4% year-over-year decline, respectively. The consensus mark for Transocean’s 2025 earnings indicates 107.7% growth.

Strong Revenue Growth: Nabors posted operating revenues of $833 million in the second quarter of 2025, up from $735 million in the year-ago quarter, reflecting robust operational momentum. This increase was driven by higher rig deployments and improved performance across International Drilling and Drilling Solutions segments, suggesting that the company’s diversified portfolio is resilient. Momentum in revenues underscores Nabors’ ability to capture opportunities across geographies and service lines. Such sequential growth builds investor confidence in the company’s capacity to sustain top-line expansion through 2025.

SANAD JV Growth With Saudi Aramco: The SANAD joint venture (JV) is a long-term growth engine. Two new rigs were deployed in Saudi Arabia in the second quarter, bringing the total to 12, while Saudi Aramco awarded a fourth tranche of five additional newbuilds. These will start operations between 2026 and 2027, ensuring multi-year visibility of earnings. Given Saudi Aramco’s scale and stability, SANAD provides Nabors with a reliable revenue stream and strengthens its strategic foothold in one of the most critical energy markets, positioning the company well for durable international expansion.

Successful Integration of Parker Wellbore Acquisition:The March 2025 acquisition of Parker Wellbore already contributed materially in the second quarter, exceeding expectations in both margins and cash flow. Parker’s Quail Tools and drilling product lines have lifted Nabors’ Drilling Solutions EBITDA to $76.5 million from $40.9 million in the first quarter. The integration has been ahead of schedule, with synergy realization tracking above the $40 million target set for the year, demonstrating strong execution. Parker’s operations, particularly in Alaska, the Gulf of Mexico and international markets like the Middle East and India, have broadened Nabors’ global reach while reinforcing its technology-driven portfolio. Effective integration is a strong signal that Nabors can execute on transformative deals, enhance its service portfolio and drive higher returns for shareholders.

Record-Setting Technology & SmartRig Milestones: Nabors’ PACE series rigs set new drilling records in multiple U.S. basins. A four-mile lateral in the Bakken, a 20,000-foot lateral in the Haynesville, and the longest Eagle Ford well at over 32,500 feet set several milestones. These technological milestones highlight Nabors’ leadership in high-spec drilling and automation. Clients increasingly seek advanced rigs to improve efficiency and reduce costs, and the company’s ability to consistently deliver record performance strengthens its competitive positioning, driving demand, pricing power and long-term value creation.

Continuing Trend of Net Loss: For the year ended Dec. 31, 2024, Nabors reported astaggering adjusted loss of $6.67 per share, and since then, the trend has continued, with it reporting an adjusted loss of $2.71 per share in the second quarter of 2025 compared with a $4.29 per share loss in the prior-year quarter. The company’s inability to translate higher revenues and EBITDA into positive net earnings highlights persistent cost pressures, heavy depreciation and interest expenses. Although its loss has narrowed down from the previous quarters, persistent negative earnings also hinder the firm’s ability to reinvest in growth or strengthen its balance sheet, making the stock less attractive for long-term investors.

Heavy Debt Load Remains a Risk: Nabors’ long-term debt stood at $2.7 billion as of June 30, 2025, reflecting a total debt-to-total capital of 80.7%. Interest expense during the second quarter also reached $56 million, eroding profitability and limiting financial flexibility. Although management plans refinancing, elevated debt burdens make the company vulnerable to credit market conditions and interest rate changes. Any delay in free cash flow growth or refinancing execution could intensify balance sheet risk, deterring risk-averse investors. However, in terms of debt load, Nabors has a competitive edge over Precision Drilling, which, in its second-quarter results, reported a high long-term debt of C$5.5 billion. In order to strengthen its balance sheet and reduce its debt obligations, the company recently divested its Quail Tools business, a high-performing tubulars subsidiary, to Superior Energy for $600 million. With this deal, Nabors expects a net debt reduction of more than 25%, or $625 million, along with $50 million in annual interest savings.

Lower 48 Rig Market Weakness: While Nabors stabilized its Lower 48 rig count at around 62 rigs, margins remain under pressure. Daily adjusted gross margin fell to $13,900 from $15,600 a year ago, reflecting soft oil-focused drilling demand and pricing competition. Management further expects its daily adjusted gross margin to fall to about $13,300 in the third quarter of 2025 and also a flat-to-down oil activity in U.S. basins for the rest of the year. Given the segment’s importance, sustained weakness in U.S. shale drilling could cap near-term earnings growth, especially if natural gas activity does not offset softness in oil basins. Helmerich & Payne’s North America Solutions segment delivered solid performance in the third quarter of fiscal 2025, generating direct margins of $266 million, which translated to a margin per day of $19,860, reinforcing its competitive edge.

Capital-Intensive Growth Strategy: Nabors’ capex guidance for 2025 is $700-$710 million, including $300 million for SANAD rigs and $60 million for Parker. While these investments support long-term growth, they strain short-term cash flows and add execution risk. In the second quarter alone, capex consumed $142 million, more than offsetting operating cash flow before adjustments. Any delay in SANAD projects or slower customer payments (as seen in Mexico) could tighten liquidity. Investors wary of capital-heavy business models may see this as a structural challenge for shareholder returns. Comparatively, Transocean has low capital requirements, with only $120 million estimated by the management for the full year of 2025.

The Zacks Rank #3 (Hold) company presents a mixed investment case where the positives and challenges offset each other. On the one hand, Nabors is demonstrating revenue growth, successful integration of Parker Wellbore, record-setting technology milestones and expanding international opportunities through the SANAD joint venture with Saudi Aramco. These factors provide visibility for long-term growth, strengthen global positioning, and highlight the company’s technological leadership in high-spec drilling. However, persistent net losses, a highly leveraged balance sheet, and pressure in the U.S. onshore drilling market weigh on near-term profitability and stock performance.

With shares having already underperformed peers like Precision Drilling, Helmerich & Payne and Transocean, much of the downside risk appears priced in, while upcoming earnings improvements and revenue growth could support a gradual recovery.

In this context, investors should consider adopting a hold strategy for now to monitor Nabors’ execution on debt reduction, cost management, and SANAD-driven growth while avoiding premature exit before these initiatives potentially translate into shareholder value.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite