|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Market participants across the world are eagerly waiting for a possible interest rate cut by the Fed in its September FOMC meeting. Expectations for a rate cut next month rose following Fed Chairman Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium on Aug. 22.

The CME FedWatch currently shows a 87.3% probability of a 25 basis-point cut in the benchmark interest rate next month. Moreover, the interest rate derivative tool shows a 64% chance of a total 50 basis-point cut by the end of this year. The Fed Fund rate is currently in the range of 4.25-4.5%.

Structurally, the consumer discretionary sector is growth-oriented. The share prices of these companies grow over a long time period. Growth sectors are sensitive to the movement of market interest rates and are inversely related.

A low-interest rate will reduce the discount, thereby raising the net present value of investment in growth stocks. Consequently, a low-interest rate regime will benefit growth sectors such as consumer discretionary, technology and cryptocurrency.

At this stage, investment in consumer discretionary stocks with a favorable Zacks Rank should bear fruit. Five such stocks are: Netflix Inc. NFLX, The Walt Disney Co. DIS, Carnival Corporation & plc CCL, Ralph Lauren Corp. RL and Hasbro Inc. HAS. Each of our picks currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

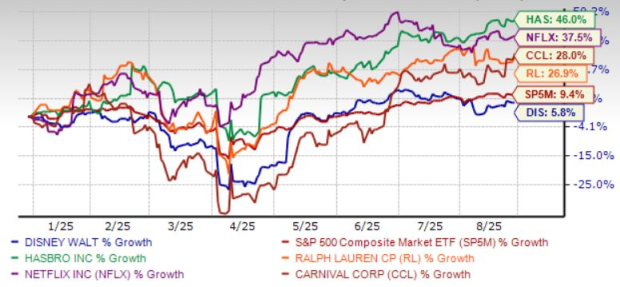

The chart below shows the price performance of our five picks year to date.

Netflix reported strong second-quarter 2025 earnings results driven primarily by membership growth, higher subscription pricing and increased ad revenues. The second-quarter content slate wrapped up on a high note as Squid Game S3 (122M views) became the company’s sixth biggest season of any series in just a few weeks of viewing.

On April 1, NFLX launched its Ad Suite in the United States and ramped it up in international markets. The ad-supported offerings will enable management to witness impressive subscribers and ARPU (average revenue per user) growth.

Netflix uses AI, data science and machine language extensively to provide consumers with more appropriate and intuitive suggestions. Netflix's AI platform takes into account an individual’s viewing habits and hobbies and accordingly provides recommendations. AI applications enable NFLX to offer a high-quality streaming service at reduced bandwidths.

NFLX raised its full-year 2025 revenue forecast to $44.8-$45.2 billion from the previous range of $43.5-$44.5 billion. The increase in revenues stems from multiple growth drivers working in tandem. Member growth accelerated toward the end of the second quarter, exceeding internal forecasts, while NFLX’s advertising business continues to gain traction with expectations to roughly double ad revenues in 2025.

Netflix has an expected revenue and earnings growth rate of 15.5% and 31.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.9% over the last 60 days.

The Walt Disney is benefiting from strength in Domestic Parks & Experiences revenues driven by growth at domestic parks, Disney Vacation Club and Disney Cruise Line, partially offset by a decline at international locations including Shanghai Disney Resort and Hong Kong Disneyland Resort.

As of June 28, 2025, Disney+ had 127.8 million paid subscribers compared with 126 million as of March 29, 2025. Domestic Disney+ average monthly revenue per paid subscriber increased 0.4% sequentially to $8.09 as higher advertising revenues were offset by the impact of subscriber mix shifts.

International Disney+ (excluding Disney+ Hotstar) average monthly revenue per paid subscriber rose 2% sequentially to $7.67 due to increases in prices and subscriber mix shifts. Hulu SVOD Only average monthly revenue per paid subscriber increased 0.3% sequentially to $12.4, as higher advertising revenues were offset by the impact of subscriber mix shifts.

In the fourth quarter of fiscal 2025, Disney expects total Disney+ and Hulu subscriptions to increase by more than 10 million from third-quarter fiscal 2025, with the majority of this growth coming from Hulu as a result of an expanded Charter deal. For Disney+ subscribers specifically, the company anticipates a modest increase compared to third-quarter fiscal 2025 levels.

DIS provided a comprehensive guidance for fiscal 2025, projecting adjusted earnings per share of $5.85, representing an 18% increase over fiscal 2024. For the Entertainment segment, the company expects Direct-to-Consumer operating income of $1.3 billion and double-digit percentage segment operating income growth overall. The Sports segment is projected to achieve 18% segment operating income growth, while the Experiences segment is expected to deliver 8% segment operating income growth.

The Walt Disney has an expected revenue and earnings growth rate of 3.9% and 17.7%, respectively, for the current year (ending September 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Carnival has outpaced the broader industry over the past year, driven by resilient travel demand, stronger booking trends, higher onboard spending, and disciplined cost management. CCL’s solid execution across these areas led management to raise its full-year 2025 guidance, supported by operational efficiencies and strategic growth initiatives.

Thanks to improved operational execution across its brands, CCL has been witnessing solid booking trends for a few quarters. Looking ahead, bookings for 2026 are tracking in line with the record levels seen in 2025, also at historically elevated pricing. With the booking window stretching further than ever, Carnival is firmly positioned to sustain long-term growth momentum.

CCL is also prioritizing fleet optimization, new ship launches, and targeted marketing investments to capture rising global demand. CCL’s strategic investment in advertising is yielding significant returns, stimulating demand across its portfolio with the launch of several new campaigns during the peak season.

Carnival has an expected revenue and earnings growth rate of 5.9% and 40.9%, respectively, for the current year (ending November 2025). The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 60 days.

Ralph Lauren has outperformed the industry in the past year, driven by the strategic execution of its “Next Great Chapter: Accelerate Plan” and robust financial performance. The plan focuses on brand elevation, consumer centricity, and operational agility.

Digital transformation drives RL’s growth, with investments in personalization, mobile, omnichannel, and fulfillment enhancing consumer engagement. Retail and wholesale remain key pillars for RL, with flagship stores, premium distribution, and partnerships boosting comparable sales across North America, Europe, and Asia in first-quarter fiscal 2026.

Digital transformation is another positive for Ralph Lauren, with continued investments in personalization, data analytics, and seamless omnichannel experiences to engage consumers across platforms.

RL is optimizing distribution, strengthening wholesale partnerships, and elevating its retail network to reflect its premium positioning. Operational initiatives, including supply chain improvements, inventory discipline, and productivity gains, aim to expand margins while offsetting tariff impacts.

Ralph Lauren has an expected revenue and earnings growth rate of 6% and 19.8%, respectively, for the current year (ending March 2026). The Zacks Consensus Estimate for current-year earnings has improved 7.5% over the last 30 days.

Hasbro is focused on high-margin segments such as Wizards, Licensing and Digital supporting its bottom-line growth. Also, HAS’ focus on the entertainment pipeline, strategic partnerships and product innovations bodes well.

Hasbro is actively leveraging partnerships to accelerate growth across digital gaming, licensing and entertainment platforms. In the second quarter of 2025, HAS expanded its strategic partnerships to strengthen digital and licensing businesses.

By 2027, digital gaming and licensing partnerships are projected to contribute about 25% of corporate revenues. Additionally, Hasbro anticipates growth in gaming-related revenues, encompassing board games, trading cards, digital licensing and video games.

Although tariff uncertainty and supply-chain disruptions are concerns, HAS raised its full-year 2025 revenue and adjusted EBITDA guidance. Strong performance in the Wizards segment, games portfolio, licensing partnerships and digital initiatives are encouraging for HAS’ prospects.

Hasbro has an expected revenue and earnings growth rate of 6.6% and 21.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min | |

| 40 min | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 |

Zak! Designs celebrates 50 years: How Irv Zakheim went from selling puka shell necklaces to owning a $150 million mealtime company

DIS

The Spokesman-Review, Spokane, Wash.

|

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite