|

|

|

|

|||||

|

|

Novo Nordisk NVO and Viking Therapeutics VKTX have emerged as notable players in the obesity space.

A market leader in the GLP-1 space, Novo Nordisk markets its semaglutide drugs under brand names Ozempic (pre-filled pen) and Rybelsus (oral tablet) for type II diabetes (T2D), and Wegovy (injection) for chronic weight management.

On the other hand, Viking Therapeutics is a clinical-stage biotech firm. Its investigational dual GIP and GLP-1 receptor agonist, VK2735, has shown blockbuster potential in early to mid-stage studies for treating obesity.

At first glance, comparing Novo Nordisk and Viking Therapeutics may seem uneven given the vast gap in scale, resources and commercial execution. Yet both are tethered to the same GLP-1–driven metabolic treatment space, where shifting demand dynamics, intensifying competition and mounting execution risks are weighing heavily on investor sentiment. Recent setbacks for both players have only amplified the risks, making them far from straightforward investment choices. Against this backdrop, it becomes essential to evaluate their fundamentals closely to determine which, if either, presents the relatively safer option at this stage.

Novo Nordisk has one of the broadest diabetes portfolios in the industry. The company continues to be the global market leader in the GLP-1 segment, with a 51.9% value market share as of the end of the second quarter of 2025.

Wegovy is a significant contributor to Novo Nordisk's revenues. The sales of the drug generated $5.41 billion (DKK 36.9 billion) during the first half of 2025. NVO is suffering from slower-than-expected momentum for its semaglutide-based drugs — Wegovy and Ozempic — particularly in the U.S. obesity market, where uptake is being disrupted by persistent illegal compounded versions despite the FDA’s crackdown. Adoption of Wegovy has lagged across both cash-pay and insured channels, while international launches are experiencing uneven uptake across obesity markets.

Novo Nordisk is actively working to maintain its leadership in diabetes and obesity care by expanding the reach of semaglutide across multiple indications. Wegovy now carries approvals beyond weight loss, including cardiovascular and osteoarthritis-related benefits, while Ozempic’s label covers diabetes patients with heart and kidney disease. An FDA decision on oral Wegovy, expected by year-end, could further strengthen its competitive edge as the first oral obesity pill, improving adherence and helping regain market share.

Novo Nordisk is advancing its obesity pipeline with both internal candidates and external deals. Its most advanced program, CagriSema, a follow-up drug to Wegovy, met study endpoints but delivered less weight loss than expected in late-stage studies. Meanwhile, its early-stage asset, Amycretin, showed stronger weight-loss efficacy than Wegovy in a phase I study. NVO has also pursued acquisitions and partnerships, including the 2023 purchase of Inversago Pharmaceuticals, adding oral monlunabant, and a $2.2 billion collaboration with Septerna to develop oral small-molecule treatments for obesity, T2D and other cardiometabolic conditions.

Novo Nordisk is diversifying beyond GLP-1s by strengthening its Rare Disease franchise, advancing Mim8 in hemophilia A, and securing EU approval for Alhemo, with further reviews underway. In the United States, Alhemo is already cleared for hemophilia A and B. Meanwhile, the FDA granted accelerated approval for Wegovy in treating MASH with fibrosis, making it the first GLP-1 approved for this condition and marking a key milestone in liver care.

NVO recently underwent a major transition in its executive management as CEO Lars Fruergaard Jørgensen stepped down due to market headwinds and a decline in the company’s stock since mid-2024. The board has appointed Maziar Mike Doustdar as its new president and CEO, who took office on Aug. 7, 2025.

The company’s arch-rival Eli Lilly LLY remains a formidable adversary in the obesity market space, which threatens its market share. LLY markets its tirzepatide injections under the brand names Mounjaro for T2D and Zepbound for obesity. Despite being on the market for less than three years, both drugs have become LLY’s key top-line drivers. In the first half of 2025, Mounjaro and Zepbound generated combined sales of $14.7 billion, accounting for 52% of Lilly’s total revenues. Following strong second-quarter results, Lilly raised its full-year sales guidance.

Viking Therapeutics is one of the few biotech stocks that has shown immense potential in this space. Its experimental obesity drug, VK2735, has shown blockbuster potential, having demonstrated superior weight reduction capabilities in clinical studies, both as a subcutaneous (SC) injection and an oral pill.

However, the stock price recently suffered a significant dive after VKTX reported mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735. Though patients on the highest drug dose lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group, a significant number of patients also dropped out of the study.

Despite management’s assurance that they might be able to mitigate the side effects of oral VK2735 by gradually moving patients from low doses to higher ones, the results have raised negative investor sentiments around Viking Therapeutics stock. While many investors raised questions on the drug’s tolerability and safety profile, some even cited dampened prospects for Viking Therapeutics as an acquisition target. Viking Therapeutics is also evaluating a subcutaneous version of VK2735 in two recently initiated late-stage studies. However, the data is not likely to be expected until the end of 2026 or early 2027.

Beyond VK2735, Viking Therapeutics is expanding its obesity pipeline. It plans to file an investigational new drug application to begin clinical studies on its novel dual amylin and calcitonin receptor agonist for obesity treatment later this year. VKTX has decided to focus only on the obesity pipeline while exploring collaboration opportunities for its non-alcoholic steatohepatitis and X-linked adrenoleukodystrophy candidates.

Yet, VKTX’s biggest challenge lies in its lack of an approved product in its portfolio and the intense competition from pharma giants that already dominate the obesity landscape.

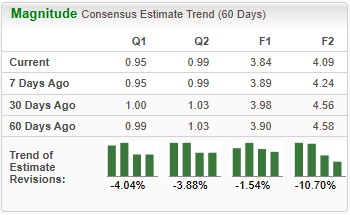

The Zacks Consensus Estimate for Novo Nordisk’s 2025 sales and earnings per share (EPS) implies a year-over-year increase of around 15% and 17%, respectively. EPS estimates for both 2025 and 2026 have been trending downward over the past 60 days.

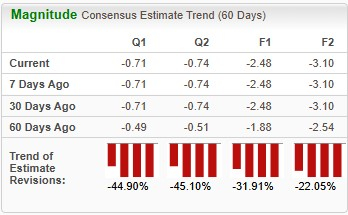

Devoid of a marketed product, we expect Viking Therapeutics’ 2025 loss per share to widen by 146%. Loss estimates for 2025 and 2026 have widened over the past 60 days.

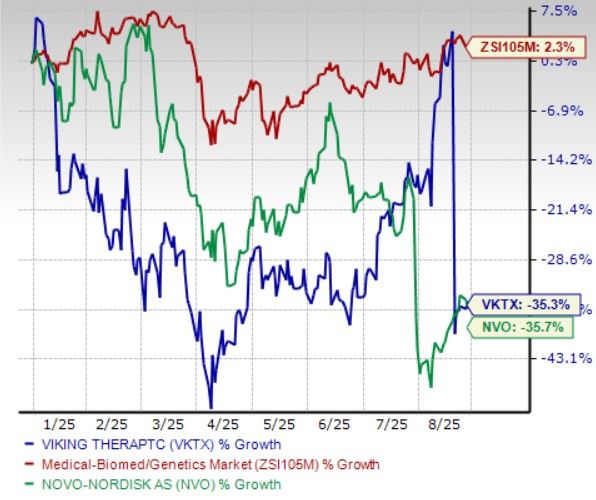

Year to date, shares of NVO have lost about 35.7%, while those of VKTX have plummeted 35.3%. In comparison, the industry has gained 2.3%, as seen in the chart below.

From a valuation standpoint, Novo Nordisk is more expensive than Viking Therapeutics, going by the price/book (P/B) ratio. NVO’s shares currently trade at 9.67 times trailing book value, higher than 3.68 for VKTX.

Both Novo Nordisk and Viking Therapeutics currently carry bearish ratings — Novo Nordisk with a Zacks Rank #5 (Strong Sell) and Viking Therapeutics with a Zacks Rank #4 (Sell). The cautious stance is warranted as both face meaningful execution risks and limited near-term catalysts, leaving investors exposed to further downside.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For Novo Nordisk, the outlook remains clouded by multiple headwinds. The company’s recent leadership change comes at a time of slowing momentum for its GLP-1 franchise, with compounded alternatives and Eli Lilly’s rapidly scaling obesity drugs continuing to erode market share. The recent guidance cut underscores the pressure, and it may take time before the new CEO can stabilize operations and restore investor confidence.

Viking Therapeutics, meanwhile, faces its own challenges as a development-stage biotech without an approved product or established revenue stream. The disappointing mid-stage results for oral VK2735 have raised concerns about tolerability and safety, while competition from entrenched players like Lilly and Novo adds further uncertainty. However, VKTX benefits from a strong cash position of $808 million (as of June 2025) and zero debt, giving it financial flexibility to refine its lead program and progress other obesity candidates. If management succeeds in improving VK2735’s profile, the stock could rebound meaningfully, offering attractive upside potential.

From a valuation perspective, Viking Therapeutics appears more compelling, trading at a discount to Novo Nordisk on a P/B basis. Considering the relative risks and opportunities, Viking Therapeutics emerges as the comparatively safer bet for medium-term investors, while Novo Nordisk faces more entrenched structural challenges that may limit recovery in the near future. For investors seeking long-term exposure to the obesity market, Eli Lilly appears to be a more prudent choice compared with Novo Nordisk and Viking Therapeutics.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 13 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite