|

|

|

|

|||||

|

|

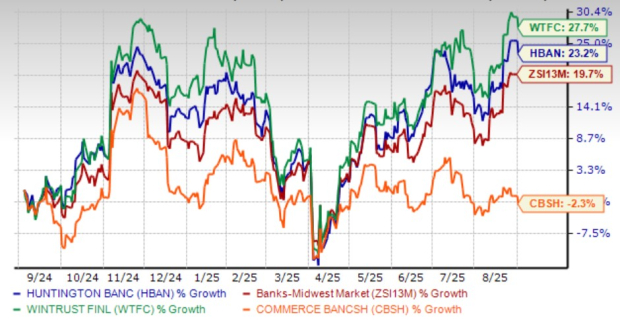

Shares of Huntington Bancshares HBAN have gained 23.2% in a year compared with the industry’s growth of 19.7%. Its peers, Wintrust Financial Corporation WTFC, has gained 27.7% while Commerce Bancshares Inc. CBSH fell 2.3%, over the same time frame.

Price Performance

Does HBAN stock have more upside left despite recent strength in share price? Let us find out.

Rising Net Interest Income (NII): Huntington’s NII and net interest margin (NIM) are witnessing a rise. NII recorded a four-year CAGR of 10.5% (2019-2024). Also, NIM improved to 3.25% in 2022 from 2.84% in 2021. However, the metric declined in 2024 compared with 2023 due to high funding costs. Nonetheless, both metrics increased year over year in the first half of 2025 as the Fed reduced rates by 100 basis points in 2025 and kept them steady since then, which stabilized funding/deposit costs. Furthermore, the company maintains modest asset sensitivity through down-rate protective hedging, which supports NIM and NII growth in a rate-cut scenario while still allowing it to take advantage of higher interest rates. Management expects NII to rise 8-9% (up from 5-7% previously guided) from the $5.34 billion registered in 2024.

Rising Deposits: HBAN is one of the top 20 bank holding companies in the United States and remains focused on acquiring the industry's best deposit franchise. The company’s total deposits saw a five-year (ended 2024) CAGR of 14.6%, with the rising trend continuing in the first half of 2025. Moreover, driven by the strong performance of the commercial and consumer portfolios, the total loan balance saw a CAGR of 11.5% in the same time frame, with the trend continuing in the first six months of 2025. Going forward, an improving lending scenario and expected Fed rate cuts will continue to aid loans and deposit growth, supporting the company’s top line. Management now expects average deposit growth to be 4-6% (up from 3-5% stated previously) from the $155.1 billion reported in 2024 on the back of acquisitions and deepening primary bank customer relationships.

Strategic Acquisitions: Over the past few years, HBAN has expanded its footprint and capabilities in several verticals through acquisitions. In July 2025, Huntington entered a definitive agreement to acquire Veritex Holdings, Inc., to accelerate its strong organic growth in Texas by expanding its presence in Dallas/Fort Worth and Houston. In 2022, the company acquired Capstone Partners. (which enhanced the complementary capabilities of the capital markets business) and Torana (to enhance digital capabilities and enterprise payments strategy). In 2021, it completed the merger with TCF Financial to become one of the top 25 U.S. bank holding companies. Such inorganic efforts will help the company to gain significant market share and, thereby, enhance its profitability.

Strong Liquidity: As of June 30, 2025, Huntington's liquidity, comprising cash and due from banks and interest-bearing deposits, aggregated $10.9 billion. The company’s largest source of liquidity is core deposits. It had a total long-term debt of $18 billion, while it had only $576 million of short-term borrowings during the same period. The company enjoyed senior unsecured notes ratings of A- from Standard & Poor’s and Fitch and A3 from Moody’s. This will likely enable it to access the debt market at favorable rates. Hence, given the decent liquidity, the company is better suited to meet its debt obligations going forward.

Escalating Expenses: Huntington’s non-interest expenses saw a CAGR of 10.9% over the last five years (ended 2024). The rising trend continued in the first half of 2025. This was due to higher personnel costs, outside data processing and other services expenses, and marketing expenses. Although strategic efficiency initiatives are likely to reduce expenses to some extent, long-term investments in key growth initiatives are likely to maintain a higher expense base. Adjusted non-interest expenses, excluding notable items, are anticipated to grow 5-6% (up from 3.5- 4.5% previously stated) in 2025 from the $4.51 billion reported in 2024.

Loan Concentration: As of June 30, 2025, commercial loans comprised 57% of Huntington’s total loan portfolio, indicating a high level of concentration. This limited diversification poses a risk, especially in the current uncertain macroeconomic environment. The strain on commercial lending is already evident, with 73.7% of the company's non-performing assets tied to these loans as of June 30, 2025. The lack of diversification within the loan portfolio increases its susceptibility to sector-specific or broad economic stress, weakening its overall financial performance.

Huntington’s resilient NII growth, strong deposit and loan momentum, and an expansion-focused acquisition strategy will support its long-term growth. Its liquidity position and favorable credit ratings provide additional stability.

However, escalating expenses and heavy concentration in commercial loans create vulnerabilities, especially if economic conditions worsen.

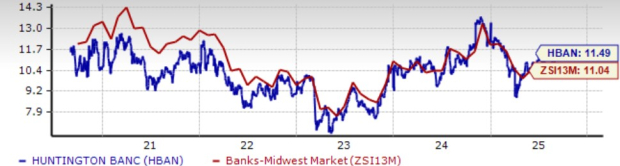

From a valuation perspective, HBAN stock seems expensive relative to the industry. The company trades at a forward price-to-earnings (P/E) ratio of 11.49X, above the industry’s average of 11.04X. Wintrust Financial is trading at a P/E ratio of 12.17X, while Commerce Bancshares is trading at 14.08X.

Price-to-Earnings F12M

As such, prospective investors might consider waiting for a more attractive entry point, given the stock’s current premium valuation. HBAN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite