|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Chipotle Mexican Grill, Inc. CMG has displayed a volatile trading pattern in recent months, pressured by weakening consumer confidence, value-seeking behavior and rising competitive intensity in the fast-casual space. Additionally, a decline in comparable restaurant sales and ongoing macroeconomic uncertainty have weighed on investor sentiment. The stock dove to its 52-week low of $41.03 yesterday, closing the trading session at $41.41.

The stock's current price reflects a steep discount from its 52-week high, underscoring a sharp reversal in momentum after years of steady comps and earnings growth. In the past three months, shares of Chipotle have declined 21.2% compared with the Zacks Retail - Restaurants industry’s 3.8% drop. Over the same timeframe, the stock has underperformed the S&P 500’s growth of 8.6%.

From a technical perspective, CMG stock is currently trading below its 50-day moving average, signaling a bearish trend.

As Chipotle leans on its strong fundamentals and long-term growth drivers, investors are left wondering whether now is the right time to take a position in CMG stock or wait for clearer signs of recovery. Let’s decode.

One of the key drivers behind CMG’s recent pullback has been a shift in consumer behavior against a challenging macroeconomic backdrop. With inflation squeezing household budgets, value-conscious diners are gravitating toward lower-priced alternatives, such as bundled $5 meals from competitors. While Chipotle emphasizes that its entrées remain attractively priced relative to fast casual peers, the brand has struggled to persuade more cost-sensitive customers of its value proposition. This disconnect has weighed on traffic momentum and, in turn, investor sentiment.

Broader macro trends have also posed challenges. Fluctuations in consumer confidence, particularly during the late spring, aligned closely with weaker traffic patterns. Although promotional efforts and limited-time menu innovations offered a temporary boost, the inconsistency underscored Chipotle’s reliance on broader consumer sentiment. This heightened sensitivity to macroeconomic conditions is increasingly viewed by investors as a near-term risk, particularly against the backdrop of an uncertain economic outlook.

Rising input costs have further weighed on CMG’s profitability. While the company benefited from temporary relief in avocado prices and supply-chain efficiencies, inflation in key proteins like steak and chicken, along with the impact of tariffs, pressured margins. Labor costs also trended higher as staffing and wage pressures persisted, offsetting some of the operational gains from equipment rollouts and in-restaurant efficiencies. These dynamics have raised concerns about whether Chipotle can sustain its industry-leading margins in a prolonged inflationary environment.

Competition is another factor pressuring the stock. Rivals in both quick-service and fast-casual dining have stepped up promotions and introduced aggressive value offerings aimed at attracting budget-conscious diners. Chipotle experienced temporary share losses during periods of heightened competitive intensity, underscoring the need for stronger promotional cadence and more visible communication of its value. While the brand’s loyal customer base remains an advantage, the current environment has amplified these competitive headwinds.

Chipotle is actively investing in initiatives to drive traffic, enhance customer engagement, and strengthen its operational base. The company has rolled out new back-of-house technology, including produce slicers, dual-sided planchas, and high-capacity fryers, designed to improve food consistency, reduce prep time, and increase throughput during peak hours. These investments are expected to improve the guest experience and create capacity for new revenue opportunities such as catering.

Menu innovation remains a central focus, with limited-time offerings like Chipotle Honey Chicken and Adobo Ranch driving incremental transactions and brand excitement. Management is committed to maintaining a steady cadence of such launches, while also reintroducing proven favorites that have consistently resonated with customers. These initiatives are aimed at broadening consumer appeal and reinforcing Chipotle’s value proposition in a highly competitive environment.

Increased focus on digital engagement bode well. The company continues to enhance its loyalty program, which boasts roughly 20 million active members. Programs such as Summer of Extras have successfully reactivated low-frequency users and increased purchase frequency. With new AI-driven personalization tools and upcoming campaigns targeted at college students, Chipotle is working to further strengthen loyalty and digital sales penetration.

Expansion also plays a critical role in Chipotle’s strategy. The company remains on track to open 315 to 345 new locations in 2025, with approximately 80% featuring Chipotlanes to enhance convenience. International markets are gaining traction as well, with encouraging results in Canada, Europe and the Middle East. These opportunities, combined with a debt-free balance sheet and significant cash reserves, provide a solid foundation for sustained expansion.

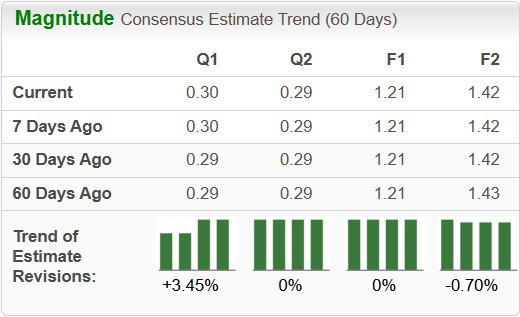

Over the past 60 days, the Zacks Consensus Estimate for Chipotle’s fiscal 2025 earnings per share (EPS) has remained unchanged at $1.21. Over the same time frame, estimates for industry players, including Brinker International, Inc. EAT, McDonald's Corporation MCD and The Cheesecake Factory Incorporated CAKE, have increased 5.4%, 0.9% and 3%, respectively.

Chipotle stock is currently trading at a premium. CMG is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 30.61, well above the industry average of 24.75, reflecting an attractive investment opportunity. Other industry players, such as Brinker, McDonald's and Cheesecake Factory, have P/E ratios of 15.4, 24.31 and 15.1, respectively.

Chipotle’s long-term growth story remains intact, supported by brand strength, consistent unit expansion, and ongoing investments in menu innovation, digital engagement, and operational efficiency. However, near-term headwinds from consumer trade-down behavior, rising input and labor costs, and heightened competitive pressures warrant caution. At a premium valuation relative to peers, much of the optimism surrounding Chipotle’s expansion potential appears to be priced into the stock.

We recommend waiting for clearer evidence of traffic stabilization and margin resilience before initiating new positions. For existing shareholders, maintaining exposure may be prudent given Chipotle’s long runway and differentiated positioning, though near-term volatility is likely to persist.

Chipotle currently carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 |

Business People: Minnesota Black Chamber names Yoland Pierson president and CEO

MCD

Pioneer Press, St. Paul, Minn.

|

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite