|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

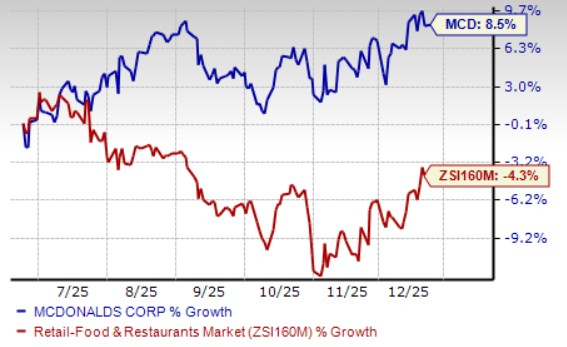

Shares of McDonald's Corporation MCD have gained 8.5% in the past six months against the Zacks Retail - Restaurants industry's fall of 4.3%. The company is standing out in a period marked by softer consumer demand and uneven traffic trends across the sector. The global quick-service restaurant (QSR) leader has benefited from disciplined execution and the strength of its value-led operating model, helping the stock demonstrate relative resilience amid a challenging industry backdrop.

Investor sentiment has been supported by McDonald’s continued focus on its Accelerating the Arches strategy, which centers on menu innovation, effective marketing and consistent value and affordability. This approach has helped the company defend traffic share across key markets and reinforce brand relevance, even as cost pressures and promotional intensity weigh on the broader restaurant landscape.

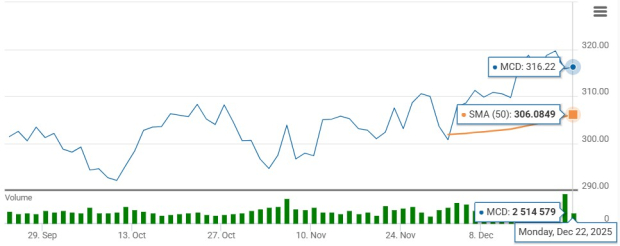

Technical indicators also suggest steady market confidence in the stock’s recent performance, reflecting McDonald’s defensive positioning and the durability of its business model. The combination of scale, brand loyalty and a franchise-heavy structure continues to underpin investor perception of financial stability.

Currently trading 3.1% below its 52-week high of $326.32, investors are now left with a bigger question: Should they buy McDonald's stock, or hold steady amid industry and macro headwinds?

Let’s delve into MCD’s growth narrative, challenges and valuation to decode the best course of action.

McDonald’s performance continues to be underpinned by disciplined execution of its Accelerating the Arches strategy, which prioritizes menu innovation, compelling marketing and consistent value and affordability. This integrated approach has allowed the company to remain competitive in a highly pressured consumer environment, supporting traffic share gains across a majority of its core markets. By pairing familiar, great-tasting offerings with clear value messaging, McDonald’s has reinforced brand relevance even as discretionary spending remains constrained.

Value execution remains a central pillar of McDonald’s strategy, particularly in the United States, where consumer behavior continues to be bifurcated. While traffic from lower-income consumers remains under pressure, higher-income consumers continue to show relative strength, underscoring the importance of a broad-based value architecture. McDonald’s focus on delivering everyday affordability across its core menu is designed to serve multiple income cohorts, helping protect visitation and maintain competitive positioning without relying solely on short-term promotions.

Menu innovation and localized execution are also contributing meaningfully to performance. The company continues to invest in high-growth categories such as chicken and beverages, while tailoring offerings to local tastes across international markets. These initiatives, combined with well-timed marketing campaigns, have supported customer engagement and reinforced McDonald’s ability to drive incremental occasions and maintain share in diverse geographies.

Digital engagement further strengthens McDonald’s operating model. The company continues to leverage its loyalty ecosystem and app-based platforms to deepen customer relationships, enhance value perception and drive repeat visits. Digital-led campaigns and promotions have improved customer acquisition and engagement while also providing McDonald’s with greater flexibility to adapt to changing consumer needs. Together, these fundamentals position the company to navigate ongoing macro pressures while supporting long-term visibility and resilience.

McDonald’s operating environment remains challenging, reflecting continued pressure on consumer discretionary spending across the restaurant industry. Management continues to highlight a bifurcated consumer backdrop in the United States, with traffic from lower-income consumers declining at a nearly double-digit pace — a trend that has persisted for close to two years. While higher-income consumers remain relatively resilient, prolonged softness at the lower end constrains overall traffic growth and increases reliance on value-driven offerings to protect volumes. This dynamic is not unique to McDonald’s, as peers such as Starbucks Corporation SBUX and Dutch Bros Inc. BROS have also pointed to uneven demand trends tied to affordability pressures and shifting consumer behavior.

Cost inflation remains another notable headwind. McDonald’s continues to face elevated labor, food and paper costs, with beef inflation described as particularly sticky relative to historical norms. Although the company benefits from scale and supply-chain leverage, management has acknowledged that current sales growth has not always been sufficient to fully offset inflationary pressures at the restaurant margin level. This challenge is broadly shared across the sector, as operators like Chipotle Mexican Grill, Inc. CMG also navigate higher input and labor costs while attempting to preserve margins without materially impacting traffic.

Additionally, the highly competitive and promotional nature of the QSR industry presents ongoing execution risk. McDonald’s emphasis on value and affordability is critical to maintaining relevance, but sustaining aggressive value positioning without eroding unit economics requires careful calibration. Management has also expressed caution regarding the broader macro outlook across both the U.S. and key international markets, with consumer pressures expected to extend into 2026. Prolonged economic uncertainty, combined with persistent cost inflation and intense competition, could limit earnings leverage and weigh on near-term performance.

The Zacks Consensus Estimate for MCD’s 2026 sales is pegged at $28.2 billion, indicating 5.7% year-over-year growth.

Meanwhile, other industry players like Starbucks' sales in fiscal 2026 are likely to gain 3.5% year over year, whereas Chipotle and Dutch Bros’ sales in 2026 are likely to witness a rise of 9.7% and 24.4%, respectively.

The consensus estimate for McDonald’s 2026 earnings per share has increased in the past 60 days, as shown in the chart.

From a valuation standpoint, MCD is trading at a discount to the industry. With a forward 12-month price-to-earnings ratio of 23.88, which is below the industry average of 24.39.

Other industry players, such as Starbucks, Chipotle and Dutch Bros, have P/E ratios of 33.87, 31.24 and 73.65, respectively.

McDonald’s recent outperformance reflects the market’s preference for defensive, well-executed restaurant operators rather than a material inflection in near-term growth. The company’s scale, brand strength and value-led strategy continue to support traffic resilience and earnings stability, justifying a Zacks Rank #3 (Hold) stance for existing investors. However, management’s cautious view on consumer health, persistent cost inflation and elevated competitive intensity suggest that upside drivers may remain constrained in the near term, keeping growth visibility somewhat limited.

With valuation appearing reasonable but not compelling enough to offset macro and margin-related headwinds, MCD’s risk-reward profile looks balanced at current levels. Long-term investors can remain invested, supported by the company’s durable business model and global footprint, but new buyers may be better served waiting for clearer signs of earnings leverage or a more attractive entry point before adding exposure.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite