|

|

|

|

|||||

|

|

The Trade Desk TTD stock has tumbled 28.1% in the past three months, and closed last session at 52.03, way below its 52-week high of 141.53. This has left investors wondering whether the pullback represents a buying opportunity or an indicator of deeper troubles ahead.

It has underperformed the Zacks Internet Services industry’s gain of 29% while the Zacks Computer & Technology sector and the S&P 500 Composite have gained 12.8% and 8.4% over the same time frame.

So, what is causing the slide for TTD stock? Let’s unpack the issues behind the recent price slump and evaluate whether holding onto the stock is a smart move.

TTD expects to capitalize on the future growth opportunities due to solid execution across key initiatives, Connected TV (CTV), retail media, international expansion, Kokai, UID2 and OpenPath.

As more consumers shift away from linear TV, advertisers are following suit, and TTD is well-positioned to capture that trend. TTD had earlier referred to CTV as the “kingpin of the open Internet.” On the recent earnings call, management highlighted that programmatic CTV continues to deliver the “most effective and highest return on ad spend,” strengthening TTD’s position in the CTV market.

Video, which includes connected CTV, accounted for a high-40s percentage of its overall business and continues to increase its share of the mix in the quarter. It also has forged deep partnerships with Disney, NBCU, Roku, Netflix, LG and Walmart, among others.

The company’s AI-powered Kokai platform further strengthens its competitive moat. More than 70% of clients are now using the company’s Kokai platform, with full client adoption expected to be completed by this year. The integration of Koa AI tools was highlighted by management as a “game changer” for the Kokai platform, as it can deliver significant gains in campaign precision, efficiency and outcomes.

Campaigns, across the board, running on Kokai, are delivering more than 20-point improvements in key performance indicators compared with legacy ones, added TTD. Those performance gains are likely to translate directly into deeper wallet share. Management highlighted that advertisers transitioning the majority of spend to Kokai are increasing their overall spend on the platform more than 20% faster than those who still have not.

Complementing Kokai, OpenPath is simplifying the programmatic supply chain by allowing publishers to integrate directly with The Trade Desk’s platform. Sincera's acquisition is enhancing supply chain transparency through OpenSincera, which makes data available to the ecosystem for free. TTD is also upbeat about Deal Desk, which is currently in the beta stage. Deal Desk leverages AI forecasting to optimize deals and re-route underperforming deals to better open market and premium internet alternatives. Disney is already leveraging Deal Desk.

TTD is also focused on securing long-term, high-value partnerships with major advertisers, agencies, and publishers. The company now has nearly 100 joint business plans (JBPs) in the pipeline. These deals are expected to boost revenue visibility.

As a pure-play ad-tech company, TTD is highly sensitive to macroeconomic conditions. Macroeconomic uncertainty could prove a drag on advertising budgets. TTD remains cautious regarding the impact of the volatile macro backdrop, particularly on the large global brands. If macro headwinds worsen or persist through the remainder of 2025, revenue growth may face further pressure due to reduced programmatic demand.

The intensely competitive nature of the digital advertising industry, dominated by industry giants like Alphabet and Amazon AMZN, as well as other smaller players like PubMatic PUBM and Criteo CRTO, continues to put pressure on TTD’s market positioning. Walled gardens like Google and Amazon dominate this space as they control their inventory and first-party user data, allowing for highly targeted ad campaigns.

While CTV remains a strong revenue driver, this market is also increasingly becoming competitive. AMZN’s expanding DSP business is giving tough competition to TTD, especially in this space. Even PubMatic is expanding its presence in CTV and retail media and competing for ad dollars.

Higher expenses are likely to weigh on profitability. In the last reported quarter, total operating costs surged 17.8% year over year to $577.3 million. Expenses soared on account of continued investments in boosting platform capabilities, particularly platform operations. Higher costs can prove a drag on margins, especially if revenue growth does not keep pace.

Overreliance on North America for revenues is another concern. Though TTD is focusing on geographic expansion, executing well across disparate markets can be complex and risky.

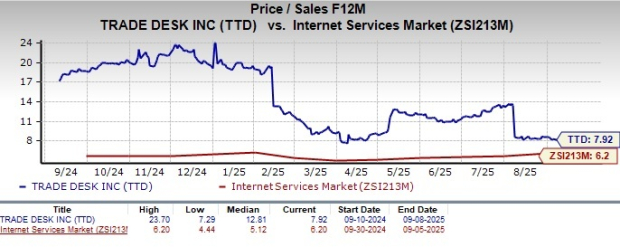

TTD stock is also not so cheap, as its Value Style Score of F suggests a stretched valuation at this moment. The stock is trading at a premium, with a forward 12-month price/sales of 7.92X compared with the industry’s 6.2X.

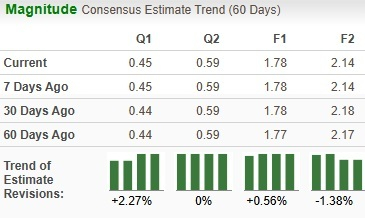

Analysts have marginally increased earnings estimates for the current year.

Amazon has gained 8.4%, while Criteo and PubMatic shares have declined 8.5% and 26.4%, respectively, over the past three months.

The Trade Desk remains one of the well-known names in the digital advertising space, with tremendous exposure to high-growth channels like CTV and retail media. The recent slump seems to reflect investors' concerns around AMZN’s growing clout and global macro uncertainty.

Given the mix of solid fundamentals and near-term headwinds, investors holding TTD stock can retain it in their portfolios for now, but new investors would be better off waiting for a favorable entry point.

At present, TTD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite