|

|

|

|

|||||

|

|

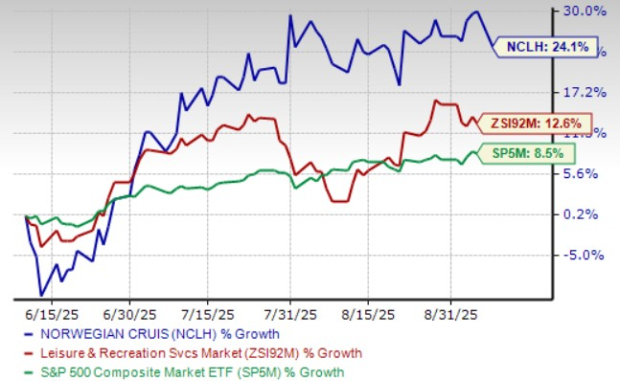

Shares of Norwegian Cruise Line Holdings Ltd. NCLH have rallied 24.1% in the past three months compared with the Zacks Leisure and Recreation Services industry’s 12.6% growth. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 8.5%.

NCLH shares have gained momentum, supported by record booking levels, resilient onboard revenue generation, and demand catalysts such as the upcoming Great Tides Waterpark. Alongside disciplined cost management and steady balance sheet deleveraging, NCLH’s “Charting the Course” strategy is enhancing operational efficiency and supporting its long-term earnings outlook.

At the same time, shifting monetary signals are adding to the industry’s momentum. Federal Reserve Chair Jerome Powell’s recent Jackson Hole remarks opened the door to a potential rate cut. A lower-rate environment would likely ease financing costs and sustain consumer spending, providing Norwegian Cruise with a favorable macro backdrop to extend its stock momentum and position itself for long-term demand resilience.

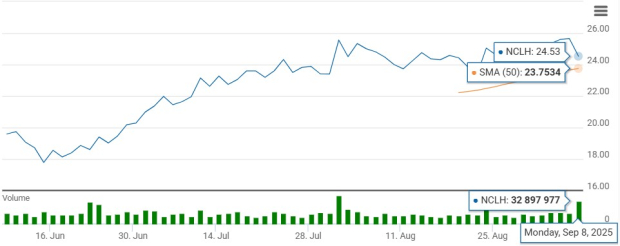

From a technical perspective, NCLH is currently trading above its 50-day moving average, indicating solid upward momentum and price stability.

As of yesterday, Norwegian Cruise stock is trading 16.3% below its 52-week high of $29.29 (attained on Jan. 31, 2025). So, should investors pour more capital into NCLH now? Let us take a closer look.

NCLH’s performance continues to be supported by strong demand across its brands, with bookings and onboard spend remaining at record levels. The company has benefited from both close-in demand and advanced ticket sales, reaching new highs, underscoring consumer confidence in cruising as a preferred vacation option. This strong demand environment, coupled with disciplined pricing, is sustaining yield growth and providing visibility well into future sailings.

A central driver of momentum is NCLH’s focus on premium and luxury offerings. The introduction of Oceania Allura and confirmation of new Sonata Class ships reinforce the company’s long-term investment in the upscale segment. Changes to stateroom mix, such as replacing solo cabins with penthouse and concierge suites, are designed to capture higher yields and align with guest preferences. These efforts highlight the company’s strategy of maximizing returns through targeted fleet enhancements.

The transformation of Great Stirrup Cay represents another key pillar of growth. New additions, including the Great Tides Waterpark, expanded pool areas, Hammock Bay, Horizon Park and the adult-only Vibe Shore Club, are expected to drive incremental revenues while elevating guest satisfaction. Management projects that approximately one-third of guests will visit the island by 2026, rising to 1.2 million visitors by 2027, providing a steady uplift to yields and brand loyalty.

Operational discipline also remains a cornerstone of NCLH’s performance. The company is guiding to flat costs for 2025, building on over $200 million in savings, with confidence in surpassing $300 million by 2026. Importantly, these savings are being reinvested into product quality, from enhanced dining to digital tools that improve the guest journey. This balance of cost control with reinvestment supports higher guest satisfaction, repeat rates, and ultimately, sustainable margin expansion.

One of the key hurdles for Norwegian Cruise has been balancing its deployment strategy against shifting consumer demand. While the pivot toward shorter Caribbean and Bermuda itineraries is designed to boost load factors, these routes generally generate lower yields than longer European sailings. The trade-off has raised investor concerns about whether occupancy gains will be enough to offset potential pricing pressure, particularly as consumer preferences evolve in an uncertain macro environment.

Broader financial headwinds also remain. Elevated leverage continues to weigh on sentiment, with net debt still above 5x EBITDA despite ongoing deleveraging efforts. Although management is targeting mid-4x leverage by 2026, refinancing needs and exposure to interest rate movements could create volatility. Currency swings add another layer of uncertainty. In the second quarter, currency remeasurement losses reduced EPS by 8 cents.

Rising costs are another factor to monitor. While NCLH has made notable progress on efficiency initiatives and sub-inflationary cost management, the industry continues to face persistent wage and input inflation. Maintaining margin expansion will depend on sustaining these savings without eroding guest satisfaction, a delicate balance as the company ramps up investment in new ships and private island projects. These capital-intensive initiatives carry execution risk.

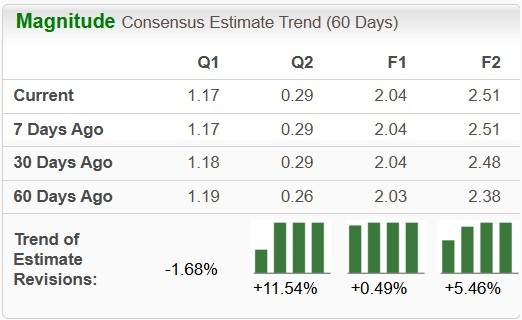

Over the past 60 days, the Zacks Consensus Estimate for NCLH’s 2025 earnings per share (EPS) has been revised upward, increasing from $2.03 to $2.04. This upward trend reflects strong analyst confidence in the stock’s near-term prospects. Over the same time frame, estimates for industry players, including Royal Caribbean Cruises Ltd. RCL, Carnival Corporation & plc CCL and OneSpaWorld Holdings Limited OSW, have increased 1%, 1% and 2%, respectively.

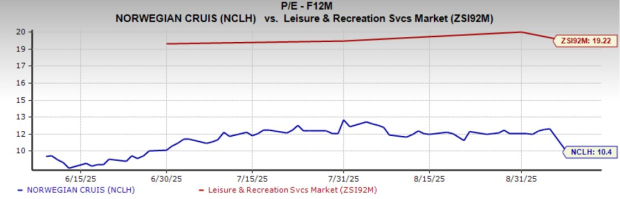

Norwegian Cruise stock is currently trading at a discount. NCLH is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 10.4, well below the industry average of 19.22, reflecting an attractive investment opportunity. Other industry players, such as Royal Caribbean, Carnival and OneSpaWorld, have P/E ratios of 20.11, 14.25 and 19.93, respectively.

Norwegian Cruise Line’s recovery trajectory is underpinned by record bookings, disciplined cost management, and strategic investments in premium ships and private island experiences. These initiatives support the company’s long-term outlook and reinforce its positioning within the leisure travel sector. However, near-term challenges tied to foreign exchange headwinds, yield trade-offs from deployment shifts, and persistent cost pressures warrant a cautious stance.

At a forward P/E multiple well below industry peers, NCLH trades at an attractive valuation. Yet, much of its upside potential hinges on the successful execution of its “Charting the Course” strategy and the pace of deleveraging. We recommend waiting for clearer evidence of sustained margin expansion and balance sheet improvement before initiating new positions. For existing shareholders, maintaining exposure appears reasonable given the stock’s discount and demand resilience, though near-term volatility is likely to persist.

Norwegian Cruise currently carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite