|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The e-commerce industry is undergoing a significant shift in consumer preferences.

Many of the industry's stalwarts like eBay and Amazon aren't well positioned to address this change.

Customized brand-owned websites and online stores that aren't forced to compete head to head with rivals are the industry’s growing norm.

It's a tough time to be putting your portfolio's idle cash to work. Most of the market's most popular stocks seem overbought, overpriced, or both.

Dig a little deeper though, and you'll find some names still worth buying. Shopify (NASDAQ: SHOP) is one of them. Although the stock's 115% advance over the course of the past 12 months makes it look and feel just as overheated as many other tickers, this one's got plenty of upside left ahead.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Even if you've never heard of it, there's a good chance you've used Shopify's technology.

Shopify helps businesses establish and operate an online store. The same can be done without such third-party tools, and using platforms like eBay (NASDAQ: EBAY) and Amazon (NASDAQ: AMZN) is also an option. However, hiring programmers to build an e-commerce-capable site can be expensive as well as complicated, while using services like Amazon's and eBay's makes it difficult to build direct relationships with consumers who become customers. With Shopify's solutions though, its clients can simply use its templates and utilize its payment-processing solutions. The company can even help its clients manage their deliveries.

In other words, with Shopify, all the biggest headaches of operating an online business are already figured out for you. Its clients simply pay a modest monthly fee plus a small percentage of every sale its technology helps facilitate. Everybody wins.

And there's little doubt as to the growing marketability of its offerings. While the company no longer discloses the information, estimates put the worldwide number of online stores currently using Shopify's tech in the ballpark of 5 million.

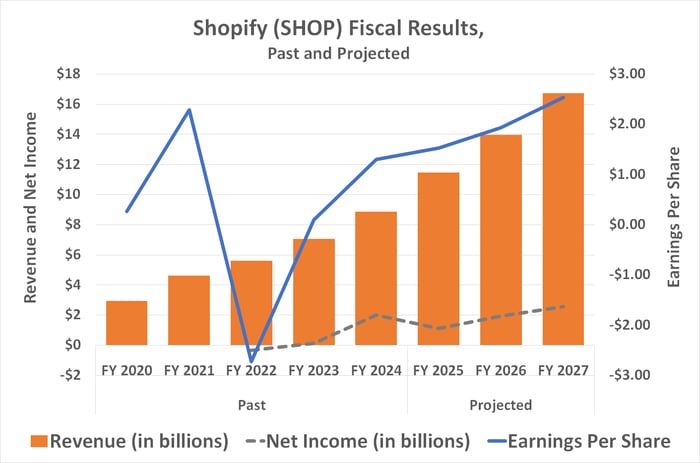

The company does still report how much business it's facilitating, however. Its platform handled $87.8 billion worth of payments for goods and services during the quarter ending in June, up 31% year over year. For its part in completing these sales, Shopify generated nearly $2.7 billion of its own revenue, up 31% as well, and extending a multiyear streak of growth that's expected to persist at least for a few more years. Earnings are projected to grow at a similar pace.

Data sources: MarketWatch, StockAnalysis, Simply Wall St. Chart by author.

Shopify's double-digit growth rate could potentially last far longer than this though. An outlook from Precedence Research suggests the global e-commerce industry could grow at an average annual pace of nearly 15% through 2034, with Shopify's all-important North American market driving much of this growth.

The company may be positioned to capture more than its fair share of this growth, in fact.

In the online shopping industry's infancy, names like eBay and Amazon led the charge largely because they simply existed. Consumers weren't giving much thought to the experience, or the middleman's backstory -- they just liked the convenience, and often, the price.

Times are changing though. Consumers increasingly value authenticity, and want to know what a particular merchant stands for before becoming a paying customer.

It's not a shift that favors Amazon's massive online mall, which offers hundreds of millions unique items sold by a few million different sellers, none of whom are able to tell their stories through Amazon's platform, and all of which must compete with other sellers -- sometimes even including Amazon itself!

That's not the case with a Shopify-powered site, each of which can be as customized as their owners would like. More blog than shopping? No problem. A subscription-based informational website? Again, no problem. Shopify's solutions are flexible, allowing merchants to build the online persona they know makes the most sense for their business.

Image source: Getty Images.

The growing importance of this capability can't be overstated either. Website hosting service WP Engine recently reported that 82% of the Gen Z generation (currently between the ages of 13 and 28) are more likely to trust a company just for using images of real customers in their advertising rather than actors or models. Conversely, less than one-third of all consumers wholly trust a company when it uses imagery with paid spokespeople, even though this has been advertising's known norm for decades.

In other words, the seemingly little things matter... a lot.

The kicker: Perhaps one of the biggest drawbacks to the use of a sprawling service like Amazon's is that, while a particular merchant may know a buyer's name, email address, shipping address, or even that individual's shopping history, Amazon.com's shoppers are first and foremost Amazon's customers. The e-commerce giant is in a position to promote other products directly to that consumer, potentially undermining a merchant's future sale to the same individual even though it was the merchant that first brought that customer to Amazon.com and prompted a sale.

With Shopify, however, Shopify's merchants effectively own their customer list.

Amazon isn't existentially threatened by Shopify, to be clear. For that matter, neither is eBay nor Walmart. Many consumers will continue to value the price, selection, and convenience offered by massive e-commerce platforms.

As online retailing continues to evolve though, look for shoppers to also seek out products from merchants with real stories to tell that more personally resonate with them. Amazon can't make this happen. Shopify can.

Yes, trading at roughly 100 times this year's projected profits of around $1.50 per share, the stock's expensive. This company is also growing its top and bottom lines at a brisk double-digit pace, however, and is likely to continue doing so for a long, long time. It's arguably well worth the premium price, especially in light of the pullback from its early August peak. If the stock's recent and not-so-recent history is any indication, that window of opportunity isn't apt to remain open for very long.

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $671,288!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,031,659!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Shopify, Walmart, and eBay. The Motley Fool has a disclosure policy.

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite