|

|

|

|

|||||

|

|

Novo Nordisk NVO, now led by CEO Mike Doustdar, who only took office last month, announced a major restructuring plan aimed at streamlining operations, improving decision-making speed and redeploying resources to its core growth areas in diabetes and obesity. The plan, intended to be implemented immediately, involves cutting about 9,000 jobs worldwide, including 5,000 in Denmark, representing roughly 11% of NVO’s workforce. Management expects the transformation to generate annualized savings of around DKK 8 billion by 2026, which will be reinvested in R&D, commercial execution, and manufacturing scale-up to address the growing global demand for obesity and diabetes treatments.

The overhaul comes in response to a massive setback in July after Novo Nordisk cut its 2025 sales and profit outlook, citing slower-than-expected momentum for its semaglutide drugs, Wegovy and Ozempic. U.S. obesity market uptake has been hindered by lingering counterfeit sales despite the FDA ending its compounding grace period, prompting the company to pursue legal and regulatory action. Adoption of Wegovy has lagged in both cash-pay and insured channels, while international rollouts show uneven progress. At the same time, competition has intensified as Eli Lilly’s LLY tirzepatide-based drugs, Mounjaro and Zepbound, have captured rapid demand and market share, pressuring NVO’s position in both obesity and diabetes markets.

Financially, the transformation will result in a near-term impact. Novo Nordisk expects significant one-time costs associated with its restructuring plan, with net charges estimated at DKK 8 billion, including impairments. About DKK 9 billion in expenses will be booked in the third quarter of 2025, partly offset by roughly DKK 1 billion in savings in the fourth quarter. As a result, the company cut its 2025 operating profit growth outlook to 4-10% at constant exchange rates, down 6 percentage points from the prior forecast of 10-16%.

While short-term profitability will be pressured, management argues that the restructuring positions Novo Nordisk for more sustainable long-term growth and competitiveness in its key markets. NVO has strong fundamentals, and the untapped nature of the obesity market makes us believe that the stock has significant upside potential in the future. It is also making good pipeline progress, which includes several new candidates for diabetes and obesity. Let’s dig deeper and understand the company’s strengths and weaknesses to understand how to play the stock.

Novo Nordisk’s success in recent years has been driven by the sales of Ozempic (injection) and Rybelsus (oral) for diabetes, and Wegovy for obesity. Despite recent market turmoil, the company holds a strong position in diabetes care, with one of the industry's broadest portfolios.

Wegovy is a major revenue driver, recording sales of $5.41 billion (DKK 36.9 billion) during the first half of 2025, up 78% year over year on strong prescription growth. Ozempic also continues to boost overall revenues. To protect its lead amid competition from Lilly, Novo Nordisk is heavily investing in its GLP-1 manufacturing capacity. As of July 1, CVS Caremark, a major pharmacy benefit manager, has designated Wegovy as its preferred GLP-1 therapy for weight loss.

Novo Nordisk is expanding semaglutide's reach through new indications. Wegovy is now approved for reducing major cardiovascular events, easing HFpEF symptoms, and relieving osteoarthritis-related knee pain in obesity. Ozempic’s label includes use in diabetes patients with cardiovascular and kidney diseases. Recently, NVO reported data from a real-world study that showed Wegovy significantly outperformed Eli Lilly’s tirzepatide in reducing cardiovascular risks in obese patients with existing cardiovascular diseases. This reinforces Wegovy’s position as the only GLP-1 therapy with proven heart protection in this population.

The FDA is reviewing Novo Nordisk’s application for a 25 mg oral semaglutide for obesity, with a decision expected by year-end. Oral pills could boost adherence over injections. Potential approval would give Novo Nordisk a notable advantage as the sole manufacturer of a marketed oral obesity pill, positioning it to capture significant market share. NVO has also filed Rybelsus for cardiac event prevention in diabetes patients. A 7.2 mg Wegovy dose, showing up to 25% weight loss in the STEP UP study, is under EU review. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU.

Beyond its GLP-1 portfolio, Novo Nordisk is broadening its presence in rare diseases. The company is advancing regulatory plans for Mim8 in hemophilia A and has secured EU approval for Alhemo to treat hemophilia A and B with inhibitors. Alhemo is also under EU review for patients without inhibitors. In the United States, the therapy is already approved for both hemophilia A and B, with or without inhibitors. Recently, the FDA granted accelerated approval to Wegovy as the first GLP-1 therapy to treat noncirrhotic metabolic dysfunction-associated steatohepatitis with moderate-to-advanced liver fibrosis. This marked a significant milestone in liver care by offering patients a treatment that can both halt disease activity and reverse liver damage.

Novo Nordisk is also developing several next-generation obesity candidates in its pipeline, especially targeting the lucrative U.S. market. The most advanced weight loss candidate in Novo Nordisk’s pipeline is CagriSema, a fixed-dose combination of a long-acting amylin analogue and Wegovy. The company is planning its regulatory submission in 2026.

Novo Nordisk is also developing a small-molecule oral CB1 inverse agonist, monlunabant, in a mid-stage study. The company is currently gearing up to advance Amycretin, an investigational unimolecular GLP-1 and amylin receptor agonist, for weight management into late-stage development. The phase III program on amycretin is planned to be initiated during the first quarter of 2026. Recently, the company also signed a $2.2 billion deal with Septerna for developing and commercializing oral small-molecule medicines for treating obesity, diabetes, and other cardiometabolic diseases.

Competition in the obesity market is heating up as the obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs. Lilly and Novo Nordisk presently dominate the market.

Several other companies, like Amgen AMGN and Viking Therapeutics VKTX, are also making rapid progress in the development of GLP-1-based candidates in their clinical pipeline. Amgen has begun a broad phase III program on its dual GIPR/GLP-1 receptor agonist, MariTide, across obesity, obesity-related conditions and diabetes, with the first two phase III studies initiated in March. Viking Therapeutics started two late-stage studies evaluating the subcutaneous formulation of its investigational obesity drug, VK2735. VKTX recently announced mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735, which caused the stock to drop significantly.

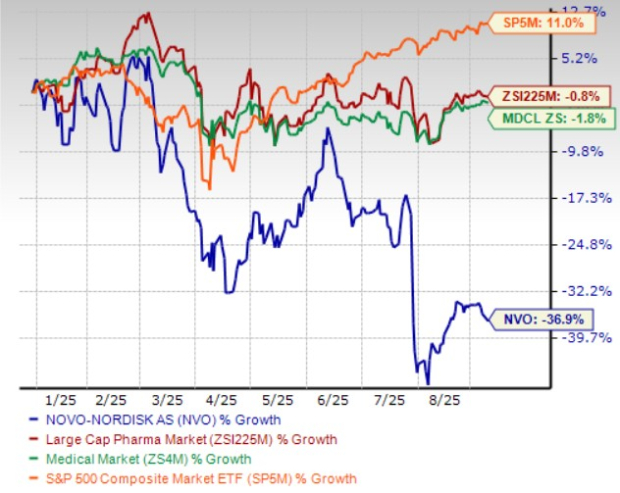

Year to date, Novo Nordisk shares have lost 36.9% compared with the industry’s 0.8% decline. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below. The stock is currently trading below its 50 and 200-day moving averages.

Novo Nordisk is trading at a discount to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 13.56 forward earnings, which is lower than 14.71 for the industry. The stock is trading much below its five-year mean of 29.25.

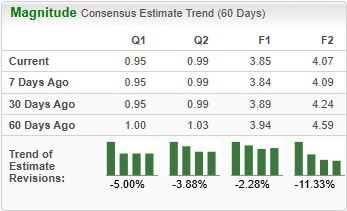

Earnings estimates for 2025 have deteriorated from $3.94 to $3.85 per share over the past 60 days. During the same time frame, Novo Nordisk’s 2026 earnings per share estimates have declined from $4.59 to $4.07.

Novo Nordisk, currently carrying a Zacks Rank #5 (Strong Sell), sharply reduced its 2025 operating profit growth outlook to just 4-10% following its restructuring plans, which include 9,000 job cuts and a hefty one-time charge of about DKK 9 billion. With slower-than-expected uptake of Wegovy in key U.S. channels, uneven international rollouts and intensifying competition from Eli Lilly’s fast-rising tirzepatide drugs, the company faces a period of near-term earnings pressure and market share risk. These dynamics, combined with elevated restructuring costs and execution uncertainty, make NVO unfavorable for investment in the short run, warranting an underperform rating.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While Novo Nordisk retains long-term potential through its broad semaglutide portfolio, label expansions and a pipeline of next-generation obesity treatments, these opportunities will take time to materialize. For now, profitability headwinds, regulatory challenges, and heightened competitive pressures overshadow its growth story, which is expected to fuel near-term volatility, making it less attractive for short-term trading. Long-term investors would also be better served waiting on the sidelines until restructuring benefits translate into sustainable performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| 10 hours | |

| 10 hours |

Hims & Hers Faces New Hurdle In Weight-Loss Brawl With Novo Nordisk

VKTX +5.00% AMGN NVO

Investor's Business Daily

|

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Eli Lilly builds orforglipron cache to avoid previous GLP-1RA shortages

LLY

Pharmaceutical Technology

|

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite