|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Even though the market is just now making its way out of the ‘Summer doldrums and many institutional investors are returning from summer vacations, Wall Street is off to an eventful week from both an economic data and industry theme perspective.

Tuesday morning, the Bureau of Labor Statistics (BLS) released a revision to its employment data. While a negative revision was expected, the magnitude of the revision was shocking and unprecedented. The revision illustrated that the US economy created more than 900k fewer jobs between April 2024 and March 2025 than initially reported. The massive miss makes three things abundantly clear:

1. Despite stimulus packages like the ‘Inflation Reduction Act’ and the ‘Chips Act,’ the jobs market was far worse under the Biden Administration and at the start of the Trump Administration than was previously reported.

2. While the data can change in the future, the Trump tariff policy is not the root cause of the job losses, as the job market had been deteriorating for months before the tariffs were implemented.

3. Whether you chalk it up to bad data or not, Jerome Powell and the Federal Reserve are very late in cutting interest rates.

Beyond the items mentioned, there are broad implications. The massive mishap shows that Wall Street investors and Americans have been making investment decisions based on wildly inaccurate job numbers. Nevertheless, the poor job numbers solidify the fact that there is likely to be an interest rate cut when the Fed meets later this month, an intermediate bullish omen for stocks.

The good news for the economy and the AI stocks is that Wednesday’s producer price index (PPI) number came in much cooler than expected. US PPI declined -0.1% for the month, versus Wall Street estimates for an increase of 0.3%. Year-over-year, core PPI was up 2.8% - far lower than the street’s estimates of 3.5%. One of the biggest fears among Wall Street has been that the Trump tariffs will cause stagflation. While the jobs market remains weak, the inflation numbers thus far under the Trump presidency shows that the consumer is carrying the least of the tariff burden, and many foreign companies and importers are “eating the tariffs.”

The fact that the economy is much weaker than the government has told us makes the performance and growth of the artificial intelligence industry that much more impressive. However, the move in AI names is not without its skeptics. AI bears and bubble callers have been saying for months three main arguments:

1. The performance is only concentrated in ‘Mag 7’ big-cap tech names.

2. The massive CAPEX spending will soon come to a screeching halt.

3. Valuations are getting ahead of themselves.

Two massive news items in the industry this week debunked each of these fallacies.

Monday, Nebius Group (NBIS), an AI infrastructure and data center operator, announced it had scored a five-year $17 billion+ deal with Microsoft (MSFT). Nebius will provide Microsoft with dedicated AI infrastructure capacity from its Vineland, New Jersey data center.To put the deal into context, Nebius’ entire market cap was less than the size of the deal it scored! NBIS shares bolted nearly 50% in Tuesday’s session.

The dramatic move and the undeniable impact on NBIS’s future growth is proof that the massive CAPEX being spent by big tech companies is trickling down to more than AI names such as Nvidia (NVDA). “Pick and shovel” companies like NBIS are likely to be winners for years to come.

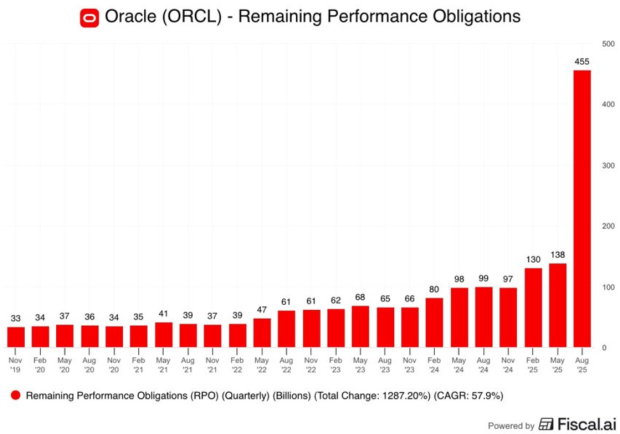

Oracle (ORCL) dipped slightly after reporting earnings that barely missed Wall Street expectations. However, the AI and cloud infrastructure powerhouse shocked Wall Street with its Remaining Performance Obligation (RPO), or future revenue growth. The company divulged that it has a massive contract backlog and that its RPO bolted 359% to $455 billion. In what I see as the most impressive earnings report of the year, the company announced that it scored four multi-billion-dollar contracts in Q1 alone. Meanwhile, ORCL CTO and Chairman Larry Ellison sees RPO reaching a trillion dollars as the trend continues! Multi-cloud database revenue from big tech companies grew at an astonishing 1,500% for the quarter. The magnificent report tells me that the AI boom is likely in its infant stages.

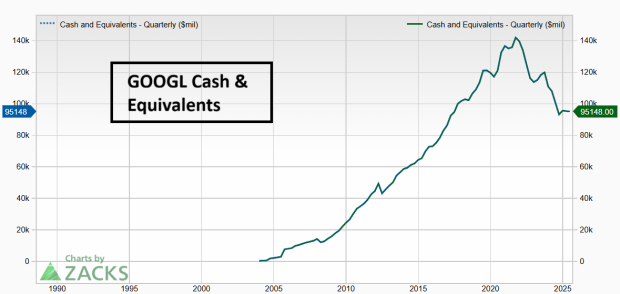

The closest precedent that investors have to the current AI boom is the internet boom of the late 1990s. Both technologies are transformative, increase production, and are garnering massive investments. However, comparing the peak of the internet boom to the current day AI roadmap reveals little comparison in terms of valuation. During the late 1990s, most internet companies had zero profits and often very little or no revenue. Today’s AI juggernauts like Alphabet (GOOGL) are highly profitable and have strong balance sheets with very little debt.

Additionally, valuations are nowhere near equal. In 2000, the Nasdaq price-to-earnings ratio peaked at 200x! Today, the Nasdaq p/e ratio is ~30x. While 30x EPS is not considered cheap, savvy investors understand the importance of looking toward forward growth. Companies like Oracle are set to grow so fast in the future that the denominator in the P/E ratio is not fully known. In other words, fast-growing companies like ORCL are likely to grow into their P/E ratios.

No Signs of Climactic Action in Leaders

Bubbles only end in one fashion – with blow-off, climactic tops. For instance, in 1999, internet leader Qualcomm (QCOM) surged from a split-adjusted $3 to $100.

While we are witnessing strong moves in AI-related names, nothing comes close to this type of froth and mania in today’s market. Though there will be pullbacks along the way, this cycle is likely to end in the same way as the internet cycle. If you want to learn more about climax tops, you can read my deep dive here.

Bottom Line

Following a significant jobs revision that indicates a weaker market and strengthens the case for a Fed interest rate cut, the AI industry’s growth has become even more impressive. Recent news from Nebius and Oracle debunks key criticisms of the AI boom, showing that the industry’s growth is still in the early stages.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Wall Streets Latest Bet Is on HALO Companies With AI Immunity

NVDA MSFT GOOGL

The Wall Street Journal

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite