|

|

|

|

|||||

|

|

Nvidia's record gains over the last few years can be credited to its flourishing GPU business.

Investors may not realize that Nvidia and others outsource much of their foundry services to TSMC.

TSMC is poised to continue capturing growth as demand for AI infrastructure scales higher.

When investors think about artificial intelligence (AI) and the chips powering this technology, one company tends to dominate the conversation: Nvidia (NASDAQ: NVDA). It has become an undisputed barometer for AI adoption, riding the wave with its industry-leading GPUs and the sticky ecosystem of its CUDA software that keep developers in its orbit. Since the launch of ChatGPT about three years ago, Nvidia stock has surged nearly tenfold.

Here's the twist: While Nvidia commands the spotlight today, it may be Taiwan Semiconductor Manufacturing (NYSE: TSM) that holds the real keys to growth as we look toward the next decade. Below, I'll unpack why Taiwan Semi -- or TSMC, as it's often called -- isn't just riding the AI wave, but rather is building the foundation that brings the industry to life.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

What makes Taiwan Semi so critical is its role as the backbone of the semiconductor ecosystem. Its foundry operations serve as the lifeblood of the industry, transforming complex chip designs into the physical processors that power myriad generative AI applications.

TSMC manufactures GPUs designed by Nvidia, CPUs for Advanced Micro Devices, and a widening range of custom silicon that cloud hyperscalers are using to optimize AI workloads more efficiently. Today, Taiwan Semi dominates the global foundry market with roughly 68% share of industry revenue -- leaving rivals like Samsung Electronics in a distant second place with just 8%.

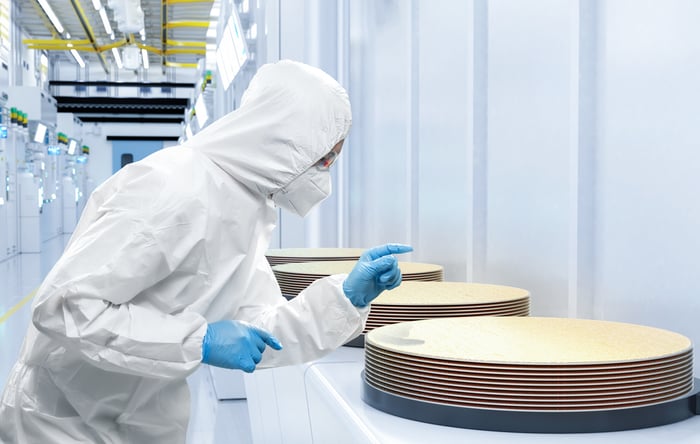

Image source: Getty Images.

One of the louder bear cases against Nvidia and AMD is the growing adoption of application-specific integrated circuits (ASICs). Hyperscalers are becoming highly motivated to design their own silicon -- not only to fine-tune training performance for AI models, but also to reduce reliance on incumbents and push back against their pricing power.

The trend is already visible: Alphabet's Google is rolling out its tensor processing units (TPU), Amazon is deploying its Trainium and Inferentia chips, while Microsoft is experimenting with its own AI accelerators.

For Nvidia and AMD, this shift could translate into slower growth as spending that once flowed directly toward their GPUs is instead redirected to internally developed hardware. For these enterprises, vertical integration isn't just a budgeting exercise; it's a strategic hedge against dominating third-party suppliers.

For TSMC, however, these dynamics look quite different. Custom ASICs still need a manufacturer, and Taiwan Semi's existing footprint in advanced fabrication services makes it a logical partner. In essence, TSMC is less vulnerable to which specific chip design gains momentum. Rather, the company is positioned as a neutral beneficiary riding the secular tailwinds fueling trillions of dollars being poured into AI infrastructure.

For investors, the central question boils down to durability in an increasingly competitive AI landscape. With its forward price-to-earnings (P/E) multiple peaking near 50 during the height of the AI frenzy, Nvidia is perhaps the most defining symbol of AI euphoria. Even after cooling off, the stock still trades at 38 times its forward earnings -- meaningfully elevated over its three-year average.

NVDA PE Ratio (Forward) data by YCharts

While this premium underscores the market's confidence, it also leaves little margin for error. Any slowdown in demand across compute and networking -- or mounting competition from custom silicon -- could put downward pressure on Nvidia's lofty valuation multiple.

By contrast, TSMC's valuation tells a different story. Despite being the underlying enabler of Nvidia, AMD, and hyperscalers alike, Taiwan Semi has not enjoyed the same degree of valuation expansion. To me, this suggests that the market has yet to fully price in TSMC's critical role at the intersection of AI development, infrastructure, and manufacturing.

As AI infrastructure spending accelerates, Taiwan Semi is uniquely positioned as an agnostic winner, as the company stands to benefit regardless of which chip designer is featured most prominently in the spotlight. By 2030, TSMC won't just be part of the AI story -- it likely will be seen as a critical chapter supporting the entire ecosystem.

For long-term investors, this makes TSMC stock a no-brainer opportunity to buy and hold -- one poised to outperform even today's most hyped semiconductor names.

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $681,260!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,046,676!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 47 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite