|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The global AI in healthcare market is experiencing explosive growth. According to a Fortune Business Insights report, the market is projected to scale from $39.25 billion in 2025 to approximately $504.17 billion by 2032, at a CAGR of 44.0%. Such growth is expected to be driven by rising demand for AI-enabled diagnostics, imaging, drug discovery, clinical workflow automation, and remote patient monitoring — areas where traditional systems are increasingly inadequate.

With technology giants aggressively moving into the space, select MedTech players are also emerging as prime beneficiaries. Two such names, Butterfly Network BFLY and Omnicell OMCL, stand out as well-positioned stocks that investors should keep on their radar to capture this transformative trend. Let’s delve deeper.

Big tech players are aggressively positioning themselves to capture this upside. NVIDIA NVDA led the charge through multiple strategic moves. For example, its collaboration with IQVIA leverages agentic AI to automate complex workflows across clinical research and life sciences, combining IQVIA’s domain data and analytics with NVIDIA’s AI Foundry services. Through its partnership with GE HealthCare and its Isaac for Healthcare platform, NVIDIA is pushing into autonomous medical-device functions —such as automated X-ray placement, ultrasound studies and image quality checks —enabling the simulation and virtual testing of physical AI systems before deployment.

Further, in its second-quarter 2025 Business Update, Palantir PLTR disclosed a partnership with TeleTracking, wherein its AIP (Artificial Intelligence Platform) will be used in hospitals to optimize staffing workflows, accelerate decision-making, and improve patient-centered care operations. The update shows that TeleTracking is integrating Palantir’s AIP tools to deliver near-real-time insights and support hospital command center operations to better manage capacity, staff resources and patient flow.

Quantum and cloud players, too, are collaborating in the drug discovery space. IonQ, alongside AstraZeneca, AWS and NVIDIA, demonstrated a hybrid quantum-classical workflow that ran a key reaction simulation about 20 times faster, highlighting how quantum can help cut bottlenecks in pharmaceutical R&D.

Meanwhile, classical and quantum infrastructure deals are also maturing. IBM IBM, in June, rolled out its advanced Quantum System Two next to Japan’s Fugaku supercomputer at RIKEN. This setup lets research groups and MedTech labs use powerful classical HPC and quantum hardware together in one place to handle big simulations and machine learning tasks.

Finally, capital flows to quantum firms indicate that strategic investors view quantum as a platform play for future healthcare advantage. Here, we should mention Quantinuum’s $600 million capital raise in September 2025, led by Honeywell with participation from NVIDIA and other strategic investors. While the funding release itself emphasized scaling quantum computing broadly, Quantinuum’s parallel announcements throughout 2025 show healthcare as a clear beneficiary. In August, the company launched QIDO, a quantum-integrated chemistry platform with Mitsui and QSimulate, aimed at faster drug and materials discovery.

Butterfly Network: The company has been advancing the use of AI/ML in diagnostic imaging. In August 2025, it reported that its iQ+ handheld ultrasound paired with a machine learning model achieved very high accuracy (AUROC of 0.94) in detecting aortic stenosis, which is often underdiagnosed. Butterfly Networkalso launched a new “Aorta Exam” protocol via its ScanLab AI-powered training app to help clinicians learn to use handheld ultrasound with greater consistency and skill. Recently, the company announced its role in the international research study CAD LUS4TB that will evaluate the impact of AI-assisted point-of-care ultrasound (POCUS) on tuberculosis (TB) triage in under-resourced settings.

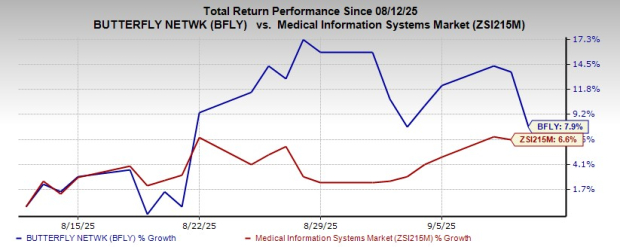

BFLY currently carries a Zacks Rank #2 (Buy). The company is projected to report 2025 earnings growth of 29.4% on a revenue increase of 10.9%. Over the past 30 days, Butterfly Network shares gained 7.9%, outperforming the industry’s 6.6% rise.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicell: In 2025, Omnicell has been pushing forward its technology roadmap along multiple fronts. It opened a new Innovation Lab in Austin, TX, dedicated to creating solutions across the medication journey, including advanced robotics, AI, autonomous devices, sensor tech and machine vision.

Additionally, it introduced product lines like MedTrack (an RFID-enabled drawer for tracking medications, especially in operating rooms) and MedVision, a web-enabled software for real-time inventory visibility and automated reordering in clinics. These technologies aim to reduce manual tasks, improve safety, reduce waste and increase efficiency in medication management workflows.

OMCL too holds a Zacks Rank #2. The company is projected to report 2026 earnings growth of 12.9% on a revenue increase of 2.3%. Omnicell is currently trading at a forward 12-month price-to-sales (P/S) multiple of 1.25. This valuation stands well below both its five-year median of 13.9X and the Zacks Medical Info Systems industry average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 14 min | |

| 18 min | |

| 26 min |

Stock Market Today: Dow Falls On New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

NVDA

Investor's Business Daily

|

| 35 min | |

| 40 min | |

| 48 min | |

| 1 hour | |

| 1 hour |

AI Stocks Hit Reset. Will Nvidia, Snowflake, CoreWeave, Salesforce Earnings Decide What's Next?

NVDA

Investor's Business Daily

|

| 1 hour |

Quantum Computing Stocks: Will Earnings, 2026 Outlooks Reignite Momentum?

IBM NVDA

Investor's Business Daily

|

| 1 hour |

AI Stocks Hit Reset. Will Nvidia, Snowflake, CoreWeave, Salesforce Earnings Decide What's Next?

PLTR

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite