|

|

|

|

|||||

|

|

Thursday on Wall Street began with encouraging economic data. In the morning, the Consumer Price Index (CPI) number met Wall Street expectations with a 2.9% year-over-year inflation rate. One of my favorite trading adages is “Words talk, data screams.” Following President Donald Trump’s ‘Liberation Day,’ most Wall Street Pundits anticipated elevated, tariff-induced inflation. While inflation is not all the way down to the Fed’s target of 2%, inflation remains tame. The fact of the matter is that, currently, US consumers and companies (as a whole) are experiencing little price shock. At the same time, exporters are being forced to largely “eat” the Trump tariffs or risk pricing themselves out of the fruitful US consumer market. Though the tariff and inflation correlation may change in the future, investors must work with the data in front of them and avoid relying on gut feelings or spooky headlines.

Meanwhile, tech stocks remained strong Thursday in the afterglow of software giant Oracle’s (ORCL) blockbuster earnings report, which showed the company has ~$500 billion in backlog. Between Oracle and Microsoft’s (MSFT) $17 billion data center deal with Nebius (NBIS), the AI market is sending a message a clear message: the AI boom is not only not slowing; it is likely in its early stages, and AI and data center spending is likely either to remain static or increase.

I have mentioned several times to Technology Innovator subscribers that I was contemplating putting on a hedge position as bearish September seasonality looms. However, seasonality is merely a secondary indicator, and price takes precedent over narratives. Thus far, all that has happened is that the QQQ has tested its rising 10-week moving average and found support.

I suspect that next week’s Fed meeting or options expiration (next Friday) could be a turning point. That said, investors should continue to allow the price and volume action to guide them. However, savvy investors understand that they are in the interpreting business, not the predicting one. Today, the NYSE registered an 80/80 upside breadth day (80% of stocks rose, while volume was concentrated in those winners). 80/80 days are yet another sign of strong market participation and bullish demand.

Friday, September 15th: Consumer sentiment @ 10:00 am EST.

AI names are responding well to the Oracle news this week. Examples include CoreWeave (CRWV) (up ~26%), Astera Labs (ALAB) (up more than 20%), and Arm Holdings (ARM) (up ~12% for the week).

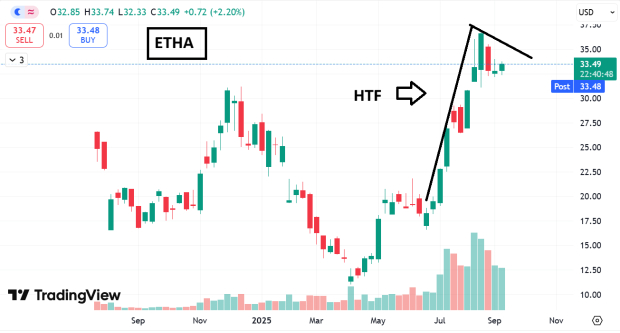

In crypto land, theiShares Ethereum ETF (ETHA) is currently carving out a classic O’Neil “High-tight flag” pattern. A HTF occurs when a stock shows extreme power – gaining 100% or more in 8 weeks or less. Next, the stock pulls back no more than 20% as it builds the “flag” portion of the pattern.

I highly recommend studying the pattern as it is one of the most powerful and rewarding. A recent example of an HTF is ALAB. Historical examples include:

· TSLA in June of 2013

· QCOM in June of 1999

· AXON (TASR) in September of 2003

I will work on putting together a high-tight flag educational article with marked-up charts in the coming days (you can follow my articles by clicking my name in the top left corner of this article and entering your email).

The Russell 2000 Index ETF (IWM) is finally starting to perform for bulls after a long and painful wait. IWM is up a robust 9.32% over the past month. I suspect that a lower interest rate environment will continue to be a tailwind for this market segment, and should the IWM break out of the current 5-year base structure it’s in, we may see fireworks into 2026. As the old Wall Street adage goes, “The longer the base, the higher in space.”

Bottom Line

Bulls remain in control, and the price action is telling them to stay long for now. While investors should continue to be vigilant about seasonality and a potential post-FOMC pullback, price should remain king.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Marketplaces Are the Next Frontier in Publisher Deals With AI Companies

MSFT

The Wall Street Journal

|

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite