|

|

|

|

|||||

|

|

The Goldman Sachs Group, Inc. GS stock reached a new all-time high of $793.2 in yesterday’s trading session.

The extensive rally in the GS stock was driven by strong momentum in mergers and acquisitions (M&As) and initial public offering (IPO) markets, which is likely to boost the company’s investment banking (IB) business. Further, the Federal Reserve’s 2025 stress test indicated robust financial health, with shareholder-friendly actions like dividend hikes and buybacks.

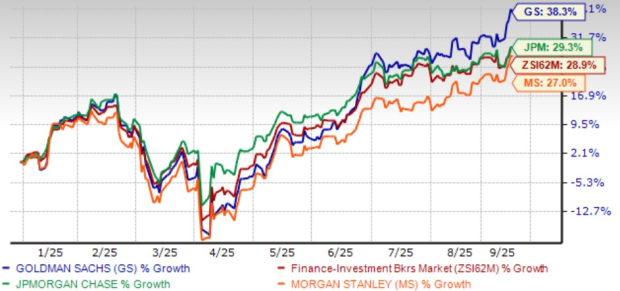

Year to date, shares of Goldman have appreciated 38.3% compared with the industry’s rally of 28.9%. Its peers JPMorgan JPM and Morgan Stanley MS have gained 29.3% and 27%, respectively.

Price Performance

The strength in the GS share price makes it a worthy topic of whether it is time to buy the stock. Let us delve deeper and analyze various factors at play to decide its investment worthiness.

Goldman’s IB revenues jumped 24% in 2024 to $7.73 billion from 2023, rebounding from a slump during the previous couple of years when global deal-making stalled amid the Russia-Ukraine conflict, recession fears and high inflation. Despite a subdued IB performance, the company maintained its #1 ranking in both announced and completed M&A.

This year has had its share of hiccups. It began on an optimistic note, although the market sentiment cooled after the launch of Trump’s tariff policies on 'Liberation Day.' Nonetheless, deal-making activities have picked up since then, with the uptrend in IB revenues continuing through the first six months of 2025.

During the Barclays 23rd Annual Global Financial Services Conference, Goldman’s CEO David Solomon stated that the company has logged strong activity across IPOs and M&As as of late, thanks in part to a friendlier regulatory environment under the pro-growth Trump administration.

Additionally, M&As are expected to remain robust in the second half of 2025, driven by greater clarity on taxes, tariffs, deregulation, pent-up demand, and corporates’ pursuit of greater scale and competitiveness. At the same time, the IPO market is showing renewed vitality. With rising M&As and IPO pipelines, Goldman’s decent IB backlog and leadership position will continue to support its IB performance.

GS’s streamlining effort has been underway for some time as it retreats from the underperforming, non-core consumer banking ventures and sharpens its focus on core businesses, including asset management, which is being viewed as a more stable revenue source.

The Asset and Wealth Management (AWM) division’s net revenues witnessed a CAGR of 9.9% from 2022 to 2024. Although in the first half of 2025, the segment’s net revenues fell due to a decline in equity and debt investments on the back of market uncertainty, it is expanding into fee-based revenue streams. As of June 30, 2025, the AWM division managed $3.3 trillion in assets under supervision and is experiencing strong momentum in alternative investments and customized wealth solutions for ultra-high-net-worth individuals.

Goldman is reportedly exploring acquisitions to expand its AWM footprint. Additionally, at the above-mentioned conference, the company stated that the division’s business is expected to grow in the high-single-digit range, thus contributing to a higher overall return for the firm.

Goldman maintains a fortress balance sheet, with the Tier 1 capital ratios well above regulatory requirements. As of June 30, 2025, cash and cash equivalents were $153 billion, and near-term borrowings were $69 billion. This financial strength allows it to return capital to shareholders aggressively through buybacks and a healthy dividend.

Post-clearing the 2025 Fed stress test, the company increased its quarterly dividend to $4.00 per common share, marking an increase of 33.3% from the prior payout. In the past five years, the company has raised dividends five times, with an annualized growth rate of 22%. Currently, its payout ratio sits at 26% of earnings.

Similarly, JPMorgan and Morgan Stanley raised their dividends five times over the past five years. At present, JPMorgan has a payout ratio of 29%, while Morgan Stanley’s payout ratio is 42%.

Additionally, Goldman has a share repurchase plan in place. At the end of the second quarter of 2025, it had $40.6 billion worth of shares available under authorization.

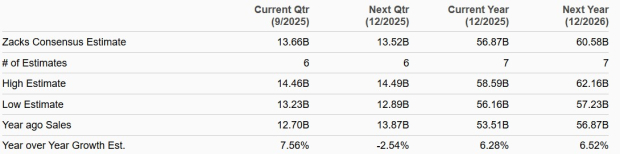

The Zacks Consensus Estimate for Goldman’s 2025 and 2026 sales implies year-over-year growth of 6.3% and 6.5%, respectively.

Sales Estimates

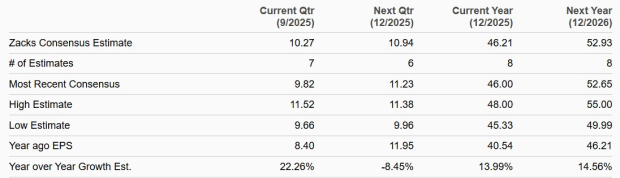

Over the past month, the Zacks Consensus Estimate for 2025 and 2026 earnings has been revised upward to $46.21 and $52.93, respectively. The Zacks Consensus Estimate for both years' earnings implies year-over-year growth of 13.9% and 14.6%, respectively.

Earnings Estimates

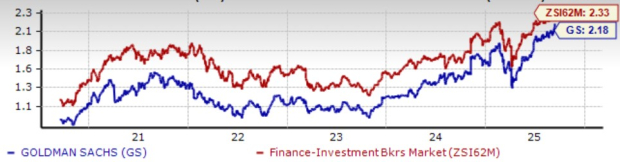

In terms of valuation, the GS stock looks inexpensive. The stock is trading at a forward price/book (P/B) of 2.18X compared with the industry average of 2.33X. Then again, Goldman’s stock is trading at a discount to its peers, JPMorgan and Morgan Stanley, which have forward P/B multiples of 2.49X and 2.52X, respectively.

Price-to-Book TTM

Goldman is well-positioned to handle near-term volatility, backed by strong operational results and a diverse revenue stream. Its strong capital returns, and an improving asset and wealth management business will support its financials in the long term. The rebound in M&As and robust deal pipeline will continue to support the company’s IB business. Its strong liquidity profile will enable a sustainable capital distribution plan.

The stock is trading at a discount. GS remains an attractive long-term investment option, supported by aggressive capital returns through dividends and buybacks, and a favorable business outlook.

At present, Goldman carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 49 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 14 hours | |

| Feb-26 |

How JPMorgan's Bankers Stayed Close to Epstein After Bank Fired Him as a Client

JPM

The Wall Street Journal

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite