|

|

|

|

|||||

|

|

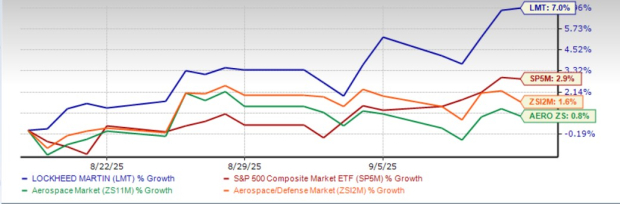

Shares of America’s largest defense contractor, Lockheed Martin Corp. (LMT), have surged 7% over the past month, outperforming the Zacks Aerospace-Defense industry’s growth of 1.6% and the broader Zacks Aerospace sector’s rise of 0.8%. The stock also beat the S&P 500’s return of 2.9% during the same period.

On the contrary, LMT’s industry peers, The Boeing Company (BA) and Embraer S.A. (ERJ), have lost 7.1% and 0.9%, respectively, over the same period.

A handful of favorable news announcements, implying solid demand and growth prospects for Lockheed’s products, must have bolstered investors’ confidence in this stock, which got duly reflected in the form of a decent price hike at the bourses.

Among the notable news, one significant was the Polish ministry’s mid-August agreement with the U.S. government to modernize Poland’s fleet of 48 F-16 aircraft to the advanced F-16V Viper configuration. Next to that week, LMT completed delivery of five new Black Hawk helicopters to the Philippine Air Force.

Soon after that, Lockheed won a $720 million contract for the production of Joint Air-to-Ground Missiles and HELLFIRE missiles from the U.S. Army. At the end of August, the U.S. Army down-selected LMT’s Spike Non-Line-of-Sight system capability for the Mobile-Long Range Precision Strike Missile (M-LRPSM) Directed Requirement competition, awarding the company the first phase of the contract to develop and test a precision-guided missile system prototype for the M-LRPSM Directed Requirement.

The company opened its order book for September, with a handful of defense contracts, which included a $900 million production contract for Javelin missiles as well as associated equipment and services, along with a $9.8 billion award for the production of 1,970 Patriot Advanced Capability – 3 Missile Segment Enhancement (PAC-3 MSE) interceptors and associated hardware.

Looking ahead, the contracts mentioned above should play the role of a major growth catalyst for LMT’s revenue growth in the coming quarters, thanks to revenues generated once these are completed. To this end, it is also imperative to mention that a steady order flow culminates in a solid backlog count for defense contractors like Lockheed.

Evidently, the company’s backlog totaled $166.5 billion as of June 29, 2025, with its management expecting to recognize approximately 38% of its backlog over the next 12 months and approximately 64% over the next 24 months. Such a solid backlog count bolsters LMT’s long-term revenue prospects and thus might enable the stock to continue its rally on the bourses.

Meanwhile, apart from its proven dominance in the U.S. defense industry, Lockheed enjoys a strong prominence in the international defense market, with its international business generating 27.1% of its total sales, as of June 2025. Notably, orders for tactical missiles, Black Hawk helicopters, and F-35 jets from multiple nations highlight the solid demand enjoyed by LMT outside America.

Additionally, defense programs like Aegis and Multi-Mission Surface Combatant ships attract interest from Japan, Saudi Arabia, and others. This sustained international demand enhances Lockheed’s revenue diversification and positions it for long-term global expansion.

This is further reflected in the Zacks Consensus Estimate for LMT’s long-term (three-to-five years) earnings growth rate of 10.3%.

Now, let’s take a sneak peek at its near-term estimates to check if those mirror a similar growth story.

The Zacks Consensus Estimate for 2025 and 2026 sales implies an improvement of 4.5% and 4.3%, respectively, year over year.

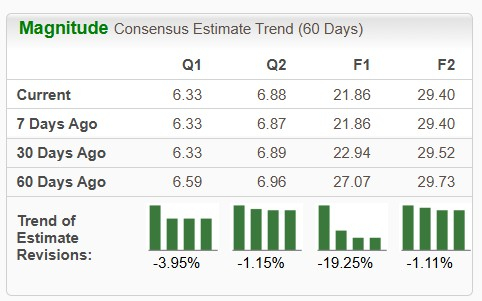

However, its 2025 earnings estimates suggest a decline of 23.2%. On the other hand, LMT’s 2026 earnings estimate calls for a rise.

The near-term bottom-line estimates for LMT have moved south over the past 60 days, implying analysts’ declining confidence in the stock’s earnings-generating prospects.

In terms of valuation, LMT’s forward 12-month price-to-earnings (P/E) is 17.34X, a discount to its peer group’s average of 20.37X. This suggests that investors will be paying a lower price than the company's expected earnings growth compared to its peers.

Its industry peer, Embraer, is, however, trading at a premium to both LMT and the peer group average. ERJ is currently trading at a forward 12-month earnings of 22.36X.

Lockheed faced significant financial challenges on classified contracts, recognizing $555 million losses in 2024 and about $1.4 billion cumulative losses by June 29, 2025, in its Aeronautics segment. Additionally, its Missiles and Fire Control segment recorded $1.46 billion in losses due to a competitively bid contract with fixed-price options, with $1.3 billion accrued as liabilities. Future performance issues or cost growth could lead to further material losses affecting financial results.

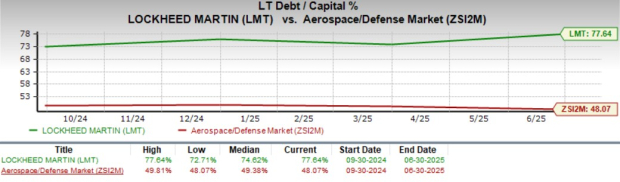

Moreover, Lockheed holds a poor solvency position, with both its long-term and current debt values exceeding its cash balance. Further, LMT’s long-term debt-to-capital ratio is higher than the industry average (as one can see below). Such a high debt-to-capital ratio suggests that the company relies more heavily on debt financing compared to its industry, indicating a higher financial risk and a greater burden on cash flow due to interest payments.

Lockheed’s near-term earnings plunge, coupled with elevated debt levels increasing financial risk, may deter new investors from investing in this stock despite its long-term growth potential.

However, those who own this Zacks #3 (Hold) company’s shares may continue to do so, given its discounted valuation, strong performance at bourses and long-term growth catalysts. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 6 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Defense Funds Poised For Breakouts As Trump Readies Potential Iran Strike

LMT BA

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

New Aerospace Stock, Up 110% This Week, Lands Support From GE Aerospace

LMT

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite