|

|

|

|

|||||

|

|

Wall Street investors are currently bracing for one of the most highly anticipated, yet uncertain, Federal Open Market Committee (FOMC) meetings/decisions in a very long time. Several story lines make this FOMC meeting in particular interesting. First, President Trump and his administration have aggressively pressured Federal Reserve Chairman Jerome Powell to cut interest rates for months. Meanwhile, several cross-currents exist in this unique economy, including slightly elevated inflation (CPI is ~1% above the Fed’s target) and healthy GDP (Q2 GDP showed a 3.3% annual growth). Below are five things to know before Wednesday’s FOMC meeting:

The Fed’s ‘mandate’, set by the US Congress, is to achieve maximum employment and stable prices with a long-term goal of 2% inflation. Though the Fed has failed to attain its inflation goal, two recent events likely solidify an interest rate cut on Wednesday.

· Jerome Powell recently communicated that the Fed is open to a “more flexible, inflation-targeting framework.”

· The US Bureau of Labor Statistics (BLS) just released one of the largest negative job revisions in history, with job growth 911,000 below what was initially thought for the year through March 2025. This signals a weaker economy and lends credence to President Trump’s call for lower interest rates.

Though many Wall Street investors are contemplating whether the Fed will cut rates by .50-bps or 25-bps, a 25-basis point cut is the most likely outcome by far. For instance, the ‘CME FedWatch Tool’ has the odds of a 25-bps cut at 96%. Similarly, betting website PolyMarket has the odds of a 25-bps interest rate cut at a near-certain 90%.

Investors should be prepared for wild price swings into the end of the week. Historically, FOMC meetings are far more volatile than average trading days, swinging ~1% on average. In addition to the FOMC decision, investors will need to contend with monthly options expiration (OPEX) this Friday. OPEX often leads to funky price action and increased volatility as market makers rush to hedge their market risk.

FOMC days are notorious for marking key turning points in equity markets. Heading into Wednesday’s FOMC, bulls have been in complete control of the market, with the Nasdaq 100 Index (QQQ) recording ten consecutive daily gains. Will Wall Street use the event as an excuse to ‘sell the news?’

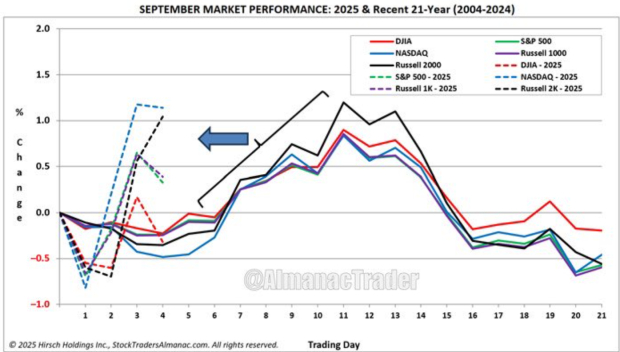

Meanwhile, historical seasonality data suggests that late September is one of the seasonally weakest times to be long stocks. While September still typically finishes green roughly half of the time, Q3 pullbacks are common and can set the stage for the year-end ‘Santa Claus Rally.’

While the last bullet point was focused on potential short-term movements, the long-term market picture becomes clearer when you extend your time frame. The Fed poised to cut interest rate cuts as the market approaches a new high. Historically, rate cuts near all-time highs are rare but extremely powerful. The Federal Reserve has cut interest rates 12 times when the S&P 500 Index was within 1% of its all-time high. The market was higher one year later all 12 times, with a median return of 15%, according to JP Morgan. The 1996 market environment is a potential precedent for the current market. Back then, the rate cut led to a 22% advance over the next year and set the table for the internet boom. Is the Fed about to throw kerosene on the fire that is the AI revolution? Should the market rally from here, AI names like CoreWeave (CRWV), Nebius Group (NBIS), Oracle (ORCL), Nvidia (NVDA), and Microsoft (MSFT) are likely to lead.

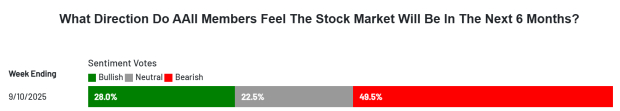

Despite the hefty market gains in 2025, many investors remain fearful, according to one sentiment survey. The latest AAII Sentiment Survey suggests that more investors are bearish than bullish – a potential bullish contrarian signal.

Nevertheless, market momentum statistics suggest that the party may just be getting started. Since 1975, there have been only six times when the S&P 500 rose 30% or more in five months. 2025 is one of those times. In 100% of these historical cases, the S&P 500 has ended higher in the following six and twelve months, per Carson Research. In fact, during such occurrences, the S&P 500 had better-than-normal performance, rallying by an average of 18.1% in the following twelve months.

Bottom Line

No matter the outcome of Wednesday’s meeting, all signs point to one of the most pivotal FOMC decisions in recent memory. While a 25-bps cut appears baked in, the potential for market volatility is elevated.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Workers Are Afraid AI Will Take Their Jobs. Theyre Missing the Bigger Danger.

MSFT

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite