|

|

|

|

|||||

|

|

GE Vernova Inc. (GEV) recently announced its agreement with Prokon Regenerative Energien to repower a wind farm in Germany, using eight 6MW-164m turbines from its Salzbergen factory. This repowering will enhance existing wind sites and boost renewable energy output, thereby supporting Germany’s clean energy targets.

To this end, Gilan Sabatier, GE Vernova’s CCO, emphasized the company’s commitment to growing profitable renewable generation. This deal underscores GEV’s strengthening position in the global wind energy industry and makes it a lucrative choice for investors seeking exposure to sustainable, fast-growing clean energy stocks.

However, a prudent investor recognizes that strategic investment decisions should not be driven by a single event but should take into account the company’s market performance, long-term growth prospects, and the challenges it faces. The ultimate goal is to make an informed decision.

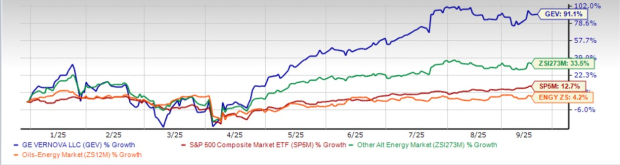

Shares of GE Vernova have surged an impressive 91.1% in the year-to-date period, outperforming the Zacks Alternative-Energy industry’s growth of 33.5% and the broader Zacks Oils-Energy sector’s rise of 4.2%. It has also outpaced the S&P 500’s growth of 12.7% over the same period.

A similar stellar performance has been delivered by other industry players, such as Bloom Energy (BE) and Talen Energy Corp. (TLN), whose shares have surged 201.8% and 101.3%, respectively, year to date.

Since the start of 2025, GEV’s share price momentum has gained from strong financial results and multiple strategic agreements showcasing its products’ growing market demand. The year began with a contract to supply 14 of its 4.2MW-117m turbines for Japan’s Iwaya and Shitsukari wind farms, followed by a partnership with Engine No. 1 and Chevron to develop scalable power solutions for U.S. data centers powered by natural gas.

In February, GEV teamed up with NRG Energy and TIC (Kiewit subsidiary) to provide 7HA gas turbines as part of a venture focusing on the rapid development of new electricity generation capacity. March saw a major deal with RWE for 109 of its 2.8MW-127m onshore wind turbines in Texas, powering the Honey Mesquite and Forest Creek wind farms.

April marked the commissioning of the 147 MW Abukuma wind farm powered by GE turbines. In May, GEV announced a $16 million investment to expand manufacturing and engineering in India. June brought a service contract with Uniper to upgrade three GT26 gas turbines at the Grain power station in the UK.

July featured an early work agreement with Fortum for the possible deployment of the BWRX-300 small modular reactor in Finland and Sweden. Most recently, August saw plans to invest $41 million to expand generator capacity at its Schenectady facility.

These diversified deals illustrate GEV’s expanding footprint and innovation across renewables, electrification, and nuclear sectors, fueling its robust growth trajectory.

With wind energy playing a critical role in the global energy transition, GE Vernova benefits from the growth trends of the wind industry, capitalizing on its decade-long expertise in providing technologically advanced products, such as turbines and blades. The company currently has an installed base of approximately 57,000 wind turbines (totaling more than 120 GW of installed capacity), which operate across more than 51 countries. It also has the largest installed base of onshore turbines in the United States.

Moreover, looking ahead, global nuclear capacity needs to be tripled by 2050 to reach zero-carbon objectives, according to the World Nuclear Association. This presents solid long-term growth opportunities for GE Vernova’s nuclear power business through the significant deployment of its BWX-300 SMRs.

In line with this, the Zacks Consensus Estimate for GEV’s long-term (three-to-five years) earnings growth rate is pegged at a solid 18%.

In fact, the growing investment in renewable-sourced electricity worldwide has also been bolstering the long-term growth prospects of other clean energy stocks, such as TLN and BE. Notably, the long-term earnings growth rate for TLN is 24.7%, while that for BE is 28%.

Now, let’s take a quick look at GEV’s near-term estimates to see if that also depicts the same growth story.

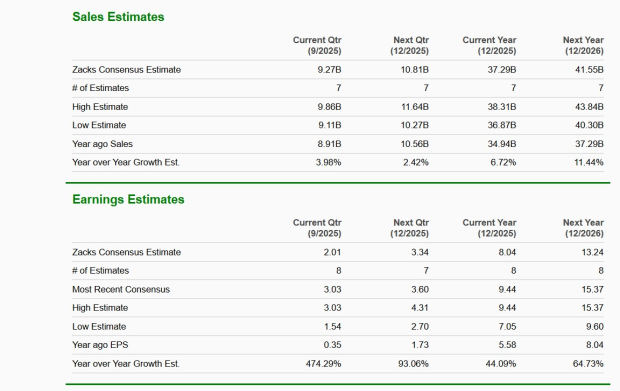

The Zacks Consensus Estimate for GEV’s 2025 and 2026 sales implies an improvement of 6.7% and 11.4%, respectively, year over year. A similar improvement can be witnessed in the company’s 2025 and 2026 earnings estimates.

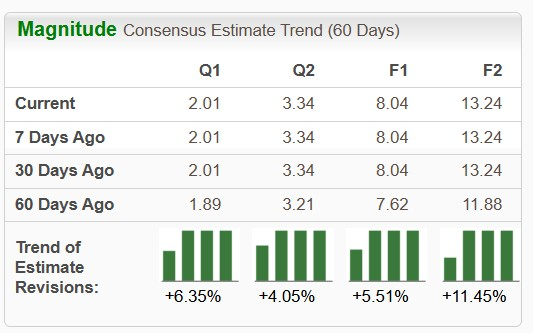

Moreover, GEV’s near-term earnings estimate has moved north over the past 60 days. The upward revision in earnings estimate indicates analysts’ increasing confidence in the stock’s earnings-generating capabilities.

Despite boasting solid growth opportunities, GE Vernova faces a few challenges, which a prudent investor should be aware of. Notably, the installation and maintenance of offshore wind turbines can be particularly impacted due to weather-related scheduling delays on account of their complex infrastructure, higher wind speeds, and the challenges of accessing offshore sites. Realizing the challenging market environment of the offshore wind industry, GE Vernova halted its engagement in new offshore wind turbine orders since last year (as per major media sources). The company also agreed to a termination of its last remaining Offshore Wind supply agreement during the first quarter of 2025.

GEV relies on complex global supply networks for components used in its gas turbines, wind turbines and grid infrastructure. Specifically, it purchases approximately $20 billion in materials and components sourced from over 100 countries. Therefore, disruptions in the availability of raw materials, such as steel and rare earth elements, along with logistical delays, have affected and may adversely impact GE Vernova’s production timelines and hike its input costs, thereby hurting its bottom line.

In terms of valuation, GEV’s forward 12-month price-to-earnings (P/E) is 53.59X, a premium to its peer group’s average of 15.74X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to its peers.

Its industry peers are also trading at a premium to the peer group average. While TLN is trading at a forward 12-month earnings of 24.26X, BE is trading at 103.40X.

To conclude, new investors interested in GEV stock may adopt a wait-and-watch approach, considering its premium valuation and supply-chain challenges.

However, those who already own this Zacks Rank #3 (Hold) stock may continue to retain it, given its robust price performance, upward revision in earnings estimates, and solid earnings growth potential supported by optimistic sales estimates. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite