|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Newmont Corporation NEM and Kinross Gold Corporation KGC are two prominent players in the gold mining space with global operations and diversified portfolios. Gold prices are skyrocketing, driven by the Federal Reserve’s dovish stance, uncertainties surrounding U.S. trade tariffs and geopolitical tensions.

Bullion prices have rallied to record highs this year, primarily attributable to aggressive trade policies. These include the sweeping new import tariffs announced by President Donald Trump that have intensified global trade tensions and heightened investor anxiety. Also, central banks worldwide have been accumulating gold reserves, apprehending risks arising from Trump’s policies.

Prices of the yellow metal have surged roughly 43% so far this year. The Federal Reserve’s interest rate reduction by a quarter of a percentage point, along with prospects of more rate cuts this year amid concerns over the labor market, has triggered the rally lately, driving prices north of $3,700 per ton for the first time. Increased purchases by central banks and geopolitical and trade tensions are the other factors expected to help the yellow metal sustain the upswing in gold prices.

Let’s dive deep and closely compare the fundamentals of these two mining giants to determine which one is a better investment now.

Newmont continues to invest in growth projects in a calculated manner. The company is pursuing several projects, including the Ahafo North expansion in Ghana and the Cadia Panel Caves and Tanami Expansion 2 in Australia. These projects should expand production capacity and extend mine life, driving revenues and profits.

The acquisition of Newcrest Mining Limited has also created an industry-leading portfolio with a multi-decade gold and copper production profile in the most favorable mining jurisdictions globally. The combination of Newmont and Newcrest is expected to deliver significant value for its shareholders and generate meaningful synergies. NEM has achieved $500 million in annual run-rate synergies, following the Newcrest buyout.

Newmont has also divested non-core businesses as it shifts its strategic focus to Tier 1 assets. NEM completed its non-core divestiture program in April 2025 with the sale of its Akyem operation in Ghana and its Porcupine operation in Canada. NEM has executed agreements to sell its shares in Greatland Resources Limited and Discovery Silver Corp., for total cash proceeds of around $470 million after taxes and commissions.

Following the sale of these shares, the company anticipates generating $3 billion in after-tax cash proceeds from its 2025 divestiture program. These funds will support Newmont’s capital allocation strategy, which focuses on reinforcing its balance sheet and delivering returns to its shareholders.

Newmont has a strong liquidity position and generates substantial cash flows, which allow it to fund its growth projects, meet short-term debt obligations and drive shareholder value. At the end of the second quarter of 2025, Newmont had robust liquidity of $10.2 billion, including cash and cash equivalents of around $6.2 billion. Its free cash flow surged nearly threefold year over year and 42% from the prior quarter to $1.7 billion, led by an increase in net cash from operating activities and lower capital investment. Net cash from operating activities shot up 17% from the prior quarter to $2.4 billion. NEM has ditributed roughly $2 billion to its shareholders through dividends and share repurchases and reduced debt by $1.4 billion since the beginning of 2025. Newmont’s board has also authorized an additional $3 billion share repurchase program.

NEM offers a dividend yield of 1.2% at the current stock price. Its payout ratio is 20% (a ratio below 60% is a good indicator that the dividend will be sustainable). Backed by strong cash flows and sound financial health, the company's dividend is perceived as safe and reliable.

Kinross has a strong production profile and boasts a promising pipeline of exploration and development projects. Its key development projects and exploration programs, including Great Bear in Ontario and Round Mountain Phase X in Nevada, remain on track. These projects are expected to boost production and cash flow and deliver significant value. KGC also completed the commissioning of its Manh Choh project and commenced production during the third quarter of 2024, leading to a substantial increase in cash flow at the Fort Knox operation.

Tasiast and Paracatu, the company’s two biggest assets, remain the key contributors to cash flow generation and production. Tasiast remains the lowest-cost asset within its portfolio, with a consistently strong performance. Tasiast achieved record annual production and cash flow in 2024 and is on track to meet its full-year 2025 guidance. Paracatu continues to deliver a strong performance, with second-quarter production rising on higher grades and improved mill recoveries.

KGC has a strong liquidity position and generates substantial cash flows, which allows it to finance its development projects, pay down debt and drive shareholder value. KGC ended second-quarter 2025 with robust liquidity of roughly $2.8 billion, including cash and cash equivalents of more than $1.1 billion. Second-quarter free cash flow surged approximately 87% year over year and 74% from the preceding quarter, driven by the strength in gold prices and strong operating performance.

Kinross repaid $800 million of debt during 2024 and the remaining $200 million of its term loan in the first quarter of 2025. Moreover, KGC's net debt position improved to around $100 million at the end of the second quarter from $540 million in the prior quarter. KGC also offers a dividend yield of 0.5% at the current stock price. It has a payout ratio of 10%, with a five-year annualized dividend growth rate of about -0.1%.

Kinross saw a roughly 4% year-over-year rise in production costs of sales per ounce to $1,074 in the second quarter. All-in-sustaining costs (AISC), a key indicator of cost efficiency in mining, rose nearly 8% year over year to $1,493 per gold equivalent ounce sold. While a 40% increase in average realized gold prices led to a surge in second-quarter profits, the rise in unit costs underscores a spike in inflation.

KGC’s guidance indicates cost pressures through the end of 2025, with the company expecting full-year AISC per gold equivalent ounce to reach $1,500 and production cash costs to be around $1,120 per ounce. Costs are expected to rise in the remaining quarters of 2025 due to weaker expected production and inflationary impacts. Also, accounting changes to recharacterize stripping costs at certain sites as operating costs are expected to push up unit costs.

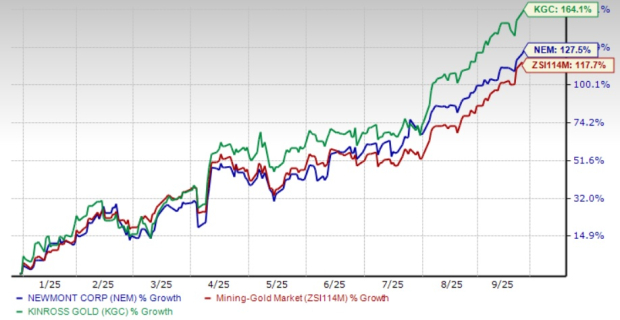

Year to date, NEM stock has rallied 127.5%, while KGC stock has soared 164.1% compared with the Zacks Mining – Gold industry’s increase of 117.7%.

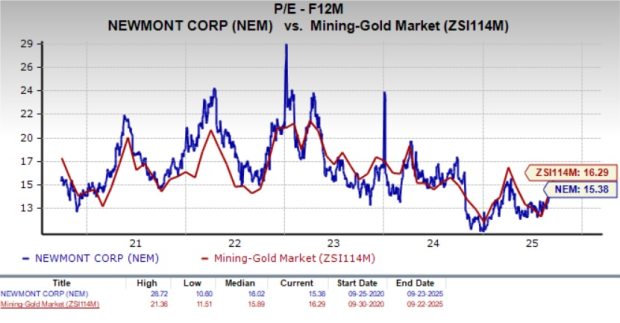

NEM is currently trading at a forward 12-month earnings multiple of 15.38. This represents a roughly 5.6% discount when stacked up with the industry average of 16.29X.

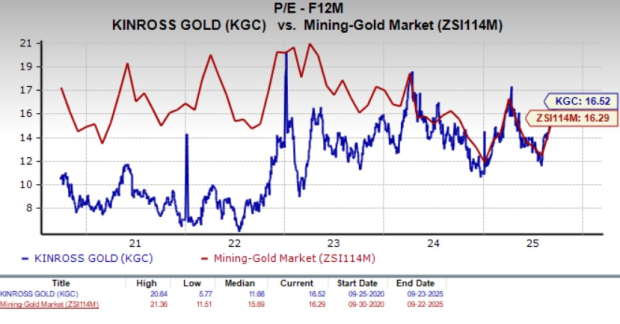

Kinross is trading at a premium to Newmont. The KGC stock is currently trading at a forward 12-month earnings multiple of 16.52, modestly higher than its industry.

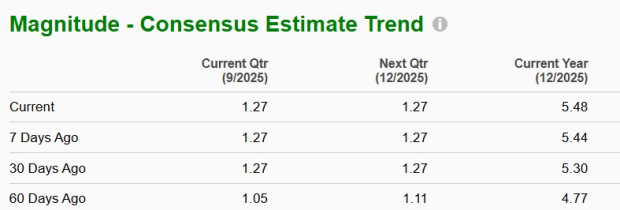

The Zacks Consensus Estimate for NEM’s 2025 sales and EPS implies a year-over-year rise of 10.7% and 57.5%, respectively. The EPS estimates for 2025 have been trending higher over the past 60 days.

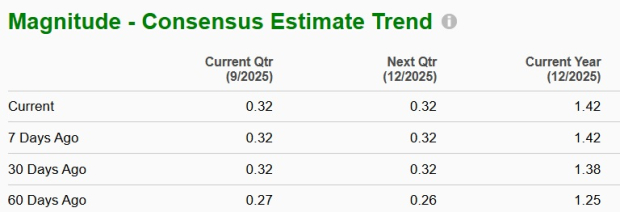

The consensus estimate for KGC’s 2025 sales and EPS implies year-over-year growth of 27.8% and 108.8%, respectively. The EPS estimates for 2025 have been trending northward over the past 60 days.

Both Newmont and Kinross are well-positioned to benefit from the strong gold price environment, each demonstrating strong financial performance and commitment to shareholder returns. Both have a strong pipeline of development projects, solid financial health and are seeing favorable estimate revisions. Newmont appears to have an edge over Kinross due to its more attractive valuation and higher dividend yield. Investors seeking exposure to the gold space might consider Newmont as the more favorable option at this time.

NEM currently sports a Zacks Rank #1 (Strong Buy), whereas KGC has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite