|

|

|

|

|||||

|

|

Western Digital Corporation WDC is experiencing strong growth driven by the surging demand for high-capacity storage fueled by cloud computing and AI. As the company delivers cutting-edge HDD technology to its customers, it remains committed to innovation, focusing on providing drives with the highest capacity, enhanced performance, improved energy efficiency and the lowest total cost of ownership.

During the fiscal fourth quarter, the company shipped 190 exabytes of storage to customers, up 32% year over year, fueled by strong demand for nearline drives and growing volumes of its 26TB CMR and 32TB UltraSMR products. Additionally, shipments of its 26TB CMR and 32TB UltraSMR drives more than doubled from the previous quarter, reaching more than 1.7 million units in June. This was one of the fastest ramp-ups in its history.

The reliability, scalability and TCO benefits of its ePMR and UltraSMR technologies remain key to its success in the data center market. Western Digital plans to build on this with its next-generation HAMR drives, which are showing promising results in early tests with two hyperscale customers. It remains ahead of internal milestones, making steady progress in aerial density and focusing on long-term reliability and manufacturing yield. The HAMR drives will move into the qualification phase soon, targeting a ramp-up in the first half of 2027. Meanwhile, its next-gen ePMR drives are set to complete qualification by early 2026, ensuring a smooth and cost-effective transition to HAMR.

In May 2025, the company drove a new era of storage innovation by advancing infrastructure solutions tailored for AI/ML, software-defined storage and disaggregated storage. With a focus on hyperscale cloud service providers, enterprises and Storage-as-a-Service vendors, the company’s Platforms Business delivered both high-capacity JBODs (Just a Bunch of Disks) and high-performance EBOF (Ethernet Bunch of Flash) NVMe-oF solutions to support intensive data workloads.

For the first quarter of fiscal 2026, management anticipates ongoing revenue growth, supported by strong data center demand and better profitability driven by increased adoption of high-capacity drives. Western Digital anticipates non-GAAP revenues of $2.7 billion (+/- $100 million) at the mid-point of its guidance, up 22% year over year. Management projects non-GAAP earnings of $1.54 (+/- 15 cents).

Despite these strengths, competition remains a key consideration. Western Digital faces competition from Seagate Technology Holdings plc STX, Pure Storage, Inc. PSTG, Hitachi, Samsung and Intel in the storage market. Moreover, customer concentration and leveraged balance sheet are added concerns.

Seagate is leveraging secular trends and technology innovation to boost areal density, driving growth in its mass-capacity storage business. Its 2024 launch of the Mozaic 3+ platform, featuring HAMR, enables denser data storage and positions the company to capitalize on AI and machine learning demand. On the PMR front, 24–28 terabyte drives are Seagate’s top sellers in revenue and exabyte shipments, with record nearline sales in the June quarter. Mozaic 3+ drives, offering three terabytes per disk, are seeing strong adoption among cloud service providers, with mid-2026 CSP qualifications on track. The main priority for fiscal 2026 is qualifying and ramping the four+ terabyte per disk platform, supporting capacities up to 44 terabytes for cloud and smaller sizes for edge. Moreover, management is steadily advancing 5TB per disk technology, aiming for market launch in early 2028. Lab demonstrations of 10TB per disk are also expected around that time. Ongoing innovation in media and photonics is key to this progress.

Pure Storage continues to reshape the future of enterprise storage with innovations tailored for modern data workloads, particularly AI, containerization and high-performance computing. In addition to hardware and architectural innovation, it advanced its cloud-native storage strategy. The company introduced Portworx for KubeVirt in the fiscal second quarter, a virtualization-centric storage solution for Kubernetes. Specifically, Pure Storage supports Red Hat OpenShift Virtualization Engine, simplifying the management of VM workloads while reducing costs. A leading financial institution is modernizing with Purity, Portworx and the Pure Storage platform, migrating from VMs to containers and Kubernetes. The shift delivers platform independence, stronger security, higher efficiency and rapid recovery, while cutting infrastructure needs by more than 70%. With Pure’s Professional Services, the company is building a fully automated, software-defined environment for long-term advantage.

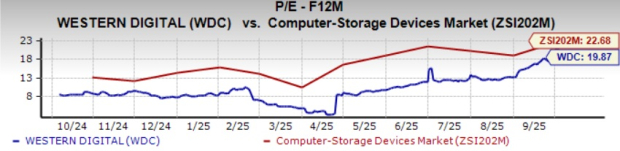

In the past year, shares of the company have gained 97.7% compared with the Zacks Computer-Storage Devices industry’s growth of 35.1%.

In terms of forward price/earnings, WDC’s shares are trading at 19.87X, lower than the industry’s 22.68X.

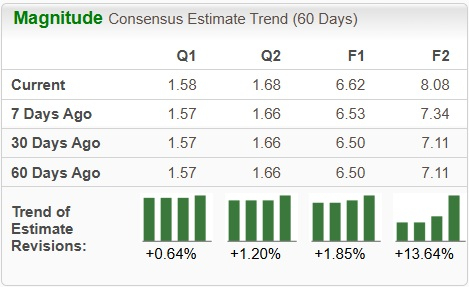

The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised up 1.85% to $6.62 per share over the past 60 days.

Currently, Western Digital sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 12 hours | |

| 14 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite