|

|

|

|

|||||

|

|

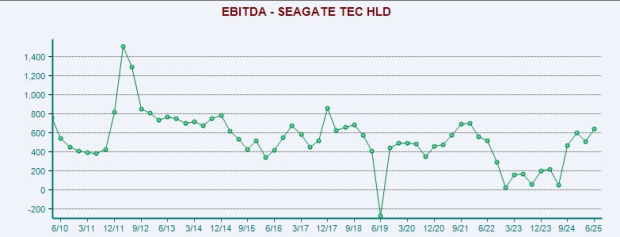

As global data creation accelerates, driven by AI, cloud computing, video content, and edge applications, demand for scalable, high-performance, and cost-efficient storage solutions is surging. The global data storage market is estimated to grow from $255.3 billion in 2025 to $774 billion by 2032, at a CAGR of 17.2%, as stated by Fortune Business Insights. In this context, storage stocks become an interesting pair to compare, with both Seagate Technology Holdings plc (STX) and Quantum Corporation (QMCO) positioned to capture value from the heightened demand for scalable, efficient, and intelligent data storage solutions across AI, cloud, and enterprise markets.

Seagate, a key storage player, is promoting growth through its Heat-Assisted Magnetic Recording (HAMR) technology, which enables higher areal density to meet the increasing storage demands of hyperscale data centers, AI training and edge environments. Organizations require modern, user-friendly solutions to handle massive data, and Quantum offers a comprehensive end-to-end software portfolio to unlock its full value. While STX holds a solid foothold in the global data storage market, especially for HDDs, QMCO remains a niche specialist serving enterprise segments like media and surveillance with integrated software-driven solutions.

Both QMCO and STX are well-positioned to capitalize on these growing trends, drawing renewed investor interest. But for those deciding between the two, which stock stands out when considering fundamentals, valuations, growth prospects, and associated risks?

Let’s delve deep into this.

In today’s data-driven world, the demand for mass-capacity storage extends from the cloud to edge data centers. As more data is generated at the edge, it is replicated and retained longer to support AI model training, checkpoints, and inferencing. With roughly 50% of data centers concentrated in just four countries, evolving data sovereignty regulations are driving the need for localized storage. Seagate expects mass-capacity hard drives to be critical for efficiency, footprint, and TCO, while enterprise storage demand at the edge is likely to follow the cloud trend, where initial AI infrastructure investments boost long-term storage needs.

Supporting this view, a leading enterprise IT provider will introduce new tiered storage solutions for AI later this year, integrating high-capacity HAMR drives to optimize TCO and data utilization, while Seagate continues to expand exabyte shipments of its PMR 24–28TB platform, achieving record quarterly sales and volumes for nearline products in the June quarter.

Leveraging commonality across PMR and HAMR platforms, Seagate is ramping Mozaic 3+ drives, with shipments expanding to additional CSPs in the September quarter and key global CSP qualifications expected by mid-2026. The fiscal 2026 priority is executing 4+TB per-disk HAMR drives, supporting cloud workloads up to 44TB and lower-capacity drives for edge deployments. Qualification has begun with a global CSP, with volume ramp expected in the first half of 2026, aligning with the target for exabyte-scale HAMR nearline shipments in the second half of 2026.

Ongoing innovation in granular platinum media and photonics technology is crucial to Seagate’s areal density roadmap. The company is steadily developing 5TB-per-disk technology, aiming for market launch in early 2028, while also working to demonstrate 10TB per disk in the lab within the same timeframe. Additionally, the increasing adoption of high-capacity nearline products and effective pricing strategies is driving margin expansion, supporting the company’s positive outlook. Demand for large-scale data storage is expected to grow as STX’s cloud and edge IoT customers invest in AI-driven initiatives to unlock and safeguard data. While remaining aware of changing trade policies, management anticipates minimal tariff impact and will continue monitoring developments to implement mitigation strategies if necessary.

However, Seagate faces several risks despite its strong market position. A significant portion of its revenues comes from outside the United States, exposing the company to forex fluctuations. It operates in a highly competitive landscape, facing rivals in HDD, SSD, and storage subsystems, while global macroeconomic challenges and supply-chain volatility add pressure. High indebtedness is another concern, limiting financial flexibility for dividends, buybacks, and acquisitions.

Nonetheless, Seagate’s evolving business model and robust product pipeline position it to drive stronger profitability and cash flow in fiscal 2026. Reflecting this confidence, the company expects to resume share repurchases this quarter, boosting shareholder returns.

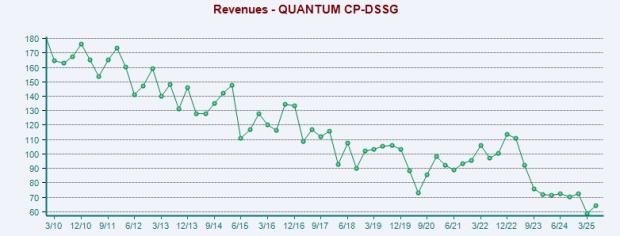

Quantum helps organizations safeguard and leverage every byte of data, providing end-to-end data lifecycle management for high-speed capture, secure backup, real-time collaboration, and cost-effective long-term archiving. With more than decade of experience, it ensures data is always available, protected, and ready to drive innovation. Its end-to-end platform uses AI to tag, catalog, and index data, making it easily accessible for reuse.

Quantum boasts a strong foundation of high-value assets with opportunities to enhance sales distribution and execution through a product-first strategy. Its solutions and roadmap are well aligned with growth trends in AI, media and entertainment, data protection, and long-term archiving. It is also restructuring teams to align with its growth model, ensuring every aspect of the sales process, from forecasting to customer support, operates with precision.

Further, it is increasing focus on top channel partners, helping them cross-sell and upsell across the portfolio, while offering stronger incentives. New partnerships in data protection and cybersecurity, along with expanded distributors in South Asia, India, and China, continue to strengthen reach in high-growth markets. As momentum builds, management remains focused on delivering differentiated value through its unique solutions. The rapid growth of AI and data is driving demand for cost-effective cold storage and long-term archiving, and Quantum is well-positioned to address it.

QMCO’s flagship solutions, ActiveScale cold storage and the Scalar i7 RAPTOR Tape library, deliver industry-leading price-performance and scalability, supporting hyperscalers and long-term archive strategies. In September, QMCO announced that its Scalar i7 RAPTOR has earned the Veeam Ready qualification from Veeam Software, the global leader in Data Resilience. This achievement extends the Veeam Ready designation across Quantum’s entire Scalar tape library portfolio, ensuring secure, cyber-resilient, and cost-effective data protection and retention.

However, softening revenues and margins remain a worry for the company. In the last reported quarter, the top line plunged 11% year over year to $64.3 million, affected by changes in product mix, as the company continues its transition toward a higher-value business model. QMCO reported a non-GAAP loss of $1.58 per share, wider than the loss of $1.57 per share in the year-ago quarter. Reduced revenue levels, along with an increase in inventory provisions and elevated import tariff expenses, hurt its bottom line. High debt load is another concern.

Over the past year, STX and QMCO have registered gains of 138.2% and 236%, respectively.

In terms of the forward 12-month price/sales ratio, QMCO is trading at 0.61X, lower than STX’s 5.16X.

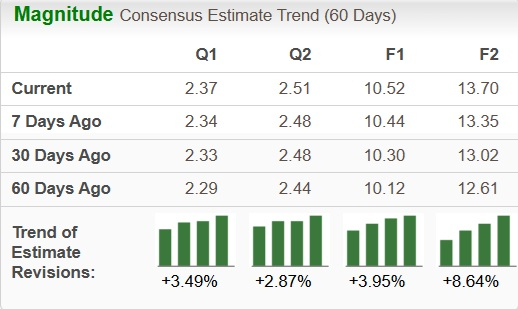

The Zacks Consensus Estimate for STX’s earnings for fiscal 2026 has been revised north to $10.52 over the past 60 days.

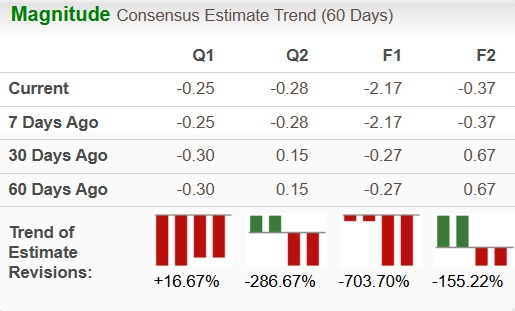

The Zacks Consensus Estimate for QMCO’s earnings for fiscal 2026 has been revised south to a loss of $2.17 over the past 60 days.

Both QMCO and STX are well-positioned to benefit from the growing data storage market, capturing opportunities across AI, enterprise, and consumer storage segments.

QMCO has a Zacks Rank #4 (Sell), while STX sports a Zacks Rank #1 (Strong Buy). Consequently, in terms of Zacks Rank, STX seems to be a better pick at the moment.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite