|

|

|

|

|||||

|

|

McKesson MCK is making a strategic shift that will redefine its role in the healthcare ecosystem. Long known as one of the largest pharmaceutical distributors in North America, the company is now focusing on expanding its higher-margin services in oncology, multispecialty care and biopharma solutions.

McKesson is positioning itself for sustainable long-term growth through technology, automation and specialized care, while preparing to separate its Medical-Surgical business to sharpen focus.

McKesson is benefiting from strong momentum in pharmaceutical distribution and specialty therapy demand. The U.S. pharmaceutical market is expected to grow at a 7% CAGR between 2019 and 2029, with specialty drugs accounting for an increasing share. Oncology spending alone is projected to expand 60% from 2025 to 2029, directly supporting McKesson’s oncology-focused platforms.

Management has guided for fiscal 2026 adjusted operating profit of $6.2-$6.4 billion, adjusted EPS of $38.05-$38.55 and a free cash flow of $4.4-$4.8 billion. These targets reflect robust operating leverage, supported by investments in distribution center automation, wherein fulfillment rates exceed 90%. The expansion of specialty distribution — now a $90-billion revenue stream — underscores the company’s scale advantage.

McKesson’s Oncology and Multispecialty segment is projected to deliver 49-53% adjusted operating profit growth in fiscal 2026, driven by network expansion, clinical trial services and new practice management tools.

The acquisition of PRISM Vision and partnerships like Sarah Cannon Research Institute enhance its clinical trial and patient access capabilities, strengthening the company’s value proposition to providers and biopharma sponsors.

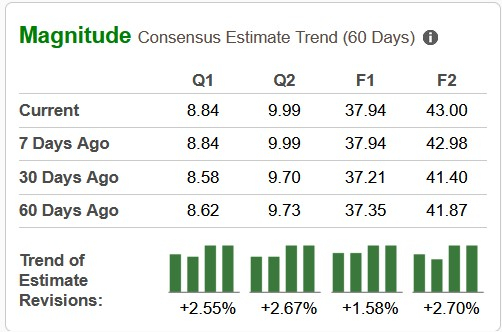

Earnings Estimate Trend

Over the longer horizon, McKesson is betting on structural trends in healthcare. The company’s U.S. Oncology Network now includes more than 3,300 providers and supports 1.4 million patients annually. This scale is central to its strategy of integrating clinical care, real-world evidence generation and biopharma services.

By leveraging technology platforms such as Ontada for real-world data analytics and iKnowMed for oncology electronic health records, McKesson is embedding itself deeper into the specialty care value chain.

Emerging therapeutic modalities represent another major tailwind. Through its InspiroGene platform, McKesson is building logistics, distribution and patient-support capabilities for cell and gene therapies — an area expected to expand rapidly over the next decade. The company’s investment in cold-chain infrastructure and automation enhances its ability to serve this market efficiently.

Capital allocation remains another long-term strength. Management has demonstrated discipline by exiting lower-return businesses, repurchasing shares and maintaining dividends, while reinvesting in high-growth areas. With return on invested capital improving by more than 1,800 basis points since fiscal 2020, McKesson is clearly benefiting from portfolio repositioning.

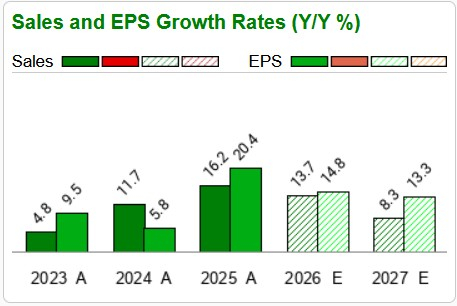

Growth Estimates

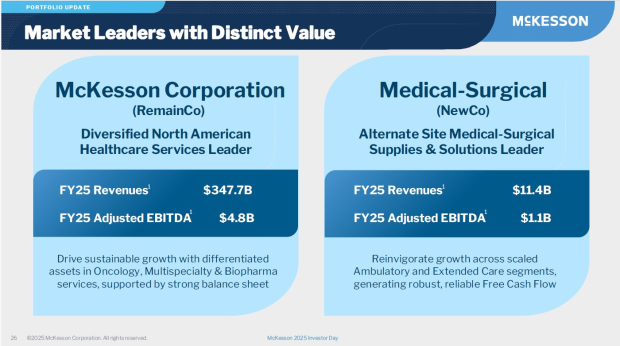

A major strategic initiative is the planned separation of the Medical-Surgical business, which generated $11.4 billion in fiscal 2025 revenues and $1.1 billion in adjusted EBITDA.

Management envisions a multi-step process, beginning with an IPO of a minority stake, followed by a full separation by the second half of calendar 2027. The separation will allow McKesson to streamline its focus on pharmaceuticals, oncology and biopharma services, while enabling Medical-Surgical to pursue its own growth path.

While this move may unlock shareholder value, execution risks related to audited carve-outs, regulatory approvals and transition services remain material considerations.

Despite its strong positioning, McKesson faces significant challenges. Regulatory and legal risks, including ongoing scrutiny tied to historical opioid litigation, remain an overhang. Operationally, integrating the latest acquisitions like PRISM Vision and managing partnerships requires disciplined execution.

The competitive landscape in specialty distribution and oncology services is intensifying, with both traditional distributors and emerging digital players seeking market share. While automation and AI investments promise margin improvement, large-scale technology deployments carry risks of disruption and cost overruns.

Finally, success in cell and gene therapy logistics will depend not only on infrastructure but also on the pace of regulatory approvals and clinical adoption.

Although pharmaceutical distribution represents a significant opportunity, with the market size expected to exceed $1 trillion by 2030, McKesson is diversifying to improve margins and streamline operations. Apart from McKesson, the two large distributors, Cardinal Health CAH and Cencora COR, are diversifying into higher-margin businesses, primarily focusing on oncology and specialty care.

Cardinal Health is executing a deliberate pivot beyond its traditional pharmaceutical distribution model, building a multi-platform healthcare solutions portfolio aimed at higher growth and margin resilience. A central pillar of this strategy is specialty care, wherein the acquisitions of Solaris Health and majority stakes in GI Alliance and ION have expanded its managed services organization platform to nearly 3,000 providers across 32 states.

This positions Cardinal as a leader in urology, oncology and autoimmune care, with diversified revenue streams from diagnostics, labs and ancillary services. Its Biopharma Solutions unit, anchored by the Sonexus patient support hub, is expected to deliver more than 20% revenue growth, supporting dozens of drug launches annually.

Complementing this, Cardinal is scaling at-Home Solutions, expanding nuclear and Theranostics offerings in oncology and urology, and enhancing OptiFreight’s technology-driven logistics platform. Together, these initiatives reflect Cardinal’s evolution into a comprehensive healthcare solutions company, with strong long-term growth levers beyond distribution.

Cencora is actively reshaping its business model to extend beyond its core pharmaceutical distribution operations, positioning itself as a broader healthcare solutions provider. While distribution remains foundational, management is prioritizing high-growth, higher-margin specialty services. The acquisition of Retina Consultants of America exemplifies this strategy, giving Cencora direct exposure to physician-centric networks, clinical trial access and novel therapies, such as investigational gene treatments.

Similarly, its investment in OneOncology expands capabilities in community oncology, integrating Cencora into the specialty care ecosystem. Beyond U.S. operations, the company continues to leverage global specialty logistics and consulting, supporting biopharma manufacturers with product launches and trial execution.

Parallel investments in digital transformation, advanced analytics and provider support programs, such as Good Neighbor Pharmacy, underscore its evolution from distributor to solutions partner. While execution risks remain, this pivot promises stronger margins and long-term resilience as specialty therapies and innovative care models gain momentum.

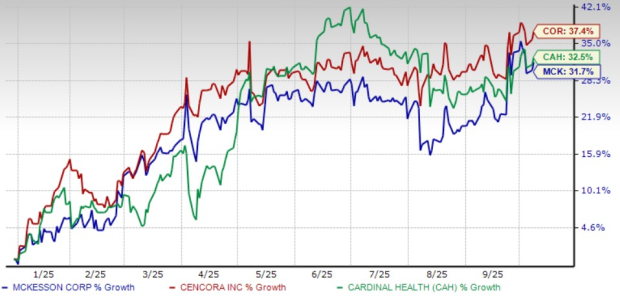

YTD Performance: MCK vs. CAH vs. COR

McKesson is at an inflection point. By pivoting toward oncology, specialty distribution and biopharma services, the company is targeting higher-margin growth avenues while shedding non-core assets.

The company’s near-term guidance suggests strong earnings momentum, supported by secular drug market expansion, while long-term initiatives, such as cell and gene therapy logistics, position McKesson at the frontier of healthcare delivery. The planned separation of Medical-Surgical underscores management’s intent to sharpen focus, though execution risks should not be underestimated.

For investors, McKesson represents a balanced opportunity — a defensive core distributor evolving into a specialty-driven healthcare solutions leader, with both short-term earnings visibility and long-term strategic upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 9 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite