|

|

|

|

|||||

|

|

PepsiCo, Inc. PEP has reported robust third-quarter 2025 results, wherein revenues and earnings per share (EPS) beat the Zacks Consensus Estimate. While revenues improved year over year, EPS declined. The company witnessed accelerated net revenue growth compared with the previous quarter, reflecting its ability to navigate a challenging environment.

PepsiCo delivered a strong third-quarter performance, supported by steady momentum in its North America beverage business and resilient growth across international markets. The company benefited from improving trends in its global convenient foods segment and better profitability within PepsiCo Foods North America. Continued innovation, cost optimization and portfolio reshaping helped drive solid results despite ongoing supply chain and inflationary pressures.

PEP’s third-quarter core EPS of $2.29 beat the Zacks Consensus Estimate of $2.27 and declined 0.9% year over year. In constant currency, core earnings fell 2% from the year-ago period. The company reported EPS of $1.90 per share, which fell 10.8% year over year in the third quarter. Foreign currency impacted EPS by 1%.

PepsiCo, Inc. price-consensus-eps-surprise-chart | PepsiCo, Inc. Quote

Net revenues of $23.94 million rose 2.6% year over year and beat the Zacks Consensus Estimate of $23.87 billion. The unit volume was down 1% for the convenience food business 1% down for the beverage business. Foreign currency impacted revenues by 0.5%.

On an organic basis, revenues grew 1.3% year over year. The rise was driven by a 4% increase in effective net pricing, offset by a 3% decline in organic volume.

Our model predicted year-over-year organic revenue growth of 2% for the third quarter, with a 3.6% gain from the price/mix and a 1.6% decline in volume.

On a consolidated basis, the reported gross profit declined 0.8% year over year to $12.8 billion. The core gross profit declined 0.4% year over year to $12.9 million. The reported gross margin declined 180 bps, whereas the core gross margin fell 160 bps year over year.

We anticipated the core gross margin to contract 20 bps year over year to 55.3% in the third quarter. In dollar terms, core gross profit was expected to increase 1% year over year.

PepsiCo reported an operating income of $3.6 billion, which fell 7.8% year over year. The core operating income declined 0.9% year over year to $4.2 billion. The core constant-currency operating income declined 1.5% year over year. The operating margin contracted significantly to 14.9% from 16.6% in the year-ago quarter on a reported basis. On an adjusted basis, the core operating margin contracted 60 bps year over year to 17.3%.

Our model predicted core SG&A expenses of $8.9 billion, which indicated year-over-year growth of 2.3%. As a percentage of revenues, core SG&A expenses were anticipated to be 37.9%, suggesting a 30-bps rise from the prior-year quarter.

We expected a core operating margin of 17.3%, implying a 60-bps decline from the year-ago quarter’s actual.

On a reported basis, PepsiCo witnessed revenue growth across most operating segments, except for IB Franchise.

Revenues on a reported basis rose 2% year over year in PBNA, 9% in EMEA, 2% in LatAm Foods and 2% in Asia Pacific Foods. However, reported revenues were flat in IB Franchise.

PEP’s organic revenues improved across most operating segments, except for PFNA and IB Franchise. Organic revenues rose 2% for PBNA, 5.5% for EMEA and 4% for the LatAm Foods segment and 1% for in Asia Pacific Foods. However, organic revenues declined 3% for the PFNA and were 1% for the IB Franchise segment.

PEP ended third-quarter 2025 with cash and cash equivalents of $8.1 billion, long-term debt of $44.1 billion and shareholders’ equity (excluding non-controlling interest) of $19.5 billion.

Net cash provided by operating activities was $5.5 million as of Sept. 9, 2025, compared with $6.2 billion as of Sept. 7, 2024.

Looking ahead, PepsiCo remains committed to strengthening its international momentum for the balance of the year, while accelerating improvements in North America. Key priorities include driving growth and profitability through portfolio innovation and cost optimization. As a result, the company expects its organic revenues to grow in 2025.

For 2025, PepsiCo remains confident in achieving low-single-digit organic revenue growth and expects core constant currency EPS to be roughly in line with the prior year. Looking beyond 2025, the company is prioritizing faster organic revenue growth and enhanced operating profit margins, supported by a strong innovation pipeline, continued portfolio transformation, optimized pricing strategies, and a streamlined cost base to fund future growth and long-term shareholder value creation.

Based on the current rates, PEP expects currency headwinds to hurt revenues and core EPS by 0.5 percentage points in 2025. The company expects a core effective tax rate of 20% for 2025.

Given the above assumption, PepsiCo expects the core EPS to decline 0.5% year over year in 2025 compared with the previous expectation of a 1.5% decline. The company reported a core EPS of $8.16 in 2024.

PEP has been committed to rewarding its shareholders through dividends and share buybacks. It expects to return a value worth $8.6 billion in 2025, including $7.6 billion of dividends. Additionally, the company plans to repurchase shares worth $1 billion in 2025.

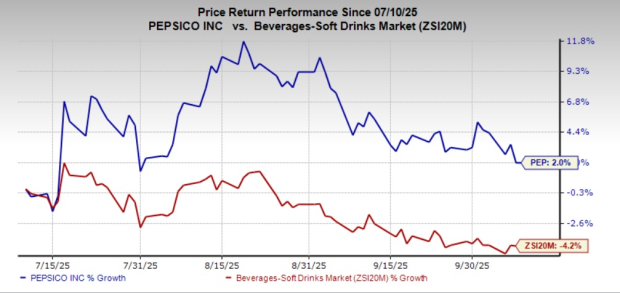

Shares of the Zacks Rank #3 (Hold) company have gained 2% in the past three months against the industry’s 4.2% decline.

United Natural Foods UNFI engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for United Natural Foods' current financial-year sales and earnings indicates growth of 2.4% and 167.6%, respectively, from the prior-year levels. UNFI delivered a trailing four-quarter earnings surprise of 416.2%, on average.

Zevia PBC ZVIA develops, markets, and distributes zero-sugar sodas, energy drinks, and organic teas across the United States and Canada under its flagship brand. The company currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for Zevia’s 2025 sales and earnings implies growth of 3.8% and 51.6%, respectively, from the previous year’s reported numbers. ZVIA has a trailing four-quarter average earnings surprise of 45.9%.

Vital Farms VITL packages, markets and distributes shell eggs, butter and other products. It carries a Zacks Rank #2 (Buy) at present. VITL delivered a trailing four-quarter earnings surprise of 35.8%, on average.

The Zacks Consensus Estimate for Vital Farms’ current fiscal-year sales and earnings implies an increase of 27.3% and 14.4%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite