|

|

|

|

|||||

|

|

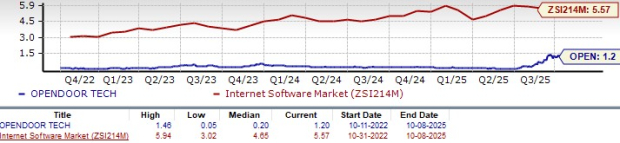

Opendoor Technologies Inc. OPEN has experienced a meteoric share price rally in recent months, yet its valuation remains strikingly low. The company trades at a forward 12-month Price/Sales (P/S) ratio of just 1.2, far below the Zacks Internet - Software industry’s average multiple of 5.57x earnings. Within its own three-year historical range of 0.05 to 1.46, the current valuation sits toward the lower end, signaling relative underappreciation by the market.

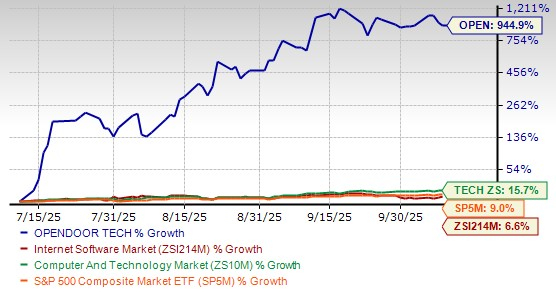

With a market capitalization of $6 billion, the stock still represents a discount story. Even after skyrocketing 944.9% over the past three months, shares remain 25.1% below their 52-week high of $10.87. At the same time, they trade at an astonishing 1,496% premium to the 52-week low of $0.51, underscoring just how extreme the recovery has been.

OPEN’s P/S Ratio (Forward 12-Month) vs. Industry

Now, the key question is whether this valuation reflects a turnaround opportunity or a classic value trap waiting to snap shut.

The stock’s parabolic rise—nearly 10-fold in three months—has reawakened investor enthusiasm, but it also raises concerns. Such rapid gains invite volatility and often outpace fundamentals. While the valuation still looks attractive relative to peers, much of the rally has been fueled by momentum and speculative buying rather than earnings consistency.

OPEN’s rally of 944.9% over the past three months overshadowed the industry’s 6.6% advance, the Zacks Computer and Technology sector’s 15.7% gain, and the S&P 500’s 9% rise during the same period. This disconnect highlights both the potential upside of Opendoor’s transformation story and the inherent risk of overextension.

OPEN’s 3-Month Performance

In September 2025, Opendoor appointed Kaz Nejatian, former chief operating officer of Shopify, as its new chief executive officer and board member, signaling a stronger push into becoming an AI-powered real estate platform. Nejatian, described as an “AI-native executive,” brings extensive experience in scaling teams and driving product innovation, and is expected to accelerate Opendoor’s transition toward leveraging artificial intelligence to simplify and streamline home buying and selling. Alongside this change, company co-founders Keith Rabois and Eric Wu have rejoined the board of directors, with Rabois assuming the role of chairman, reintroducing what the company calls its “founder DNA” at a pivotal moment.

In addition to leadership shifts, Khosla Ventures and Eric Wu have committed $40 million in equity financing through a private placement to help fund Opendoor’s growth initiatives. The company underscored its mission of providing homeowners with a faster, simpler and more certain way to transact, with Nejatian emphasizing AI as central to its next chapter. Rabois highlighted his confidence in Nejatian’s ability to innovate and unlock the company’s data and assets, while Wu reiterated Opendoor’s relevance in reshaping the homeownership experience.

Perhaps more important than the financial results are the company’s strategic pivot. Opendoor is evolving from a single-product iBuyer model into a distributed platform that integrates real estate agents. The new strategy enables agents to provide multiple selling options to homeowners—ranging from instant cash offers to traditional listings and hybrid solutions.

A standout innovation is Cash Plus, which provides sellers with upfront liquidity while still allowing them to capture upside from resale proceeds. This reduces Opendoor’s capital exposure while keeping agents and customers more engaged. Pilot programs have shown promising data: conversion rates are doubling, listing conversion is up fivefold and agent adoption is accelerating.

By expanding into capital-light revenue streams such as listing commissions, Opendoor aims to diversify its earnings base, improve margins, and mitigate risk tied to housing volatility. Early signs suggest the platform model could be transformative over the long term, though widespread financial impact is unlikely before 2026.

Opendoor retains several compelling growth levers. Its proprietary data and AI-driven pricing give it unmatched speed and accuracy in cash offers—an enduring competitive advantage in a fragmented real estate market.

The new distributed model expands its reach by enlisting agents, enhancing customer choice and boosting lead monetization. Products like Cash Plus offer more flexible and risk-adjusted solutions, reducing capital intensity while maintaining attractive contribution margins.

Over time, these shifts could allow Opendoor to capture more high-margin, capital-light revenues while scaling more efficiently. If interest rates decline and housing demand rebounds in 2026, Opendoor may be well-positioned to capitalize on pent-up activity.

Opendoor faces a two-fold challenge. First, macroeconomic conditions are unfavorable. Elevated interest rates continue to stifle demand for homes, weakening both acquisitions and resales. Seasonal volatility exacerbates the situation and housing affordability issues show little sign of abating.

Second, execution risks loom. The distributed platform strategy requires widespread agent adoption, robust training and effective marketing. Although pilot results are promising, the lag between contract execution and revenue recognition means investors may not see material financial benefits until 2026. Any delay or misstep could undercut confidence in the strategy, particularly after the stock’s sharp rally.

Despite the second quarter’s profitability, management remains guarded about the near term. Guidance for the third quarter calls for revenue of $800 million to $875 million—roughly half of the second-quarter levels. Adjusted EBITDA is expected to swing back into a loss of $21–$28 million, reflecting weaker acquisition volumes, seasonality and continued high mortgage rates.

The macro environment remains a stiff challenge. Elevated borrowing costs have suppressed buyer demand, resulting in weak clearance rates and record delistings. While spreads may moderate seasonally in late 2025, the company acknowledges that its platform pivot will take several quarters before delivering meaningful financial benefits.

Opendoor competes with Zillow ZG, Offerpad OPAD and Compass COMP across real estate models. Zillow dominates digital search and advertising but no longer offers iBuying, leaving OPEN to focus on transaction-led growth. Offerpad is a smaller iBuyer rival, but Opendoor’s scale, brand, and broader market reach provide stronger data advantages. Compass emphasizes agent relationships and branding, while Opendoor blends direct cash offers with agent-led solutions through products like Cash Plus. This hybrid approach enables Opendoor to capture both capital-intensive and capital-light revenues, positioning it as a more diversified competitor in an evolving housing landscape.

The Zacks Consensus Estimate paints a picture of gradual improvement but ongoing struggles. For 2025, analysts expect a loss of 24 cents per share—unchanged in the past 30 days—compared with a 37-cent loss in 2024. Revenue, however, is forecasted to decline 14.3% year over year, underscoring the near-term headwinds.

The narrowing of losses signals improving operational discipline, but the decline in sales reflects the company’s vulnerability to broader housing dynamics. Until mortgage rates ease and demand stabilizes, Opendoor’s ability to grow top-line revenue will remain constrained.

In weighing Opendoor’s sharp rally against its still-discounted valuation and long-term strategy, investors have good reason to remain patient with the stock. Despite ongoing macro headwinds and near-term earnings volatility, the company’s shift to a distributed platform, early traction with Cash Plus, and renewed leadership under Kaz Nejatian represent tangible steps toward a more resilient, capital-light model.

Backed by proprietary data and AI-driven pricing, Opendoor continues to refine its competitive edge in a real estate market still waiting for stability. While execution risks and housing affordability challenges cannot be ignored, the combination of underappreciated valuation, narrowing losses, and transformational growth initiatives positions the stock as a name worth holding until its strategic pivot translates into more durable financial results. Opendoor currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 2 hours |

AI Stealth Play Receives Bullish Initiation; Data Center Revenue Expected To Grow 64%

COMP

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite