|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

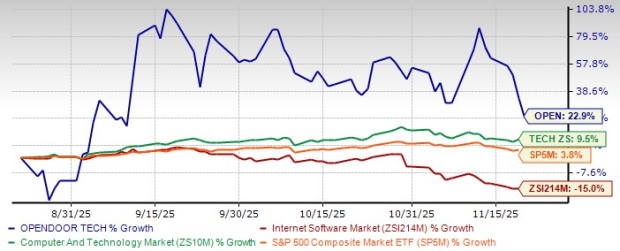

Opendoor Technologies Inc. OPEN has entered a decisive rebuilding phase under new CEO Kaz Nejatian, and the market has begun to notice. The stock is up 22.9% over the past three months, far outpacing the Zacks Internet – Software industry, the Zacks Computer and Technology sector and the S&P 500. Yet despite this renewed momentum, Opendoor still trades at a significant valuation discount to peers. The question for investors is whether this gap represents an opportunity or a value trap—especially as the company navigates a multi-quarter turnaround.

The stock now trades near $6.16 (as of Nov. 20), well below its 52-week high of $10.87, though miles above its $0.51 low—an indicator of sharply rising confidence after months of repair work on operations, unit economics and the balance sheet.

OPEN Stock Price Performance

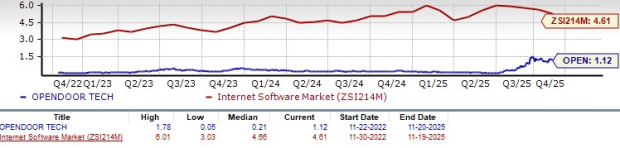

For a company reshaping itself as a tech-first operator, Opendoor’s valuation is surprisingly modest. Shares currently trade at roughly 1.12X forward 12-month price-to-sales (P/S), well below the Zacks Internet - Software industry average of 4.61X and considerably compressed in absolute terms. Its three-year historical range was 0.05X to 1.78X, with a median around 0.21X; the current level is above the median—but still near the low end of its historical range.

OPEN Stock’s Valuation

By contrast, one peer, Zillow Group, Inc. ZG, trades at roughly 5.51X P/S. The market evidently attaches a higher multiple to Zillow’s marketplace business. Meanwhile, Offerpad Solutions Inc. OPAD is valued at about 0.1X P/S, reflecting the extremely depressed valuation of the smaller iBuyer.

So, when you compare Opendoor’s 1.12X forward P/S to Zillow’s 5.51X and Offerpad’s 0.1X, Opendoor sits in the middle of peer valuation extremes. The peer spread suggests the market either sees significant execution risk at Opendoor or a potential discount if the transformation sticks and Opendoor catches up.

Opendoor’s recent third-quarter 2025 results underscored the operational reset now underway. Revenue fell 33.5% year over year, gross margin remained thin, and the company posted a $90 million net loss. But behind these backward-looking numbers is a radical transformation of its operating model, one anchored in software, AI and speed. Management has set a clear goal of reaching adjusted net-income breakeven by the end of 2026—a goal they insist is achievable through acquisition scaling, margin improvement and operating leverage.

One of Nejatian’s priorities was cleaning up a problematic convertible-note structure that created the risk of forced repayment by late 2025. Through a combination of ATM equity issuance and note exchanges, Opendoor strengthened liquidity and removed the near-term refinancing pressure. The company ended the third quarter with $962 million in unrestricted cash and a deeper runway for scaling operations.

To align management and shareholder incentives, Opendoor also announced a special dividend of tradable warrants, granting holders three series of warrants (Series K at $9, Series A at $13, Series Z at $17) for every 30 shares owned. These warrants offer upside participation without immediate dilution.

Opendoor’s recent stock performance (up 22.9% in the past three months) is strong, especially compared with its tech housing-tech peers. Zillow’s price (down 21.7% in the past three months) has been more muted in recent years—while trailing one-year returns are positive, the valuation suggests higher expectations baked in. Offerpad has seen significant recent weakness, with its share price up by only 9.1% over the past three months and trading at extremely low multiples, signaling deep investor skepticism.

Thus, Opendoor’s performance is arguably outperforming many peers while still trading at a discount. That dynamic is rare and may hint at an under-priced opportunity—but also might reflect higher risk.

Notably, Opendoor stock is down 6.1% post its third-quarter earnings. A recent special warrant issuance has created a divide among investors, adding confusion around potential dilution and the company’s evolving capital structure. While the warrants initially appeared to fuel a short-lived rally following the earnings release, the stock has since retreated—likely influenced not only by the warrant overhang but also by the broader market pullback.

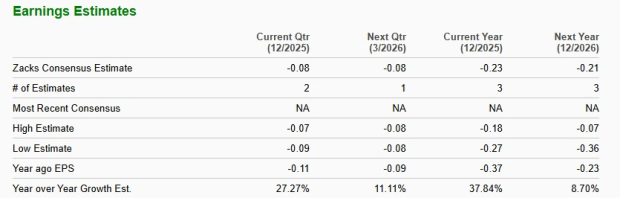

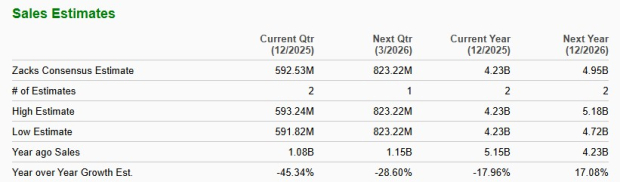

Estimate revisions point to improving expectations. Over the past week alone, projected 2025 losses narrowed from 25 cents to 23 cents per share, compared with a loss of 37 cents in the prior year. Loss expectations for 2026 have similarly tightened, and analysts now anticipate a return to revenue growth in 2026 following an expected 18% decline in 2025.

OPEN Stock EPS Estimate

OPEN Stock Revenue Estimate

Opendoor’s biggest growth catalyst is its transformation into a software-first, AI-driven real estate platform. The company launched over a dozen AI products—including automated home scoping, AI-powered inspections, multilingual valuation agents, and automated title and escrow—which drastically cut assessment times from nearly a day to about 10 minutes. This shift increases operational velocity and reduces staffing needs, allowing scalable growth.

Acquisition volume nearly doubled within weeks—from 120 to 230 homes weekly—signaling that Opendoor’s revised pricing, spreads and selection discipline are working. Higher acquisition velocity fuels more resale activity, improves inventory quality and supports stronger long-term unit economics. Management expects acquisitions to grow at least 35% in the fourth quarter, reinforcing a sharp upward trajectory.

The revived Direct-to-Consumer Funnel (D2C) flow is converting six times better than old funnels and already accounts for more than 20% of home assessments. Products like Opendoor Checkout make it possible to buy an Opendoor home online without talking to an agent—expanding customer reach and driving higher resale velocity. Future additions include seamless mortgage, warranty and insurance integration.

The bull case is compelling, but the risks remain significant. Third-quarter revenue fell sharply, and resale velocity was hampered by older, lower-quality inventory. These homes take longer to sell, carry higher repair needs, and have significantly weighed down contribution margins, which management acknowledged bottomed only in October. Contribution margin was just 2.2%, down from 3.8% in the year-ago period.

Despite cost cuts, Opendoor remains unprofitable, posting a third-quarter net loss of $90 million and an adjusted EBITDA loss of $33 million. Management expects fourth-quarter adjusted EBITDA losses in the high-$40 million to mid-$50 million range as old inventory continues to pressure results. This prolongs near-term skepticism until Opendoor 2.0 cohorts dominate results.

The company remains exposed to housing-market liquidity, mortgage-rate volatility and consumer sentiment—all external variables that can disrupt resale cycles. It also must prove the durability of its rapidly built AI tools and ensure that operational execution keeps pace with ambition.

Opendoor’s transformation is real, measurable and gaining momentum. The stock trades at a compelling valuation relative to software peers, estimate revisions have turned upward, acquisitions are accelerating, and the company has laid out a transparent, trackable roadmap to profitability.

But the near term remains messy. Old inventory, depressed revenues and thin margins will continue to weigh on quarterly results. With a current Zacks Rank #4 (Sell), the stock may face short-term pressure as financials lag operational improvements. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 5 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite