|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

In the world of real estate investment trusts (REITs), few names carry the stature of Realty Income O and Prologis PLD. Both have built enduring reputations: Realty Income as the “Monthly Dividend Company” and Prologis as the global leader in logistics real estate.

While they share the REIT structure, their business models couldn’t be more different. Realty Income focuses on net lease retail and industrial properties that deliver stable, predictable income, while Prologis thrives on the growth of e-commerce, logistics and, more recently, data centers.

As investors look ahead to the next decade of REIT performance, the key question isn’t just about dependable dividends versus expansion potential; it’s about which model is better positioned for structural growth. Let’s examine both REITs to see which one offers a stronger long-term growth trajectory.

Realty Income has built a reputation as one of the most reliable net-lease REITs, delivering steady cash flow through a highly diversified portfolio. The company owns more than 15,600 properties across 91 industries, leased to more than 1,600 tenants. Its focus on essential, service-oriented businesses, such as grocery stores, convenience outlets and healthcare services, means roughly 90% of its rental income is insulated from economic downturns and e-commerce disruptions.

The REIT’s operational performance remains robust. In the second quarter of 2025, occupancy reached 98.6%, while rent recapture on renewed leases hit 103.4%, demonstrating strong demand for its properties. Realty Income also completed $1.2 billion in acquisitions during the quarter at an attractive 7.2% initial yield, with 76% of activity in Europe, where financing remains favorable. Management now targets around $5 billion in investment volume for 2025, reflecting disciplined expansion.

The company's scale allows it to close large transactions, and its net lease structure means it can add properties with minimal operating overhead. Its move into non-traditional asset classes, including gaming and data centers, highlights its strategic focus on future growth.

Financially, Realty Income is well-positioned to support its dividend and growth initiatives. The company holds $5.1 billion in liquidity, maintains A3/Stable and A-/Stable credit ratings and keeps debt metrics manageable with a fixed-charge coverage ratio of 4.5. Known as The Monthly Dividend Company, Realty Income has delivered more than 30 years of consecutive monthly dividends and 112 consecutive quarterly increases, underscoring its reliability. With its strong portfolio, consistent operations and prudent financial management, Realty Income continues to be a preferred choice for investors seeking stable income and steady growth.

Nevertheless, certain headwinds remain. Growth in AFFO may stay subdued as tighter investment spreads and broader economic uncertainty weigh on expansion. The company’s retail exposure also presents some vulnerability to tenant bankruptcies or trade-related disruptions. Realty Income expects about 75 basis points of rent loss in 2025, partly tied to credit risks among tenants acquired through past M&A deals. Although the REIT continues to deliver dependable income, its pace of dividend increases has become more conservative and gradual.

Prologis leans into growth and stands at the heart of modern supply chains. Its properties span high-barrier, infill markets where demand consistently exceeds supply. This strategic footprint has translated into consistently healthy operating performance. In the second quarter of 2025 alone, 51.2 million square feet of leases commenced within its owned and managed portfolio, with a 74.9% retention rate. Management projects average occupancy between 94.75% and 95.25% for 2025, underscoring strong leasing momentum.

Prologis is expanding its footprint through active acquisitions and development. During the first half of 2025, the company invested $1.15 billion in acquisitions and initiated $1.49 billion in new developments, 69.3% of which were build-to-suit projects. For the full year, it expects $1-$1.25 billion in acquisitions and $2.25-$2.75 billion in development starts.

PLD’s long-term strategy, expanding from logistics into data centers, is beginning to reshape its growth profile. It is positioning itself to tap into the rapidly expanding AI market by converting select properties in major population centers into high-performance data centers. A recent reit.com news noted that while speaking at Prologis’ Groundbreakers 2025 event, Chairman and CEO Hamid Moghadam called this initiative a “huge opportunity,” pointing out that these facilities could deliver the low-latency critical for the AI inference market. The company already reports that as of June 30, 2025 its total TEI (Total Expected Investment) in non-industrial assets, including yards, parking and data centers, stood at $1.2 billion. This gives a foothold in higher growth, higher-margin real estate types.

Backed by $7.1 billion in liquidity, A-rated credit and 5.1X debt-to-EBITDA, Prologis maintains ample balance sheet strength. Its 14.8% cash flow growth and 5.96% ROE outperform industry averages, while its 12.66% five-year dividend growth rate underscores shareholder value creation. With its scale, financial discipline and forward-looking strategy, Prologis is well-positioned for sustained long-term growth.

When comparing to O, PLD trades off some of the steadiness of monthly dividends for much greater optionality. Where Realty Income relies on stable tenants and acquisitions, Prologis builds future growth into its operations and assets.

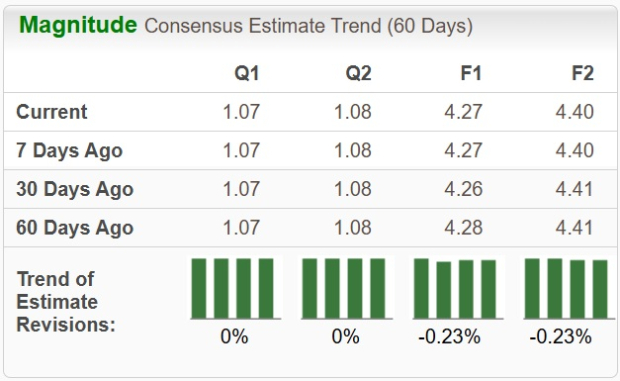

The Zacks Consensus Estimate for Realty Income’s 2025 sales and funds from operations (FFO) per share implies year-over-year growth of 6.70% and 1.91%, respectively. While estimates for O’s 2025 FFO per share have been revised northward, the same for 2026 has been tweaked southward over the past 30 days.

For Realty Income:

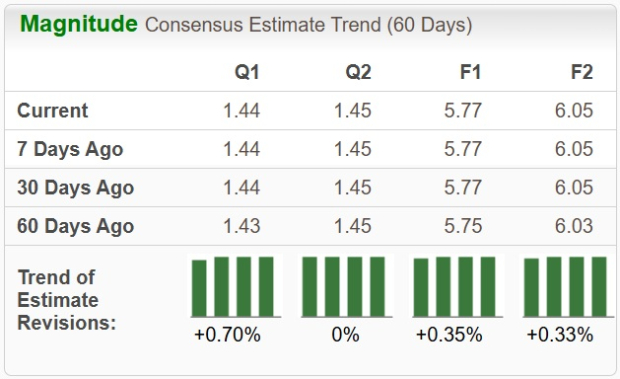

The Zacks Consensus Estimate for Prologis’ 2025 sales and FFO per share calls for year-over-year growth of 10.76% and 3.78%, respectively. What is also encouraging is that FFO per share estimates for 2025 and 2026 have been trending northward over the past 60 days.

For Prologis:

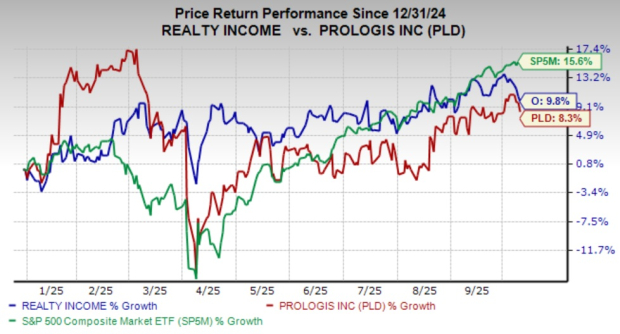

Year to date, Realty Income shares have rallied 9.8%, while Prologis stock has gained 8.3%. In comparison, the S&P 500 composite has risen 15.6% in the same time frame.

O is trading at a forward 12-month price-to-FFO, which is a commonly used multiple for valuing REITs, of 13.42X, which is on par with its three-year median.

Meanwhile, PLD is presently trading at a forward 12-month price-to-FFO of 19.12X, which is below its three-year median of 20.62X. Both O and PLD carry a Value Score of D.

Realty Income excels in reliability, diversification and consistent income generation. However, when the lens shifts to long-term growth potential, Prologis holds the edge. It is already positioning itself at the intersection of logistics and computing infrastructure, tapping into secular forces that extend well beyond traditional real estate cycles.

For investors who want both resilience and upside over the next decade, Prologis offers a stronger, more dynamic growth runway than Realty Income. Estimate revisions and valuation also suggest that PLD stands out as the better REIT pick currently.

While PLD carries a Zacks Rank #2 (Buy), O has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite