|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Intel Corporation INTC is scheduled to report third-quarter 2024 earnings after the closing bell on Oct. 23. The Zacks Consensus Estimate for sales and earnings is pegged at $13.11 billion and break-even on a per share basis, respectively. Over the past 60 days, earnings estimates for INTC have remained steady at 12 cents per share for 2025 but declined from 67 cents to 65 cents per share for 2026.

INTC Estimate Trend

The leading semiconductor manufacturer delivered a four-quarter earnings surprise of negative 331.3%, on average, beating estimates only twice. In the last reported quarter, the company’s earnings surprise was negative 1,100%.

Our proven model predicts an earnings beat for Intel for the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is perfectly the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Intel currently has an ESP of +116.67% with a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

During the quarter, Intel partnered with Exostellar to make enterprise-grade AI infrastructure accessible in a cost-effective manner. Intel’s partnership with this leading innovator in autonomous compute orchestration and cloud optimization, which leverages AI and ML technologies, is likely to deliver an end-to-end solution with support for quota enforcement, dynamic borrowing, fair queuing and priority-based scheduling. This will bring cloud-like agility and efficiency to on-premises or hybrid infrastructure for a more competitive AI hardware ecosystem.

In the to-be-reported quarter, Intel launched its AI Boost NPU and Intel Core Ultra 200V Series Processor that powered the world’s first fully rugged Copilot+PC in tablet form. Dubbed F120, this state-of-the-art tablet is designed to harness AI capabilities in complex and challenging environments across the defense, utilities, manufacturing and automotive industries. The F120 boasts seamless multitasking prowess, courtesy of Intel’s NPU and processor support. These are likely to have generated incremental revenues in the quarter.

However, Intel lagged NVIDIA Corporation NVDA on the innovation front, with the latter’s H100 and Blackwell graphics processing units (GPUs) being a runaway success. An accelerated ramp-up of AI PCs is likely to have affected the short-term margins of Intel as it shifted production to its high-volume facility in Ireland, where wafer costs are typically higher. Margins are also likely to have been adversely impacted by higher charges related to non-core businesses, charges associated with unused capacity and an unfavorable product mix. Consequently, Intel restructured its top management in the quarter to fuel its growth engine.

Moreover, China's purported move to replace U.S.-made chips with domestic alternatives could significantly affect Intel as it derives a significant portion of its revenues from the communist nation. The recent directive to phase out foreign chips from key telecom networks by 2027 underscores Beijing's accelerating efforts to reduce reliance on Western technology amid escalating U.S.-China tensions. As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in critical industries. This shift poses a dual challenge for Intel, as it faces potential market restrictions and increased competition from domestic chipmakers like Advanced Micro Devices, Inc. AMD and NVIDIA. These are likely to have adversely impacted its bottom line in the quarter.

Over the past year, Intel has gained 61.5% compared with the industry’s growth of 28.6%, outperforming its peers, NVIDIA and AMD. While NVIDIA surged 31.7%, AMD was up 50.3% over this period.

One-Year INTC Stock Price Performance

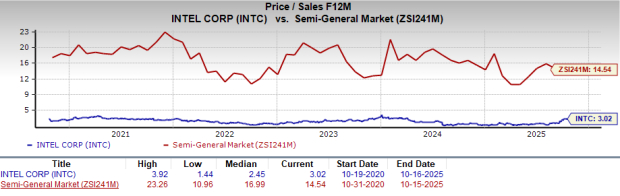

From a valuation standpoint, Intel appears to be relatively cheaper than the industry but above its mean. Going by the price/sales ratio, the company shares currently trade at 3.02 forward sales, lower than 14.54 for the industry but higher than the stock’s mean of 2.45.

Intel's innovative AI solutions are set to benefit the broader semiconductor ecosystem by driving down costs, improving performance and fostering an open, scalable AI environment. It has secured a $5 billion investment from NVIDIA to jointly develop cutting-edge solutions that are likely to play an integral role in the evolution of the AI infrastructure ecosystem. In August 2025, Softbank invested $2 billion in Intel to propel AI research and development initiatives that support digital transformation, cloud computing and next-generation infrastructure. The U.S. government will invest $8.9 billion in Intel to support critical semiconductor manufacturing and advanced packaging projects in Arizona, New Mexico, Ohio and Oregon, likely paving the way for innovation and growth.

However, increasing competition from other established players and emerging China-based firms is likely to adversely impact its bottom line. The communist nation’s stonewalling efforts and push for technological autonomy could reshape the dynamics of the semiconductor industry and affect Intel’s performance to a large extent. Management further observed that Intel needs to witness a significant cultural change to transition from Integrated Device Manufacturing to being a world-class foundry. This would involve a shift from a “no wafer left behind” mindset, where the company built extra capacity to meet demand (hoping that the added capacity would not be idle at any time), to a “no capital left behind” mindset that aims to drive efficiency by eking out every wafer possible from the existing capacity.

Intel's strategy for open, scalable AI systems extends beyond hardware, encompassing software, frameworks and tools. By fostering a broad ecosystem of AI players, including equipment manufacturers, database providers and software developers, Intel aims to offer enterprises a diverse range of solutions that cater to their unique GenAI requirements. This collaborative approach not only promotes innovation but also enhances interoperability and compatibility, empowering enterprises to leverage existing ecosystem partners with confidence.

However, it appears that the recent product launches are “too little too late” for Intel. With continued trade skirmishes and an on-and-off tariff regime, the stock is witnessing an uncertain business environment, although it is trading relatively cheaply. Intel seems to be treading in the middle of the road, and investors could be better off if they trade with caution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 25 min | |

| 25 min | |

| 43 min | |

| 1 hour |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

AMD NVDA

Investor's Business Daily

|

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite