|

|

|

|

|||||

|

|

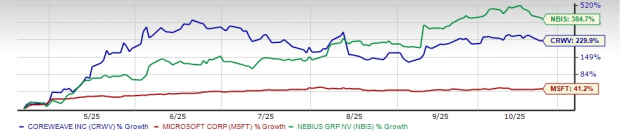

CoreWeave, Inc. (CRWV) stock has climbed 229.9% in the past six months, outpacing the Zacks Internet-Software Market’’s gain of 38.9% and the Zacks Computer & Technology sector and the S&P 500 Composite’s growth of 51.1% and 29.4%. CoreWeave provides high-performance cloud infrastructure built for AI workloads, offering large GPU clusters and data centers optimized for training and inference. It went public in March 2025. Recently, CRWV launched CoreWeave AI Object Storage, a fully managed service designed for AI workloads. Using its Local Object Transport Accelerator (LOTA) technology, it makes datasets instantly accessible globally with no egress or transaction fees.

The company has outperformed its peers and tech behemoths like Microsoft (MSFT), which has grown 41.2% during the past six months, while Nebius Group N.V. (NBIS), another emerging AI infrastructure player, has risen 384.7%.

CRWV has a 52-week high of $187. Following a strong rally, investors may wonder if the stock still holds meaningful upside or if expectations have outpaced fundamentals. Let’s break down the pros and cons to assess the road ahead.

The rapid rise of CoreWeave is driven by its ability to capitalize on the generative AI boom. Enterprise AI adoption is accelerating, driven by its strategic imperative. CoreWeave is viewed as a force multiplier, enabling this innovation and growth for both training and inference workloads. The company’s continued focus on scaling capacity and enhancing services is driving strong momentum against a supply-constrained market backdrop with better-than-anticipated sales performance.

The second quarter ended with nearly 470 MW of active power, raising total contracted power to 2.2 GW, an approximate increase of 600 MW. Rapid expansion of its footprint is ongoing, driven by strong customer demand, to maintain a steady growth path. CRWV is on track to surpass 900 MW of active power by the end of the year.

It has successfully forged strong ties with key players such as NVIDIA Corporation (NVDA). CRWV has become the first cloud provider to offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances for general availability. With this launch, CoreWeave now delivers one of the most comprehensive selections of NVIDIA Blackwell infrastructure in the industry, including the NVIDIA GB200 NVL72 system and the NVIDIA HGX B200 platform. From training trillion-parameter large language models to powering multimodal inference, CoreWeave’s flexible platform and AI-infused software stack enable customers to choose the ideal Blackwell architecture to meet their specific workloads. In September, it announced a new $6.3 billion order under its existing Master Services Agreement with NVIDIA (dated April 10, 2023). Per the deal, NVIDIA will purchase CoreWeave’s residual unsold capacity through April 2032, subject to certain conditions.

Last month, the company expanded its agreement with OpenAI to support the training of next-generation AI models, solidifying its role as a key cloud platform for demanding AI workloads. The new deal is valued at up to $6.5 billion, bringing CoreWeave’s total contract value with OpenAI to approximately $22.4 billion, following prior agreements in March ($11.9 billion) and May ($4 billion) 2025. This month, it signed an agreement with Meta Platforms to supply cloud computing capacity. Depending on certain conditions, Meta will initially pay up to $14.2 billion through Dec. 14, 2031, with an option to expand significantly through 2032 for more cloud capacity. A growing deal pipeline is expected to drive additional sales while strengthening the company’s competitive edge among leading AI infrastructure providers.

CRWV’s pipeline continues to grow and diversify, backed by a wide range of customers across media, healthcare, finance, industrials and more. In healthcare and the life sciences, it has partnered with companies like Hippocratic AI, which is developing safe and secure AI agents to enhance patient outcomes. The financial services sector is also emerging as a major driving force. CoreWeave supports proprietary trading firms like Jane Street and recently added mega-cap banks, including Morgan Stanley and Goldman Sachs.

Further, the company is on an acquisition spree to supplement inorganic growth. Recently, it agreed to acquire Monolith AI Limited, a leader in applying AI to complex physics and engineering challenges. The acquisition aims to create synergies for both CRWV and its customers by building an AI platform that accelerates R&D, streamlines product design and enhances efficiency and innovation.

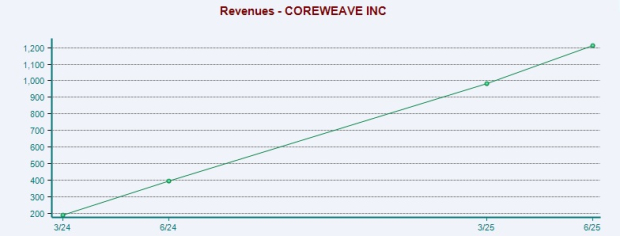

For CRWV, the acquisition builds on its previous strategic moves, including the acquisition of OpenPipe (focused on reinforcement learning) and Weights & Biases, a leading platform for model iteration and experiment tracking. In addition, the Core Scientific deal upon completion is likely to expand capacity vertically and could create operational and financial synergies for CRWV. It now projects 2025 revenues in the range of $5.15-$5.35 billion, up from the previous guidance of $4.9-$5.1 billion. The upward revision, representing a $250 million increase, reflects continued strength in customer demand. Its rapid expansion of data centers is key to its growth story.

Despite strong revenue generation and a strong liquidity position, the company is plagued by a heavy debt load. On its last earnings call, CRWV stated raising $25 billion in debt and equity since 2024, driving interest expenses up to $267 million from $67 million a year ago. For the third quarter, interest costs are projected at $350–$390 million. Elevated interest burdens weigh on adjusted net income, free cash flow and near-term profitability. For the second quarter, the company posted a net loss of $291 million and an adjusted net loss of $131 million, mainly due to these interest expenses.

CRWV continues to incur a lump-sum amount of CapEX, driven by ongoing investments to expand its platform and meet growing customer demand. It expects capex for the third quarter to be $2.9 billion and $3.4 billion, with full-year capex guidance reaffirmed at $20-$23 billion. Amid the expansion, demand continues to outpace supply and timing of data center capacity, and GPU deployment could lead to significant quarter-to-quarter CapEx fluctuations, with a notable ramp-up expected in the fourth quarter. The combination of surging CapEx, high interest expenses and supply constraints might amplify near-term financial pressures.

Stiff rivalry in the AI space remains an added headwind. NBIS is quickly expanding in the AI infrastructure sector, aiming to reach 1 GW capacity by 2026. It signed a five-year agreement with Microsoft to supply GPU capacity, valued at $17.4 billion through 2031, with the potential to increase to $19.4 billion if Microsoft boosts its demand. Nebius raised its guidance for annualized run rate (ARR) revenues from the previous range of $750 million to $1 billion to the band of $900 million to $1.1 billion.

MSFT continues to drive cloud leadership with Azure, rapidly scaling its AI infrastructure. Its deep partnership with OpenAI has positioned Azure as a leading platform for AI workloads. In collaboration with NVIDIA, Microsoft has unveiled new AI advancements, such as NVIDIA NIM microservices in Azure AI Foundry, improved inference for open-source models and serverless GPU support within Azure Container Apps.

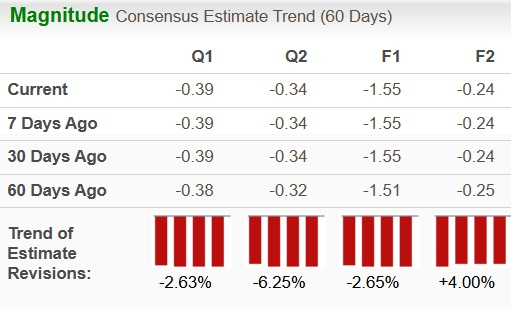

CRWV’s estimates revisions are on a downward trajectory currently. The Zacks Consensus Estimate for its earnings for 2025 has been revised south 2.65% over the past 60 days.

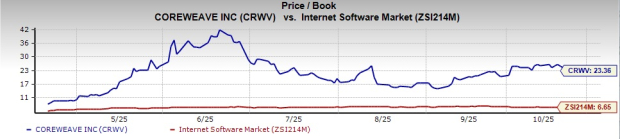

Valuation-wise, CoreWeave seems overvalued, as suggested by the Value Score of F.

In terms of Price/Book, CRWV shares are trading at 23.36X, way higher than the Internet Software Services industry’s 6.65X.

CoreWeave continues to lead across key metrics, including power, AI cloud performance, revenue and backlog. It aims to strengthen further through vertical integration of its data center infrastructure and cloud services, improving capital efficiency and lowering its cost of capital.

With a Zacks Rank #3 (Hold), CRWV appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 30 min | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite