|

|

|

|

|||||

|

|

U.S. stock markets have been witnessing extreme volatility and one of the worst-performing phases in the last four trading sessions. The Dow fell more than 4,500 points during this period. The tech-heavy Nasdaq Composite plunged 13% in the last four days. The tech-laden index entered bear market territory, sliding more than 20% from its recent high.

The S&P 500 fell more than 12% in the last four days and is currently in correction zone. Moreover, Wall Street’s broad-market index has tumbled almost 19% from its recent peak and is approaching a bear market. On April 8, the benchmark closed below an important technical barrier of 5,000, for the first time since April 2024.

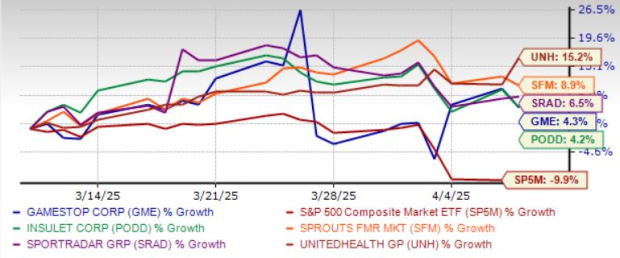

Despite extreme volatility, a handful of large-cap (market capital > $10 billion) have provided positive returns (4% or higher) in the past month, while the S&P 500 has plunged 10%. At this juncture, investment in these stocks with a favorable Zacks Rank should be prudent.

Five such stocks are Sprouts Farmers Market Inc. SFM, UnitedHealth Group Inc. UNH, Sportradar Group AG SRAD, GameStop Corp. GME and Insulet Corp. PODD.

Wall Street routed last week following the imposition of the Trump administration’s “Liberation Day” tariffs. The baseline tariff of 10% was imposed on all imports from April 5. But the important thing is that tariff rates go up to as high as 104% for some countries (such as China) depending on what rate these governments levy duties on U.S. exports.

China retaliated with 34% tariffs on all U.S.-made products to be imposed from April 10. Canada has decided to levy 25% duties on all U.S.-made vehicles that are not compliant with the USMCA Agreement. This seems to be the beginning of a global trade war.

Economists and financial experts are highly concerned about the impact of these tariffs on U.S. economic growth, especially on inflation, which is already elevated and prolonged. Market participants fear a near-term recession and, in the worst-case scenario, a stagflation in the U.S. economy.

These five large-cap stocks have strong growth potential for revenues and earnings for 2025. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks currently carries a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #1 Sprouts Farmers’ focus on product innovation, emphasis on e-commerce, expansion of private label offerings and targeted marketing with everyday great pricing bodes well. SFM has been lowering operational complexity, optimizing production, improving in-stock position and updating to smaller-format stores. These efforts helped SFM post better-than-expected fourth-quarter 2024 results, wherein both the top and the bottom lines grew year over year.

Buoyed by the performance, Sprouts Farmers provided a decent 2025 view. SFM expects net sales to rise between 10.5% and 12.5% with comps anticipated to increase in the range of 4.5-6.5%. SFM’s strong sales growth, margin expansion and disciplined financial management position it as a compelling investment opportunity.

Sprouts Farmers has an expected revenue and earnings growth rate of 11.9% and 24.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days.

Zacks Rank #2 UnitedHealth Group’s top line remains poised for growth on the back of a strong market position, new deals, renewed agreements and expansion of service offerings. UNH’s solid health services segment provides diversification benefits. The Government business remains well-poised for growth in the future.

UNH’s adjusted net earnings per share are anticipated to be in the $29.50-$30 band in 2025. A sturdy balance sheet enables UNH’s investments and prudent deployment of capital via buybacks and dividend payments.

UnitedHealth Group has an expected revenue and earnings growth rate of 12.7% and 7.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Zacks Rank #2 Sportradar Group provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally. SRAD offers sports data services to bookmakers under the Betradar brand, and to the international media industry under the Sportradar Media Services brand name. SRAD offers mission-critical software, data, and content to sports leagues and federations, betting operators, and media companies.

SRAD also provides sports entertainment, gaming, and sports solutions, as well as live streaming solutions for online, mobile, and retail sports betting. In addition, SRAD’s software solutions address the entire sports betting value chain from traffic generation and advertising technology to the collection, processing, and extrapolation of data and odds, as well as to visualization solutions, risk management and platform services.

Sportradar Group has an expected revenue and earnings growth rate of 16.8% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.3% over the last 30 days.

Zacks Rank #1 GameStop has been progressing well in its growth endeavors while maintaining a solid balance sheet. It has been taking initiatives to diversify its business and become a more technology-driven firm. GME has also been pursuing opportunities in cryptocurrency, non-fungible tokens and Web 3.0 gaming verticals.

This reduction in operational costs reflects GME’s commitment to improving efficiency and streamlining business operations. Moreover, GME improved its debt position by reducing its net long-term debt to $6.6 million at the end of 2024 from $17.7 million at the end of 2023.

GameStop has an expected revenue and earnings growth rate of -11.1% and 42.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

Zacks Rank #2 Insulet is solidifying its market leadership through a series of product innovations such as Omnipod Discover. The integration of PODD’s Omnipod 5 with Abbott’s FreeStyle Libre 2 Plus and the latest type 2 label expansion for Omnipod 5 are expected to attract more new customers.

Internationally, PODD is capitalizing on the robust opportunities for Omnipod 5 to drive share gains across all the markets it enters. Meanwhile, Omnipod 5 is set to become the primary offering for the largely underpenetrated Type 2 diabetes market, which provides a significant growth opportunity for PODD. Additionally, sound financial stability bodes well.

Insulet has an expected revenue and earnings growth rate of 18.1% and 32.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.4% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite