|

|

|

|

|||||

|

|

New Gold NGD is set to report third-quarter 2025 results on Oct. 28, after market close.

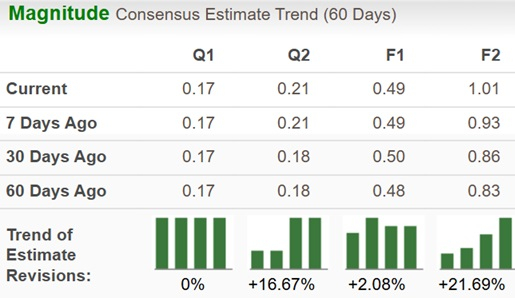

The Zacks Consensus Estimate for NGD’s earnings per share for the quarter has remained unchanged at 17 cents over the past 60 days. The estimate indicates a significant 112.5% jump from the year-ago quarter’s earnings per share of eight cents.

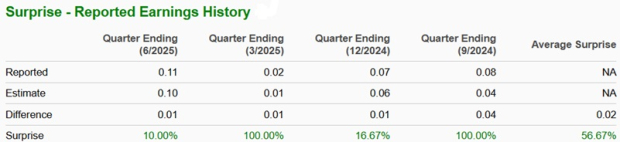

New Gold’s bottom line beat the Zacks Consensus Estimate in each of the trailing four quarters. Over the period, the company has recorded an average earnings surprise of 56.7%.

Our proven model does not conclusively predict an earnings beat for New Gold this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

Earnings ESP: The Earnings ESP for NGD is 0.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: New Gold currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the July-September 2025 period, gold prices averaged around $3,500 per ounce, up 41% year over year. Starting at $3,300 levels, gold surged to a high of $3,858.41 at the quarter’s end. Uncertainty regarding U.S trade and tariff policies, and solid demand from central banks boosted gold prices. Copper prices also strengthened, with the average price up 15% year over year. We expect this rally in copper and gold prices to have reflected in New Gold’s top-line performance in the third quarter.

For 2025, New Gold projects consolidated gold production at 325,000-365,000 ounces, reflecting a 16% year-over-year increase. The company had earlier guided that production would be higher in the second half of the year, with the first half of 2025 representing about 38% of the full-year output.

In the first half of 2025, New Gold produced 130,781 ounces of gold, delivering on its targeted 38%. It was, however, 6% lower than the year-ago consolidated production of 139,496 gold ounces. Output at New Afton mine was down 3% due to lower grade and recovery, with the B3 cave nearing exhaustion. Production at the Rainy River mine declined 7% year over year due to lower tons processed and lower grade.

In order to meet its guided total for the year, we expect consolidated gold production in the third quarter to range between 97,110 ounces and 117,109 ounces. Compared with the 78,369 ounces produced in the third quarter of 2024, this suggests growth of 24-49%.

Rainy River’s gold production is projected at 265,000 – 295,000 ounces for 2025, highlighting an increase of 20% from the prior year. The company achieved 34% of the midpoint of the range in the first half. With higher grade ore being processed currently, we expect the third-quarter output to be higher, at around 84,744-99,744 ounces. Compared with the third-quarter 2024 output of 61,892 ounces, this suggests growth of 37-61%.

New Afton’s 2025 gold output is expected to be 60,000 – 70,000 ounces. The company has already delivered 54% of this range in the first half (ahead of the planned 45%), with the B3 cave performing better than expected.

The B3 cave was scheduled to be exhausted in the third quarter, and the transition to C-Zone is expected to support production in the latter part of the year. We expect the mine’s third-quarter gold production to be 12,365-17,365 ounces. The mine had produced 16,477 ounces of gold in the third quarter of 2024.

Copper production in 2025 is expected at 50-60 million pounds, in line with 2024, as the increased throughput from C-Zone at New Afton is offset by lower grades from the remaining life of the B3 cave.

Copper production in the first half of 2025 was at 49% of the midpoint of the guidance. We expect third-quarter copper production at 11.5-16.5 million pounds compared with the 12.6 million pounds in the third quarter of 2024.

All-in sustaining costs (AISC) are expected at $1,025-$1,125 per ounce in 2025, a 17% decrease at the midpoint. This reflects higher production and lower operating costs from the New Afton C-Zone crusher and conveyor system, and the reduction in the Rainy River Phase 4 strip ratio.

Total cash costs per gold ounce sold are likely to be in the range of $600 - $700. Total costs are also expected to decrease quarter over quarter throughout 2025 due to increasing production and a lower strip ratio at Rainy River in the second half of 2025.

Overall, New Gold’s third-quarter results are expected to reflect improved gold and copper prices, higher production numbers and lower costs.

New Gold stock has surged 160.5% so far this year compared with the industry’s 115% growth.

Newmont Corp. NEM reported adjusted earnings per share of $1.71 in the third quarter, beating the Zacks Consensus Estimate of $1.29. Earnings surged 111% year over year.

Revenues were reported at $5.5 billion, which surpassed the Zacks Consensus Estimate of $4.97 billion. Revenues were up 20% from the year-ago quarter, driven by higher average realized gold prices, offset by lower sales volumes.

Newmont produced approximately 1.4 million attributable gold ounces in the quarter, which marked a 15% drop from the year-ago quarter. The company also produced around 35,000 tons of copper, down 5% year over year.

Consolidated gold ounces sold were down 16% to 1.3 million ounces. Average realized prices for gold were up 40.5% year over year to $3,539 per ounce in the quarter. Average realized prices for copper were $4.67 per pound compared with $4.31 per pound.

Here are some Basic Materials stocks, which according to our model, have the right combination of elements to post an earnings beat in their upcoming releases.

Agnico Eagle Mines Limited AEM, scheduled to release third-quarter earnings on Oct. 29, has an Earnings ESP of +11.44% and a Zacks Rank of 2.

Agnico Eagle Mines’ earnings for the third quarter are pegged at $1.76 per share, indicating a year-over-year jump of 54.4%. Agnico Eagle Mines has a trailing four-quarter average earnings surprise of 10%.

Pan American Silver Corp. PAAS, slated to release third-quarter 2025 earnings on Nov. 12, has an Earnings ESP of +2.21% and carries a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Pan American Silver’s earnings for the third quarter is pegged at 51 cents per share. The estimate indicates a 59% increase from the earnings of 32 cents per share reported in the year-ago quarter. Pan American Silver has a trailing four-quarter average earnings surprise of 45.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite