|

|

|

|

|||||

|

|

Alphabet GOOGL is set to report third-quarter 2025 results on Oct. 30.

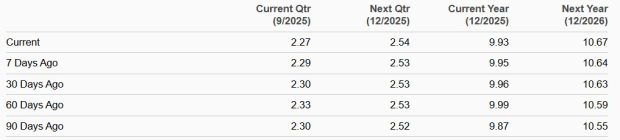

For third-quarter 2025, the Zacks Consensus Estimate for earnings is pegged at $2.27 per share, down 3 cents over the past 30 days and indicates 7.1% year-over-year growth.

The consensus mark for third-quarter revenues is pegged at $84.57 billion, indicating growth of 13.4% from the year-ago quarter’s reported figure.

Alphabet has an impressive earnings surprise history. GOOGL’s earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 15.96%.

Alphabet Inc. price-eps-surprise | Alphabet Inc. Quote

Let’s see how things have shaped up for the upcoming announcement:

GOOGL’s Search business is benefiting from AI infusion. Alphabet is leading the search domain with 90.4% market share, followed by Microsoft’s MSFT Bing, with 4.08% share, Yandex’s 1.65%, Yahoo!’s 1.46%, DuckDuckGo’s 0.87% and Baidu’s 0.75%, per the latest data from StatCounter.

Alphabet has been actively embedding AI, especially within Search, to enhance user experience, provide better AI-focused features and consequently improve ad performance. Google’s AI-powered Search features are driving deeper engagement, with AI Mode offering advanced reasoning and multi-modal responses. Users are generating queries twice as long as those in traditional searches. The Circle to Search feature is now active on more than 300 million devices. AI Overviews now reach more than 2 billion users per month and are available in over 200 countries across 40 languages. It is now driving more than 10% more queries globally.

The Zacks Consensus Estimate for third-quarter 2025 Search and other revenues is pegged at $55.09 billion, indicating 11.5% growth over the figure reported in the year-ago quarter.

Alphabet has been rapidly growing in the booming cloud computing market. Google Cloud has solidified its position as the third-largest provider in the highly competitive cloud infrastructure market against Amazon’s AMZN cloud arm, Amazon Web Services (AWS), and Microsoft’s Azure. The solid adoption of the Google Cloud Platform and Google Workspace is expected to have driven growth in the Google Cloud segment.

According to Synergy Research Group data, Google Cloud, along with Microsoft, is gaining market share, while AWS continues to lead with a 30% market share in the second quarter of 2025. Alphabet and Microsoft had 20% and 13% market share, respectively.

The consensus mark for third-quarter 2025 Google Cloud revenues is pegged at $14.66 billion, indicating 29.1% growth over the figure reported in the year-ago quarter.

However, GOOGL is suffering from a lack of capacity, and until new capacity comes online in 2025, cloud revenues are expected to see increased variability. This is expected to have hurt Alphabet’s Google Cloud revenues in the to-be-reported quarter.

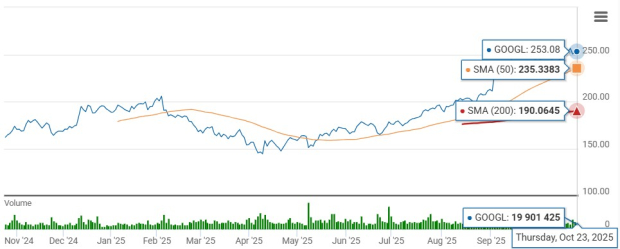

Alphabet’s shares have jumped 34.7% year to date, outperforming the Zacks Internet Services industry and the Zacks Computer & Technology sector. Over the same time frame, the sector has returned 22.9% while the industry has appreciated 32.4%.

GOOGL shares are overvalued, as suggested by Value Score D.

Currently, GOOGL is trading at a premium, with a forward 12-month price/sales of 8.31X compared with the industry’s 6.53X.

Technically, GOOGL shares are displaying a bullish trend as they trade above the 50-day and 200-day moving averages.

Alphabet has been introducing AI-powered features frequently to boost user engagement of its Search business. Alphabet is bringing Nano Banana to Google Search. GOOGL is expanding AI mode in Google Search by adding more than 35 languages and over 40 new countries and territories. AI Mode in Search is now extended to more than 200 countries and regions.

Google Cloud is benefiting from its partnership with NVIDIA NVDA. It was the first cloud provider to offer NVIDIA’s B200 and GB200 Blackwell GPUs and will be offering its next-generation Vera Rubin GPUs. The addition of Wiz to Google Cloud will boost competitive prowess against the likes of Amazon and Microsoft in the cloud computing space.

Google Cloud’s expanding clientele is expected to boost Alphabet’s top line. Google Cloud is now expanding its footprint based on the latest deals with the World Bank Group, Statcast unit of Major League Baseball, as well as LA28, Team USA and NBCUniversal for the Olympic and Paralympic Games in 2026 and 2028.

Moreover, easing regulatory boosts Alphabet’s prospects. In the antitrust lawsuit against the Department of Justice (DOJ), Alphabet received a favorable ruling as the U.S. District Judge Amit Mehta ruled against the severe remedies proposed by the DOJ that included the forced divestiture of the Chrome browser and Android operating system. The ruling keeps Alphabet’s relationship with Apple untouched as the iPhone maker offers the Google Search engine as the default in its Safari browser.

Alphabet’s dominant position in the Search market, thanks to AI infusion, is a strong growth driver. Expanding cloud footprint is noteworthy. However, a stretched valuation and stiff competition in the cloud space make GOOGL shares risky for investors ahead of third-quarter 2025 results.

Alphabet currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 min | |

| 14 min | |

| 15 min | |

| 22 min | |

| 27 min | |

| 27 min | |

| 35 min | |

| 49 min | |

| 51 min | |

| 56 min | |

| 56 min | |

| 56 min | |

| 56 min | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite