|

|

|

|

|||||

|

|

Sprouts Farmers Market, Inc. SFM and Costco Wholesale Corporation COST may differ in scale and strategy, but both are key players in the retail landscape. SFM, with a market capitalization of approximately $10.4 billion and more than 450 stores, specializes in fresh, natural and organic foods tailored to health-conscious consumers.

On the other hand, Costco boasts a substantial market capitalization of approximately $413.1 billion, operating on a membership-based warehouse model that focuses on selling bulk goods at discounted prices across various categories, including groceries, electronics and household essentials. Its network spans 914 warehouses worldwide, including 629 in the United States and Puerto Rico and 110 in Canada.

Both companies are navigating an evolving retail landscape characterized by inflation, shifting consumer values, and a greater focus on affordability and quality. While Sprouts Farmers emphasizes curated assortments and disciplined expansion within its niche, Costco leverages its scale, pricing power and loyal member base to drive steady traffic. Let’s dive deep into the stocks to determine which stands out as the better bet today.

Sprouts Farmers continues to carve out a strong position in the grocery sector, delivering fresh, natural and health-oriented foods. The company’s focus on quality produce and wellness-driven assortments aligns seamlessly with the growing consumer shift toward healthier eating habits. A major driver of this success is the company’s curated product mix and private-label strategy.

SFM’s expanding in-house brand portfolio offers shoppers high-quality alternatives at attractive prices, while supporting higher margins and brand loyalty. The emphasis on organic and nutrient-rich offerings has further strengthened its leadership among health-conscious consumers, a demographic that continues to expand faster than the broader grocery market. The company continues to introduce new private-label and high-protein products, catering to evolving nutritional preferences and protein-focused diets.

This ongoing diversification enhances both customer engagement and category growth potential. We expect comparable-store sales growth of 7.6% in the third quarter, marking a moderation from 10.2% and 11.7% growth reported in the second and first quarters, respectively. Management had earlier flagged this deceleration, primarily due to cycling against a stronger comparison base from late 2024. While the pace of growth is normalizing, traffic trends remain encouraging, underscoring continued consumer interest in Sprouts Farmers’ differentiated offering.

On its second-quarter earnings call, management hinted that both the gross margin and SG&A rate would begin to normalize starting in the third quarter, reflecting comparisons against the prior year’s improved shrink performance. We expect a 20-basis-point gross margin expansion for the quarter, reflecting a softer rate of improvement compared with the first half of the year. Meanwhile, SG&A expenses are projected to rise 14.4% year over year, though as a percentage of net sales, they are expected to leverage 10 basis points to 29.7%. These expectations point to a healthy balance between growth investments and margin discipline as the company navigates cost normalization.

Digital transformation has also emerged as a key growth catalyst. The company’s e-commerce platform and partnerships with major delivery providers like Instacart, DoorDash and Uber Eats have made online shopping more seamless and accessible. Meanwhile, its loyalty program, Sprouts Rewards, is showing promising results in driving repeat purchases and boosting customer spending. Early test outcomes indicate that engaged members are shopping more frequently and filling larger baskets — a sign of deepening brand connection.

Costco’s resilient business model, built around its membership-based structure, continues to be a key growth driver. Healthy membership renewal rates — 92.3% in the United States and Canada and 89.8% worldwide — along with efficient supply-chain operations and bulk purchasing power, enable Costco to offer competitive prices that foster customer loyalty. This strong model has helped Costco succeed, even during economic downturns.

Members pay an annual fee for access to Costco’s warehouses, where they enjoy substantial discounts on a wide range of products. This system not only ensures a steady revenue stream but also creates a sense of value and exclusivity. In the fourth quarter of fiscal 2025, membership fee income increased 14% year over year, supported by fee increases introduced last year in September in the United States and Canada. The company ended the quarter with 81 million paid household members, a 6.3% rise from the previous year.

Costco continually adapts to market trends and consumer preferences. The company frequently updates its product lineup to include a mix of everyday essentials and unique, high-demand items. Through market analysis and customized offerings, Costco has expanded its presence both domestically and internationally. In fiscal 2026, the company plans to open 35 new locations (including five relocations).

Digitization also plays a key role in Costco’s expansion. E-commerce performance was strong, with comparable sales rising 13.6% year over year. E-commerce site traffic was up 27%, and Costco Logistics deliveries rose 13% in the quarter. Management also highlighted that “digitally enabled” sales (a broader measure that will be reported going forward) totaled more than $27 billion in fiscal 2025. For the five weeks ended Oct. 5, 2025, digitally-enabled comparable sales surged 26.1%

This robust operational performance translated into strong financial results. Costco generated $13,335 million of operating cash flow in fiscal 2025 and concluded the year with $14,161 million in cash and equivalents. Management invested nearly $5,498 million in capital expenditures during the fiscal year and signaled that fiscal 2026 capex would grow modestly above last year to support planned warehouse openings.

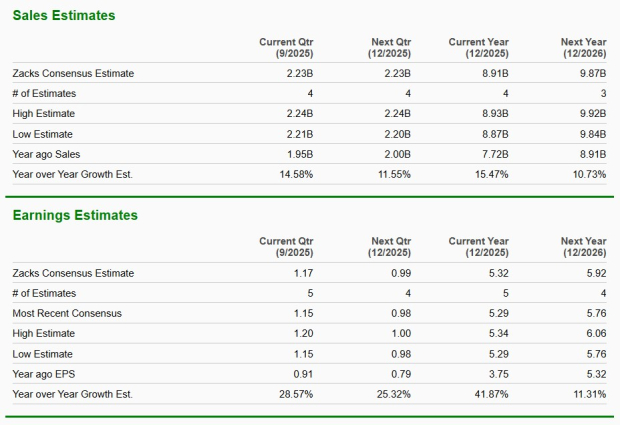

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and EPS implies year-over-year growth of 15.5% and 41.9%, respectively. The consensus estimate for EPS for the current fiscal year has been stable at $5.32 over the past 30 days.

The Zacks Consensus Estimate for Costco’s current fiscal-year sales and EPS calls for year-over-year growth of 7.7% and 11%, respectively. The consensus estimate for EPS for the current fiscal year has risen by 11 cents to $19.97 over the past 30 days.

Shares of Sprouts Farmers have declined 11.6% over the past year against Costco’s modest gain of 4.6%.

Sprouts Farmers is trading at a forward 12-month price-to-earnings (P/E) ratio of 18.29, below its one-year median of 30.84. Meanwhile, Costco’s forward P/E ratio stands at 46.02, below its median of 50.40.

Costco currently stands out as the stronger play for investors. Its membership-based model, scale efficiencies and consistent renewal rates provide exceptional earnings visibility and resilience across economic cycles. The company’s expanding digital ecosystem and disciplined global expansion strategy further enhance its growth durability. By contrast, Sprouts Farmers remains a promising niche player benefiting from health-driven consumer trends, but its growth trajectory is moderating after a strong run, leaving it more exposed to competitive and macro pressures. For now, Costco’s breadth, stability and operational consistency make it the more compelling investment choice. Costco carries a Zacks Rank #3 (Hold), while Spouts Farmers has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours |

FedEx joins other US companies in seeking a refund after Trump tariffs are ruled illegal

COST

Associated Press Finance

|

| 11 hours | |

| 17 hours | |

| 18 hours | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite