|

|

|

|

|||||

|

|

GE HealthCare Technologies Inc. GEHC is scheduled to report third-quarter 2025 results on Oct. 29, before market open.

In the last reported quarter, the company’s adjusted earnings per share (EPS) of $1.06 surpassed the Zacks Consensus Estimate by 16.48%. Its earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 12.53%.

Let’s check out the factors that might have shaped GEHC’s performance prior to the announcement.

GE HealthCare’s third-quarter numbers are likely to show steady top-line growth underpinned by Advanced Visualization Solutions (“AVS”) and Pharmaceutical Diagnostics (PDx) segments, while Imaging demand might have remained robust despite tariff drag. Patient Care Solutions (“PCS”) must have remained the weak link, with recovery tied to the product pipeline. Overall, GEHC’s diversified portfolio and innovation strategy should have helped cushion tariff headwinds and sustained low-single-digit organic growth in the quarter.

Management expects 2-3% organic top-line expansion in third-quarter, with adjusted EBITDA likely to decline in the high-single digits (year over year) due to tariff-related headwinds. Segment dynamics might have remained mixed, with Imaging and Pharmaceutical Diagnostics showing resilience and Patient Care Solutions facing margin strain.

GE HealthCare Technologies Inc. price-eps-surprise | GE HealthCare Technologies Inc. Quote

Imaging

The Imaging segment exited the second quarter with 1% organic revenue growth, supported by demand in the United States and EMEA but weighed down by softness in China. Backlog remained strong, boosted by large enterprise deals such as the record Omni Legend PET/CT order. However, tariffs shaved 110 basis points from segment EBIT margin, offsetting productivity gains. In the third quarter, capital demand and procedural momentum are expected to have sustained growth, but profitability might have remained under pressure as trade frictions persisted.

Advanced Visualization Solutions

AVS delivered 2% organic growth in the second quarter, with ultrasound adoption, especially AI-enhanced platforms, driving performance. Segment EBIT margin improved modestly, aided by volume and productivity. The upcoming new launches in ultrasound platforms, coupled with broader AI integration, are likely to have supported third-quarter momentum. With U.S. hospitals seeking productivity-enhancing solutions amid staffing shortages, AVS might have continued to act as a growth lever.

Patient Care Solutions

PCS revenues were flat in second-quarter, as monitoring solutions growth was offset by a tough comparison in life support systems. Segment EBIT margin declined sharply by 240 basis points due to inflation and mix pressures. Third-quarter numbers may again reflect margin weakness, though recent launches in anesthesia and monitoring platforms might have acted as stabilizers. Still, meaningful improvement may not materialize until 2026, until the product refresh cycle is complete.

Pharmaceutical Diagnostics

PDx stood out in the second quarter, growing 5% organically despite tough prior-year comparisons. Increased global imaging volumes and strong demand for tracers like Cerianna and Vizamyl have supported sales. While EBIT margin dipped on radiopharma investments and FX, pricing and procedure growth are expected to have sustained PDx momentum in the third quarter.

Margin & EPS Outlook

Tariffs remain the biggest earnings headwind, with second-quarter gross margin down 180 basis points, half of which was attributable to trade costs. Management has guided for a high-single-digit EBITDA decline in the third quarter, even as mitigation efforts progress. Adjusted EPS, which rose 6% year over year to $1.06 in the second quarter, is expected to have remained pressured in the third quarter. Nevertheless, robust backlog conversion, pricing discipline, and an improving product mix could have partially cushioned the tariff impact and supported full-year EPS guidance of $4.43-$4.63.

For third-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $5.07 billion, implying an improvement of 4.2% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $1.05, indicating a decrease of 7.9% from the prior-year period’s reported number.

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: GE HealthCare has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

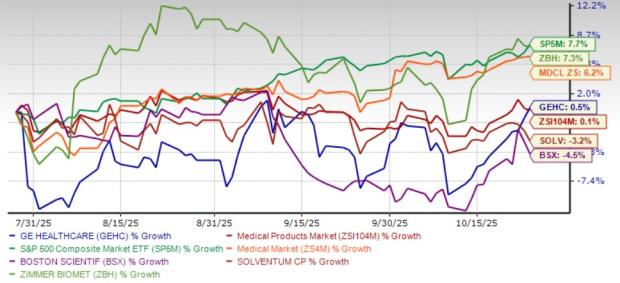

Over the past three months, GE HealthCare’s shares have gained 0.5%, outperforming the Medical - Products’ 0.1% rise. GEHC’s shares have underperformed the Zacks Medical sector’s 6.2% increase and the S&P 500’s 7.7% gain during the period.

Three Months Price Comparison

While peers like Boston Scientific BSX and Solventum SOLV lagged behind GE HealthCare, Zimmer Biomet ZBH outperformed it. While shares of BSX and SOLV have declined 4.5% and 3.2%, respectively, those of ZBH have risen 7.3%.

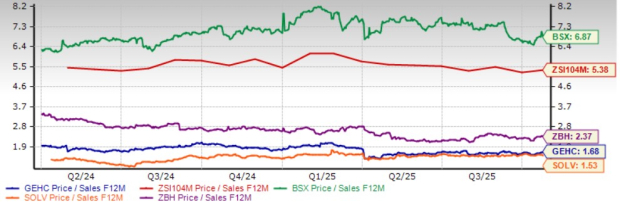

From a valuation standpoint, GEHC’s forward 12-month price-to-sales (P/E) is 1.7X, a discount to the industry's average of 5.4X.

The company is trading at a discount to its peers, Boston Scientific and Zimmer Biomet. However, GE HealthCare is trading at a premium to Solventum. Currently, Boston Scientific, Zimmer Biomet and Solventum’s P/S ratio is 6.9X, 2.4X and 1.5X, respectively.

GE HealthCare’s long-term growth story rests on a robust innovation pipeline, strategic product refreshes and expanding capabilities in high-value healthcare domains. The company is poised to benefit from a multiyear product cycle, including next-generation Imaging solutions such as Photon Counting CT, full-body PET, and advanced MR platforms, all designed to improve diagnostic accuracy and patient outcomes. In ultrasound, a full platform refresh with AI integration across cardiovascular and women’s health segments is expected to drive adoption and expand addressable markets.

In Patient Care Solutions, recently launched anesthesia systems and upcoming AI-enabled monitoring platforms should enhance both growth and margins, with a broad refresh cycle unfolding over the next 18-24 months. Pharmaceutical Diagnostics adds another strong pillar, supported by radiopharmaceuticals like Flyrcado, Vizamyl, and Cerianna, alongside digital workflow integration from the MIM Software acquisition. These innovations align with GEHC’s “D3” strategy of combining devices, digital, and drugs to deliver precision care solutions.

With a record $21 billion backlog, sustained investment in R&D, and strategic collaborations across global healthcare systems, GEHC is positioned to deliver mid-single-digit organic growth over the next several years while expanding margins as new, higher-value products scale.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite