|

|

|

|

|||||

|

|

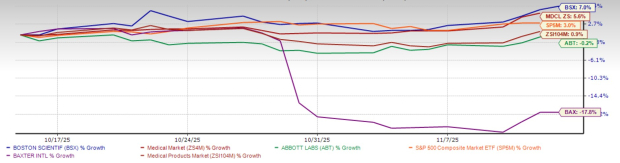

Shares of Boston Scientific BSX have climbed 7% over the past 30 days, extending their positive year-to-date momentum. The stock’s performance has outpaced its industry’s 0.9% gains, the broader Medical sector’s 5.6% growth and the S&P 500 composite’s 3% rise. BSX also stands out in comparison to major competitors, Abbott ABT and Baxter International BAX, whose shares are down 0.2% and 17.8%, respectively, in the same time frame.

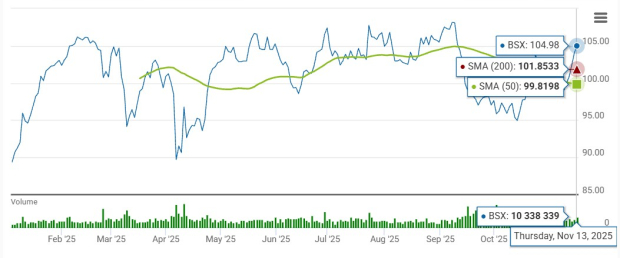

Yesterday, BSX ended the session at $104.98, just 4.1% below its 52-week high. The Marlborough, MA-based MedTech giant closed its third quarter 2025 with strong performances within its Cardiovascular and MedSurg businesses. Both operational sales and adjusted earnings per share (EPS) exceeded the high end of their respective guidance ranges and topped the consensus marks for the third consecutive quarter this year. The company also expanded its portfolio into a new adjacency in peripheral nerve pain via a new agreement.

On the technical side, the stock has been trading above the 50-day simple moving average (SMA) since late October and recently broke above the 200-day SMA, signaling a sustained bullish trend.

EP Momentum Continues: The company’s Electrophysiology (“EP”) unit posted 63% year-over-year sales growth in the third quarter, led by the Farapulse Pulsed Field Ablation System. U.S. double-digit growth in FARAPULSE was supported by the rising adoption of the OPAL HDx mapping system, with one in three FARAPULSE accounts now using the integrated FARAWAVE NAV and OPAL device. Boston Scientific also received FDA approval to expand the labeling of FARAPULSE to include the treatment of drug-refractory, symptomatic, persistent atrial fibrillation (AF).The company is steadily investing to outpace the approximately 15% EP market growth through 2028 by advancing the ecosystem of innovative solutions across both the AF and non-AF segments of the market.

WATCHMAN, Another Catalyst: A component of the Cardiology operating unit, the WATCHMAN business sales grew 35% in the quarter, led by the accelerated adoption of the concomitant procedures in the United States. Management continues to expect approximately 25% of the U.S. WATCHMAN procedures to be done concomitantly, exiting this year with a potential for that to double by 2028. Other developments to happen are the upcoming data presentation of CHAMPION in the first half of 2026 and the launch of the next-generation device, WATCHMAN Elite, expected in late 2027 or early 2028.

Asia-Pacific Leads International Sales: Asia Pacific grew 17% operationally, led by strong double-digit growth across Japan and China. Japan’s growth was driven by WATCHMAN and EP, as well as the uptake of the OPAL HDx mapping system. China grew in the mid-teens despite the substantial volume-based procurement (VBP) in the peripheral business. Growth was broad-based and driven again by strong performances of Interventional Cardiology Therapies and EP.

Boston Scientific continues to pursue acquisitions to drive growth, both strengthening its core businesses and expanding into high-growth adjacent markets. The company has entered into a definitive agreement to acquire Nalu Medical, Inc., a developer of minimally invasive solutions for chronic pain management. Boston Scientific has been a strategic investor in Nalu since 2017, currently owning approximately 9% stake. The remaining equity will be acquired for an upfront cash payment of roughly $533 million, with closing expected during the first half of 2026, subject to customary conditions.

Peripheral nerve stimulation is an emerging field with a significant unmet patient need. Nalu Medical’s highly differentiated technology complements Boston Scientific’s existing therapies — including spinal cord stimulation, basivertebral nerve ablation and radiofrequency ablation — allowing the company to deliver advanced pain relief options to a broader range of patients. Nalu is expected to generate more than $60 million in sales in 2025 and deliver year-over-year growth exceeding 25% in 2026. The transaction is anticipated to be immaterial to adjusted EPS in 2026, slightly accretive in 2027, and increasingly accretive thereafter.

Meanwhile, Boston Scientific’s 2023 acquisition of Relievant Medsystems continues to drive strong accretive growth, strengthening its capabilities in advanced interventional chronic pain.

The third quarter’s transient headwinds that impacted Europe, the Middle East and Africa sales — the discontinuation of the ACURATE valve and the upgraded ERP system implementation at Kerkrade distribution center — are likely to ease. The company also recently began the commercial launch of the WATCHMAN FLX Pro device in China. In Neuromodulation, Boston Scientific is in the early phase of launching Intracept in Europe, building on its strong double-digit U.S. growth in the third quarter.

The company’s revised 2025 outlook now suggests approximately 20% net sales growth on a reported basis, exceeding the previous guidance of 18-19%. Excluding an estimated 350 basis point contribution from closed acquisitions, organic growth is projected at 15.5% compared to the previous 14-15% range.

For the fourth quarter, revenues are expected to grow in the range of approximately 14.5-16.5% on a reported basis (up 11-13% organically).

Based on the forward five-year price-to-sales (P/S), Boston Scientific shares are trading at 7.08X over the five years, above its median and industry average. Meanwhile, Abbott has a five-year P/S of 4.72, and Baxter’s P/S stands at 0.85X.

Boston Scientific’s latest quarterly performance underscores the strength of its diversified businesses, with acquisitions adding a meaningful layer of growth. The planned addition of Nalu Medical is set to expand its neuromodulation offerings for people living with chronic pain. The company’s performance relative to industry and peers over the past month is also impressive. Despite its premium valuation compared to the industry, this Zacks Rank #2 (Buy) stock currently appears to be a compelling option to add to the portfolio. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite