|

|

|

|

|||||

|

|

With Sprouts Farmers Market, Inc. SFM set to announce its third-quarter 2025 earnings results on Oct. 29, after the market closes, investors are faced with a crucial decision: Should you add SFM to your portfolio, hold your position or sell the stock? Whether you're a long-term shareholder or a potential investor looking to capitalize on upcoming opportunities, assessing the stock’s potential ahead of its earnings release is key to making well-informed investment decisions.

Sprouts Farmers has been capitalizing on the growing demand for organic and natural products, positioning itself as a strong player in the grocery space. Analysts are optimistic about Sprouts Farmers' upcoming earnings.

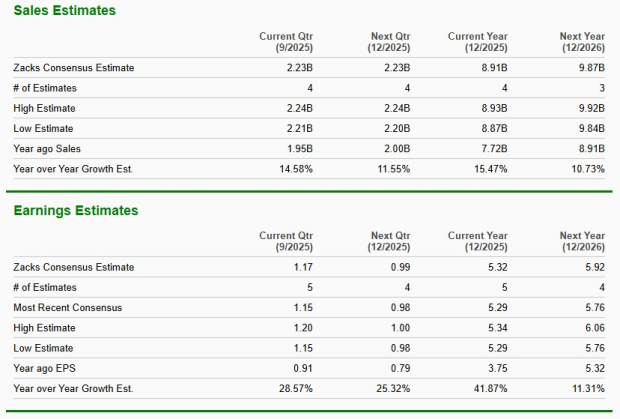

The Zacks Consensus Estimate for third-quarter revenues stands at $2,229 million, which indicates an increase of 14.6% from the prior-year reported figure. On the earnings front, the consensus estimate has been stable at $1.17 per share over the past 30 days, implying a 28.6% year-over-year rise.

Sprouts Farmers has a trailing four-quarter earnings surprise of 13.4%, on average. In the last reported quarter, this Phoenix, AZ-based company surpassed the Zacks Consensus Estimate by a margin of 9.8%.

As investors prepare for Sprouts Farmers’ second-quarter results, the question looms regarding earnings beat or miss. Our proven model does not conclusively predict an earnings beat for Sprouts Farmers this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sprouts Farmers has an Earnings ESP of +0.17% but a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

Sprouts Farmers’ emphasis on product innovation, technology and targeted marketing, along with everyday competitive pricing, bodes well. The company has been steadily increasing its footprint in the natural and organic space, driven by strong demand in this segment. The introduction of unique and health-oriented products attracts a diverse customer base and drives sales growth.

From plant-based proteins to gluten-free snacks and keto-friendly foods, Sprouts Farmers ensures that its shelves are stocked with the latest and most sought-after health products. The company’s commitment to developing innovative products under its private label has resonated well with consumers, contributing to higher profit margins.

The factors mentioned above are likely to have favorably impacted the top line. We expect comparable store sales growth of 7.6% for the quarter under review. This shows a deceleration from 10.2% and 11.7% growth registered in the second and first quarters, respectively. Management had earlier signaled this moderation due to the company cycling the higher comparison base from late 2024.

Sprouts Farmers has made substantial investments in its digital infrastructure, resulting in a robust omnichannel shopping experience. The company reported impressive growth in e-commerce sales, which surged 27% in the second quarter of 2025. As consumers increasingly prefer shopping online for convenience, SFM’s commitment to enhancing its digital capabilities positions it to capture market share.

On its last earnings call, management hinted that both the gross margin and SG&A rate would begin to normalize starting in the third quarter, reflecting comparisons against the prior year’s improved shrink performance. We expect a 20-basis-point gross margin expansion in the third quarter. This shows a sharp deceleration from the first half. We anticipate SG&A expenses to increase 14.4% year over year in the third quarter. As a percentage of net sales, we foresee SG&A expenses to leverage 10 basis points to 29.7%.

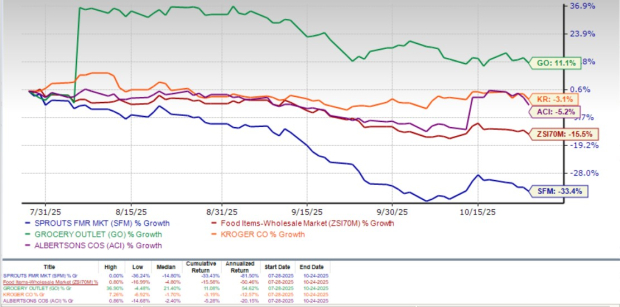

Shares of Sprouts Farmers have declined 33.4% over the past three months, underperforming the industry’s 15.5% drop.

Sprouts Farmers has also lagged behind competitors such as Grocery Outlet Holding Corp. GO, Albertsons Companies, Inc. ACI and The Kroger Co. KR. While shares of Grocery Outlet have advanced 11.1%, Kroger and Albertsons Companies have fallen 3.1% and 5.2%, respectively.

Despite the recent drop in the stock price, SFM’s valuation remains elevated relative to the industry. Sprouts Farmers currently trades at a forward 12-month price-to-sales (P/S) multiple of 1.07, which positions it at a premium compared to the industry’s average of 0.24. At the same time, SFM is trading below its 12-month median P/S of 1.69X.

This premium positioning is especially notable when compared to peers like Grocery Outlet (with a forward 12-month P/S ratio of 0.30), Albertsons Companies (0.12) and Kroger (0.29).

While Sprouts Farmers remains well-positioned in the natural and organic grocery segment, its near-term setup ahead of the third quarter release appears mixed. The company’s focus on innovation, digital growth and private-label expansion underscores a resilient long-term strategy, but slowing comparable sales growth and cost normalization could temper near-term momentum. Given the uncertain earnings beat potential and recent stock underperformance versus peers, a cautious stance seems prudent. Investors may prefer to wait for post-earnings clarity before initiating new positions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite