|

|

|

|

|||||

|

|

PayPal PYPL is set to report its third-quarter 2025 results on Oct. 28.

PYPL expects low to mid-single-digit or approximately 4% revenue growth on a currency-neutral basis for the to-be-reported quarter. Non-GAAP earnings are expected between $1.18 per share and $1.22 per share, or roughly in line with the prior year at the midpoint.

The Zacks Consensus Estimate for third-quarter revenues is pegged at $8.25 billion, indicating an increase of 5.18% from the year-ago quarter’s reported figure.

The consensus mark for earnings stands at $1.19 per share, down by a penny over the past week, calling for a fall of 0.83% from the figure reported in the year-ago quarter.

For 2025, the Zacks Consensus Estimate for PayPal’s revenues is pegged at $33.14 billion, implying a rise of 4.21% year over year. The consensus mark for full-year EPS stands at $5.23, calling for a 12.47% year-over-year jump.

This digital payment company has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with the average beat being 9.94%.

Our proprietary model does not conclusively predict an earnings beat for PayPal this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

PayPal has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

PayPal is transforming into a full commerce platform, extending beyond payments by leveraging advanced, data-driven tools to boost merchant growth and consumer loyalty. The company is focused on making its online payment experience faster, easier, and more rewarding, so more customers choose PayPal at the checkout page. It is also heavily investing in AI for personalized commerce, fraud detection and expanding crypto integration within its app.

PYPL’s third-quarter results are expected to reflect portfolio strength and a rich partner base. It is expected to have benefited from its scale, diversification and balance sheet strength, which are supporting its growth efforts. During the third quarter, the company continued to make progress on its transformation efforts and is likely to have gained from consumers and merchants expanding usage of PayPal.

In the quarter under consideration, Paypal is expected to have benefited from an improving Total Payment Volume (“TPV”). The metric is likely to have gained from a strong relationship between the company and its merchants and consumers. PYPL is expected to have experienced healthy Branded checkout TPV growth, backed by strength across large enterprise platforms, marketplaces within PayPal checkout and Pay with Venmo.

During the third quarter, PayPal made some strategic moves to generate business. The company signed a two-year agreement with Blue Owl Capital, allowing Blue Owl managed funds to buy about $7 billion worth of PayPal’s “Pay in 4” loans originated in the United States. It also teamed up with Google to deliver frictionless digital commerce experiences. PayPal launched PayPal links for easy money transfers through a personalized, one-time link. It gave early access to Perplexity’s Comet browser for U.S. and some global users. It also introduced PayPal World for seamless global wallet interoperability.

Despite strong fundamentals and increasingly diversified offerings, PayPal is likely to have faced competitive pressure from other digital wallets. Broader macroeconomic pressures and uncertainty surrounding the tariff policy could have also affected its third-quarter results.

The Zacks Consensus Estimate for PayPal’s Transaction revenues is pegged at $7.44 billion, which suggests a 5.2% increase from the year-ago quarter.

PYPL is also poised to benefit from its value-added services. Its consensus mark for revenues from other value-added services is pegged at $825.1 million for the third quarter, up from $780 million in the year-ago period.

PayPal anticipates its third-quarter transaction margin dollars to range between $3.76 billion and $3.82 billion, indicating a 4% year-over-year increase at the midpoint. When excluding interest on customer balances, the company forecasts midpoint growth of around 6% in transaction margin dollars.

The consensus mark for TPV is pegged at $448.938 billion, indicating 6.2% year-over-year growth. Paypal’s active accounts are likely to reach 439.1 million, which denotes an increase from the year-ago value of 432 million.

However, estimates for the number of payment transactions stand at 6.558 billion, which is below the company’s reported figure of 6.631 billion in the same quarter last year. The consensus mark for transaction margin is pegged at 45.9%, down from the year-ago figure of 46.6%.

PayPal remains focused on controlling its cost structure while allocating resources toward critical growth initiatives. PayPal expects its non-transaction operating expenditure to grow by a high-single-digit percentage in the third quarter. This increase is mainly due to ongoing investments in technology and new product launches, along with some marketing expenses being shifted to this period.

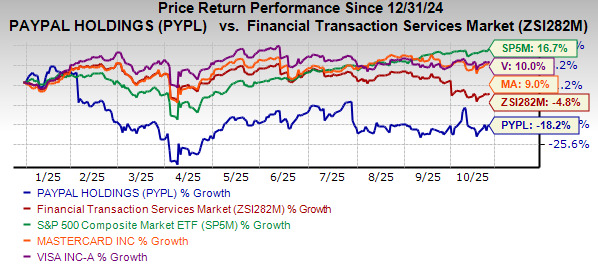

Paypal shares have declined 18.2% year to date. The Zacks Financial Transaction Services decreased 4.8%, while the S&P 500 rose 16.7% for the same period. Rivals like Visa Inc. V and Mastercard Incorporated MA continue to expand their offerings, challenging PayPal’s dominance in digital payments.

Compared to its peers, PayPal’s performance has been notably weaker. While PYPL has struggled, Visa shares have climbed 10%, and Mastercard has risen 9% over the same timeframe.

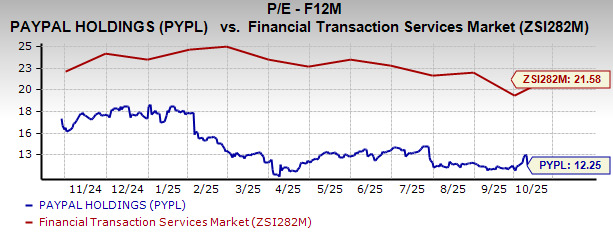

From a valuation standpoint, PayPal shares are trading cheap, as suggested by the Value Score of A. In terms of forward 12-month P/E, PYPL stock is trading at 12.25X compared with the Zacks Financial Transaction Services industry’s 21.58X.

Shares of Visa and Mastercard are currently trading at P/E of 26.08X and 30.97X, respectively.

Although PayPal’s stock has struggled this year, the company is working on a major strategic shift. PayPal is evolving from being a simple payment processor into a holistic commerce partner. By merging PayPal’s services into a single platform, it’s strengthening the connections between consumers and merchants. PayPal is focusing on improving its user experience, deepening relationships with merchants, and expanding across global markets. These key actions could unlock long-term growth for the company.

Apart from riding on the growing demand for peer-to-peer payments and digital wallets and offering a good scope for growth, PayPal is trading cheap, and the current price offers a good entry point for investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 38 min |

New Zealand retailers warn of price rises if card surcharges are outlawed

V MA

Retail Insight Network

|

| 1 hour | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite