|

|

|

|

|||||

|

|

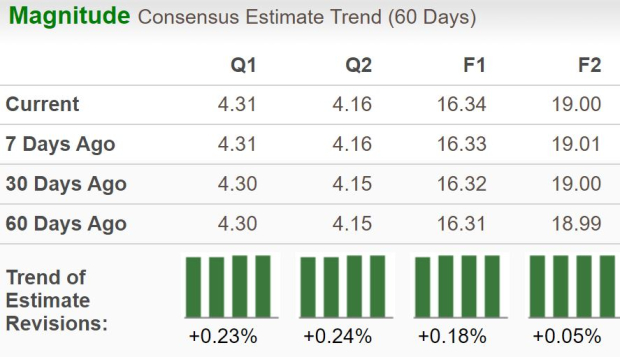

Payments giant Mastercard Incorporated MA is set to report third-quarter 2025 results on Oct. 30, 2025, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $4.31 per shareon revenues of $8.5 billion.

The third-quarter earnings estimate increased by a penny over the past 60 days. The bottom-line projection indicates an increase of 10.8% from the year-ago reported number. The Zacks Consensus Estimate for quarterly revenues suggests year-over-year growth of 15.4%.

For full-year 2025, the Zacks Consensus Estimate for Mastercard’s revenues is pegged at $32.48 billion, implying a rise of 15.3% year over year. Also, the consensus mark for 2025 earnings per share is pegged at $16.34, implying a jump of around 11.9% on a year-over-year basis.

Mastercardhas a robust history of surpassing earnings estimates, beating the consensus estimate in each of the last four quarters, with the average surprise being 3.8%. This is depicted in the figure below.

Mastercard Incorporated price-eps-surprise | Mastercard Incorporated Quote

Our proven model predicts a likely earnings beat for the company this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is precisely the case here.

MA has an Earnings ESP of +0.26% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the company’s total Gross Dollar Volume (GDV) for all MA-branded programs suggests a 9.9% rise from the prior-year quarter’s reported figure, whereas our model predicts a nearly 8% increase. We expect GDV from domestic operations to increase by almost 8% year over year and 10.3% from European operations.

Switched transactions are expected to have experienced an upsurge, driven by resilient consumer spending and increased contactless acceptance initiatives pursued by the company. The Zacks Consensus Estimate for its switched transactions indicates a 9.3% rise from the prior-year quarter’s reported figure, whereas our estimate suggests a 7.2% increase.

Increasing cross-border travel is expected to have had a positive impact on Mastercard's cross-border volumes. As such, the consensus estimate for cross-border assessments suggests an increase of 15.2% compared with the previous year, while our projection indicates growth of 14.1%. Further, the consensus mark implies domestic assessments and transaction processing assessments to witness a 10.8% and 13.5% year-over-year increase, respectively.

The Zacks Consensus Estimate for Value-added Services and Solutions net revenues indicates 21.8% year-over-year growth, while our model estimate suggests a 21.5% increase in the third quarter. Growing demand for its consulting and marketing services and loyalty solutions is likely to have driven this metric.

The above-mentioned factors are expected to have positioned the company not only for year-over-year growth but also for a likely earnings beat. The positives are expected to have been partially offset by rising expenses, rebates and incentives.

Mastercard’s adjusted operating costs are likely to have increased in the third quarter due to higher G&A costs and Advertising & Marketing expenses. We expect total adjusted operating expenses to rise nearly 16% from the prior-year quarter’s actuals. Furthermore, our estimate for payments network rebates and incentives suggests a 14% year-over-year increase.

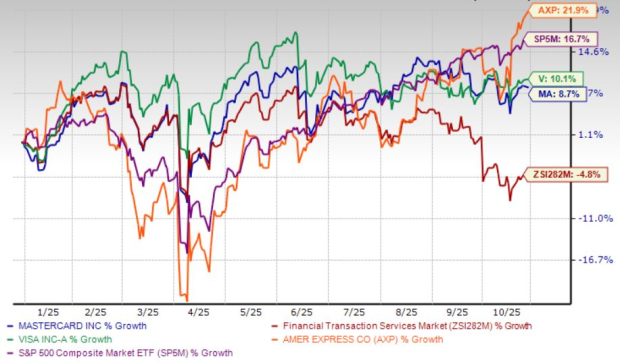

Mastercard's stock has exhibited an upward movement over the year-to-date period. Its increase of 8.7% has outperformed the industry’s 4.8% decline. In comparison, its peer, Visa Inc. V, hasjumped 10.1% during this time, while American Express Company AXP hasgained 21.9%. Meanwhile, the S&P 500 Index grew 16.7%, placing it below American Expressand above Visa and Mastercard.

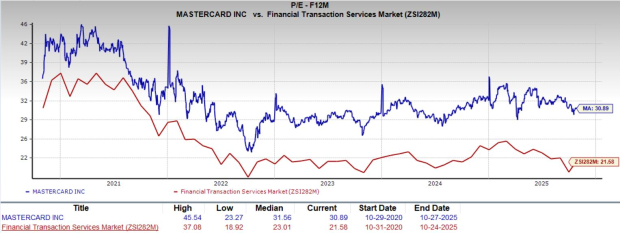

Now, let’s look at the value Mastercardoffers investors at current levels.

The company’s valuation looks stretched compared with the industry average. Currently, Mastercardis trading at 30.89X forward 12-month earnings, above the industry’s 21.58X. In comparison, both Visa and American Express offer better value at the moment, trading at a forward P/E of 26.82X and 21.09X.

Mastercard stands at a crossroads where innovation meets disruption. As giants like Walmart and Amazon plan to launch their own stablecoins to cut out the middlemen, Mastercard is not sitting idle. Instead of resisting change, it is weaving itself into the very fabric of the digital money revolution, linking traditional payments with the crypto economy through partnerships with major blockchain players.

Yet, the road ahead is not without obstacles. Regulators in both the United States and the U.K. are tightening their grip on market dominance and payment fees, testing Mastercard’s ability to adapt under scrutiny. But even with the pressure, its growth engines keep humming. From boosting digital security and fraud prevention to driving engagement through value-added services, Mastercard continues to evolve beyond the swipe.

Cash flow strength and consistent shareholder return highlight a business with deep resilience and confidence in its future. In a world shifting toward faster, decentralized finance, Mastercard’s role as the bridge between old money and new remains both its biggest challenge and greatest opportunity. However, investors must weigh that quality against a premium valuation, a sign that markets already recognize its strategic edge. With third-quarter earnings around the corner, investors may be wise to hold for now and wait for a more attractive entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours |

Digital payments sovereignty: Industry responds to UK domestic card payments alternative

MA V

Retail Banker International

|

| 14 hours | |

| 15 hours | |

| 15 hours | |

| 16 hours | |

| 17 hours | |

| 19 hours | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite