|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Visa Inc. V, a global leader in payment processing, continues to deliver what long-term investors value most: consistency. Supported by resilient consumer spending, rising cross-border volumes and the steady expansion of digital payments worldwide, Visa has quietly compounded shareholder value over the past year.

The company’s asset-light, network-driven business model, which monetizes transaction volumes without taking on credit risk, has helped it navigate a mixed macro backdrop with ease. Growing demand for Visa’s value-added services (VAS), including fraud prevention, data analytics, and payment security, has further strengthened its revenue mix and margins.

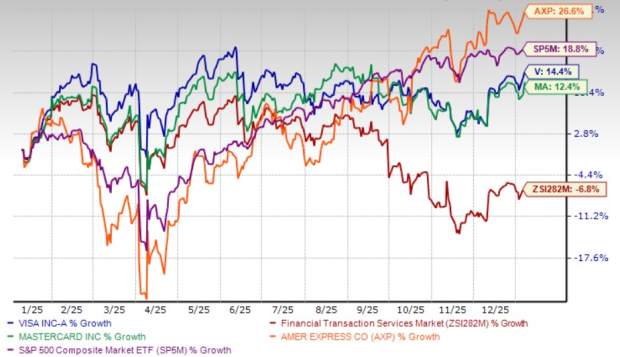

Over the past year, Visa’s stock has gained 14.4%, outperforming the broader industry and key rival Mastercard Incorporated MA. This reflects Visa’s defensive growth appeal. However, the gains still trailed American Express Company AXP, which benefited more directly from higher interest income, and the S&P 500’s 18.8% rise, fueled largely by mega-cap technology and AI-driven stocks.

This contrast raises a key question for investors: Can Visa’s steady climb turn into something more dynamic in 2026?

Visa’s performance is not driven by cyclical spikes or balance-sheet leverage. Instead, it rests on scale, global reach, and recurring transaction volumes, supported by the ongoing shift from cash to electronic payments across both developed and emerging markets.

Cross-border travel has been a key tailwind, with higher-fee international transaction volumes rebounding as travel normalizes, aiding margin expansion. At the same time, resilient everyday spending has stabilized volumes amid uneven discretionary demand, while Visa’s expanding VAS deepens client relationships, diversifies revenue, and reinforces its profile as a high-quality compounder rather than a momentum-driven stock.

Looking ahead, analyst expectations reinforce this steady-growth narrative. The Zacks Consensus Estimate calls for EPS growth of 11.7% in fiscal 2026 and 13.2% in fiscal 2027. Revenues are projected to rise 11.1% in fiscal 2026 and 10.4% in fiscal 2027, reflecting sustained payment volume growth and ongoing monetization opportunities.

Notably, earnings estimates have remained stable over the past week, signaling confidence in Visa’s outlook. Stability in estimates often matters as much as growth itself, particularly for investors prioritizing predictability.

Visa has also demonstrated execution consistency. The company beat earnings estimates in each of the past four quarters, delivering an average surprise of 2.7%.

Visa Inc. price-consensus-eps-surprise-chart | Visa Inc. Quote

For Visa, 2026 upside is likely to come from acceleration at the margin and technological improvements rather than complete reinvention. Further normalization of cross-border travel, deeper penetration of VAS, and continued global digitization of payments will gradually lift growth expectations. A few years ago, VAS was around 20% of its revenues, and now it is approaching 30%, showing its successful diversification beyond core processing.

Regulation, once a headwind for digital assets, may now work in Visa’s favor. The GENIUS Act clarified stablecoin settlement rules, enabling Visa to operate across four stablecoins and four blockchains, an early lead over banks weighed down by legacy compliance systems. More than 130 stablecoin-linked card programs now run on Visa across 40+ countries, positioning its network as a low-friction modernization path for smaller issuers. As regulation pushes complexity onto individual institutions, Visa’s scale, tools and network effects grow more valuable.

Visa is positioning for growth in agentic commerce, where AI-driven agents execute transactions on users’ behalf. By embedding payments into automated workflows, Visa extends its network beyond consumer checkouts into machine-to-machine commerce. As these models scale, Visa’s rails, authentication and tokenization could emerge as the default layer for secure AI-led payments, adding a new growth vector alongside its core transaction engine.

While Visa may not deliver headline-grabbing rallies like AI-driven stocks, its strength lies in predictable earnings growth, strong cash generation and long-term relevance in global commerce.

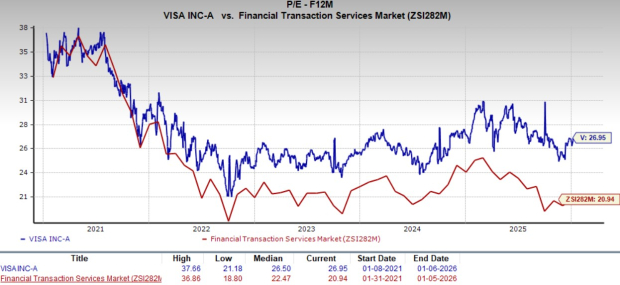

Visa trades at 26.95X forward 12-month earnings versus an industry average of 20.94X. It currently carries a Value Score of D, suggesting the stock is not cheap on paper. The current level sits slightly above the five-year median of 26.50X. By comparison, Mastercard trades at 30.40X and American Express at 21.77X, placing Visa somewhere in the middle.

Visa faces near-term headwinds from rising expenses and regulatory pressure. Adjusted operating expenses increased 10.8% in fiscal 2024 and 11.2% in fiscal 2025, weighing on margin expansion, while client incentives (a contra-revenue item) rose 11.9% and 14.4%, respectively.

If companies like Walmart and Amazon successfully launch stablecoins, other biggies may follow and divert a slice of transaction volume, affecting interchange fees growth.

Regulatory risks are also intensifying. In the domestic market, the Department of Justice had accused Visa and Mastercard of using market dominance to sustain elevated merchant fees, while multiple groups had challenged a proposed settlement aimed at resolving long-running interchange litigation. Abroad, a U.K. tribunal ruling against interchange fees and the Payment Systems Regulator’s push for fee caps add further uncertainty.

Visa’s steady growth profile, strong cash generation, and expanding role in digital, stablecoin, and agentic commerce support its long-term appeal. However, premium valuation and regulatory overhangs temper near-term upside. While 2026 will likely bring incremental acceleration rather than a breakout, Visa remains a dependable compounder. Given this risk-reward setup, Visa currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 min | |

| 16 min | |

| 38 min | |

| 42 min | |

| 10 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite