|

|

|

|

|||||

|

|

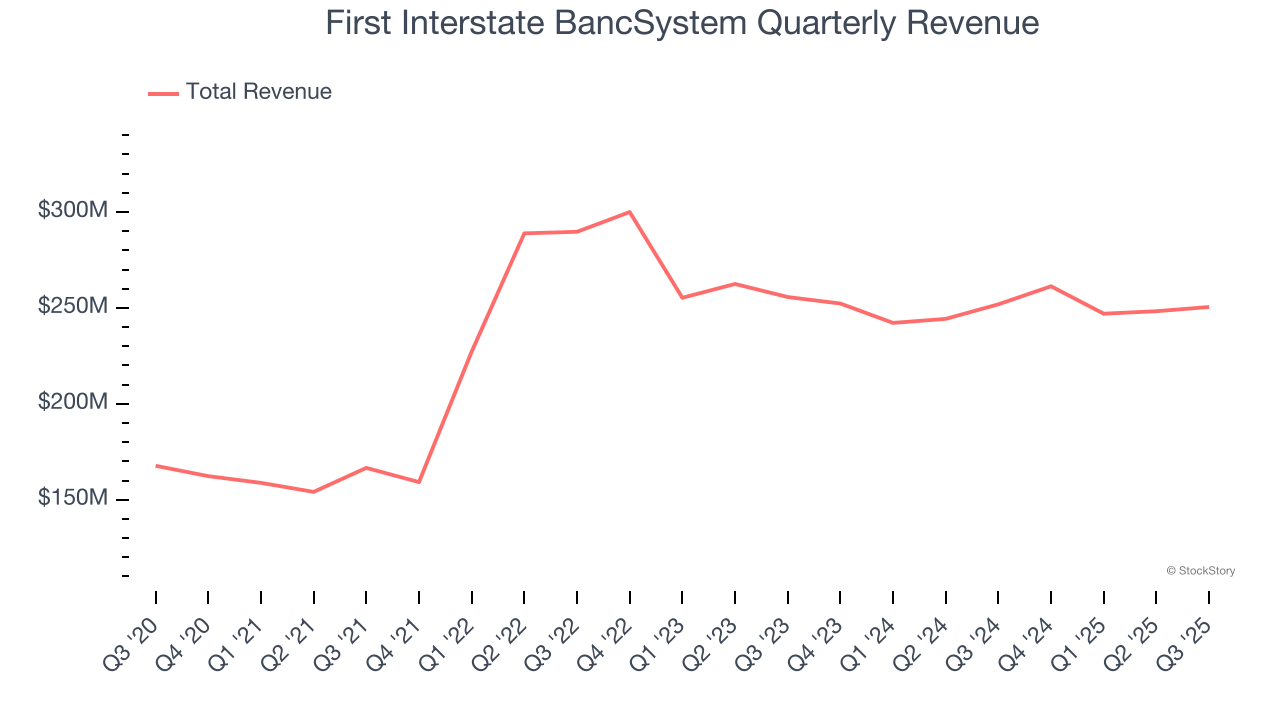

Regional banking company First Interstate BancSystem (NASDAQ:FIBK) missed Wall Street’s revenue expectations in Q3 CY2025, with sales flat year on year at $250.5 million. Its GAAP profit of $0.69 per share was 11.7% above analysts’ consensus estimates.

Is now the time to buy First Interstate BancSystem? Find out by accessing our full research report, it’s free for active Edge members.

“We continue to execute on our strategic plan, announced earlier this year, to focus on organic growth and leverage our strong balance sheet to support our customers. Our net interest margin continued to improve, and we maintained a clear focus on managing expenses prudently, with a goal to drive long-term, profitable growth,” said James A Reuter, President and Chief Executive Officer of the Company.

Tracing its roots back to 1971 and still guided by founding family principles, First Interstate BancSystem (NASDAQ:FIBK) operates a network of community banks across 14 western and midwestern states, offering comprehensive banking services to individuals, businesses, and government entities.

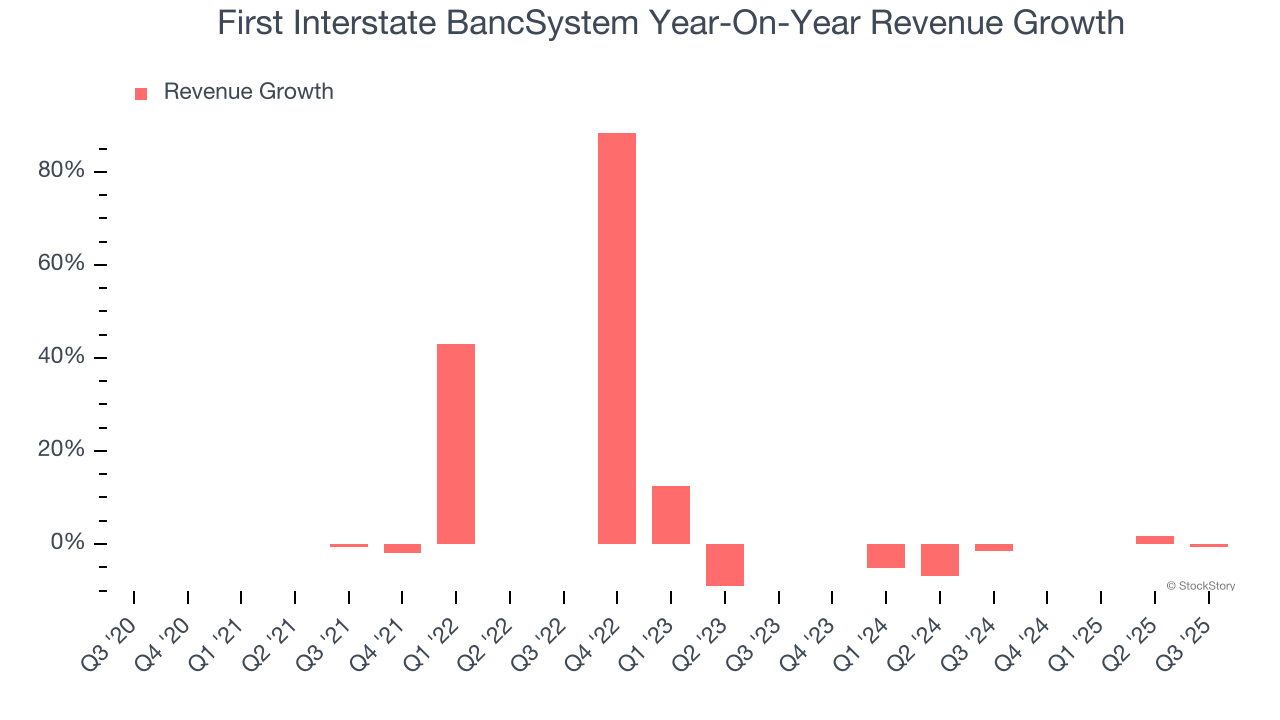

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Thankfully, First Interstate BancSystem’s 9% annualized revenue growth over the last five years was solid. Its growth beat the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. First Interstate BancSystem’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.1% over the last two years.

This quarter, First Interstate BancSystem missed Wall Street’s estimates and reported a rather uninspiring 0.6% year-on-year revenue decline, generating $250.5 million of revenue.

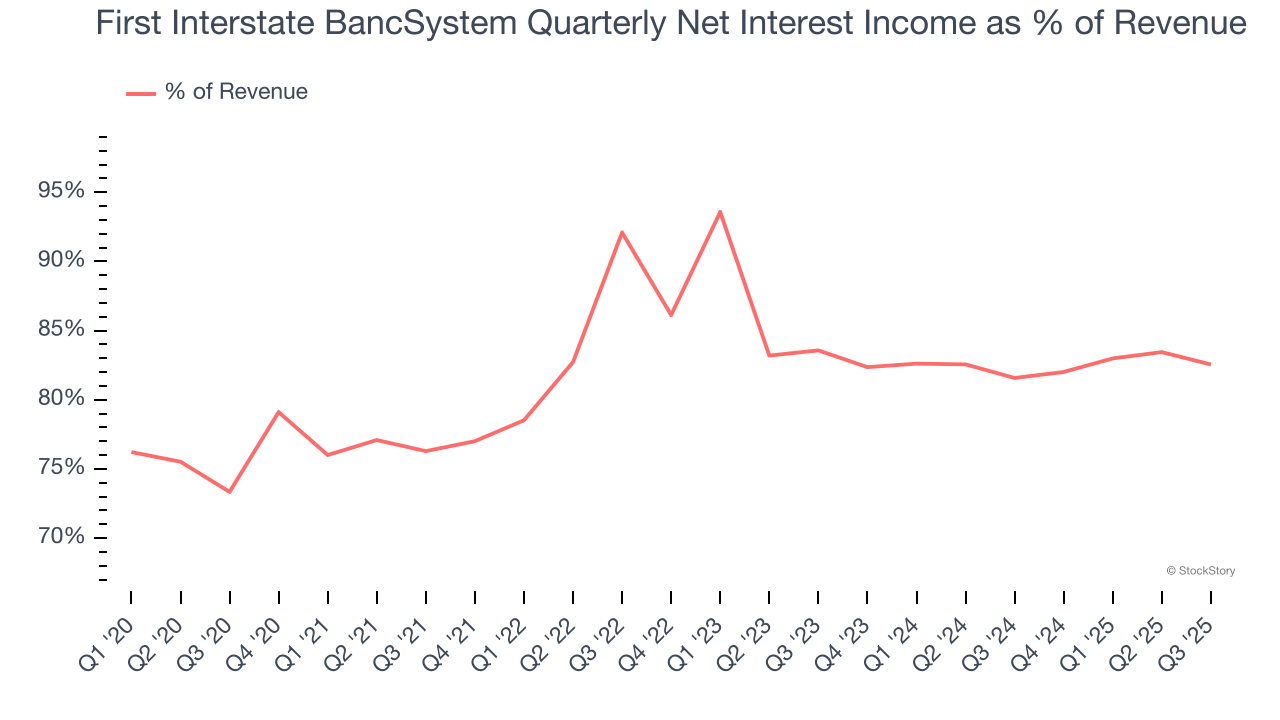

Net interest income made up 82.3% of the company’s total revenue during the last five years, meaning First Interstate BancSystem barely relies on non-interest income to drive its overall growth.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

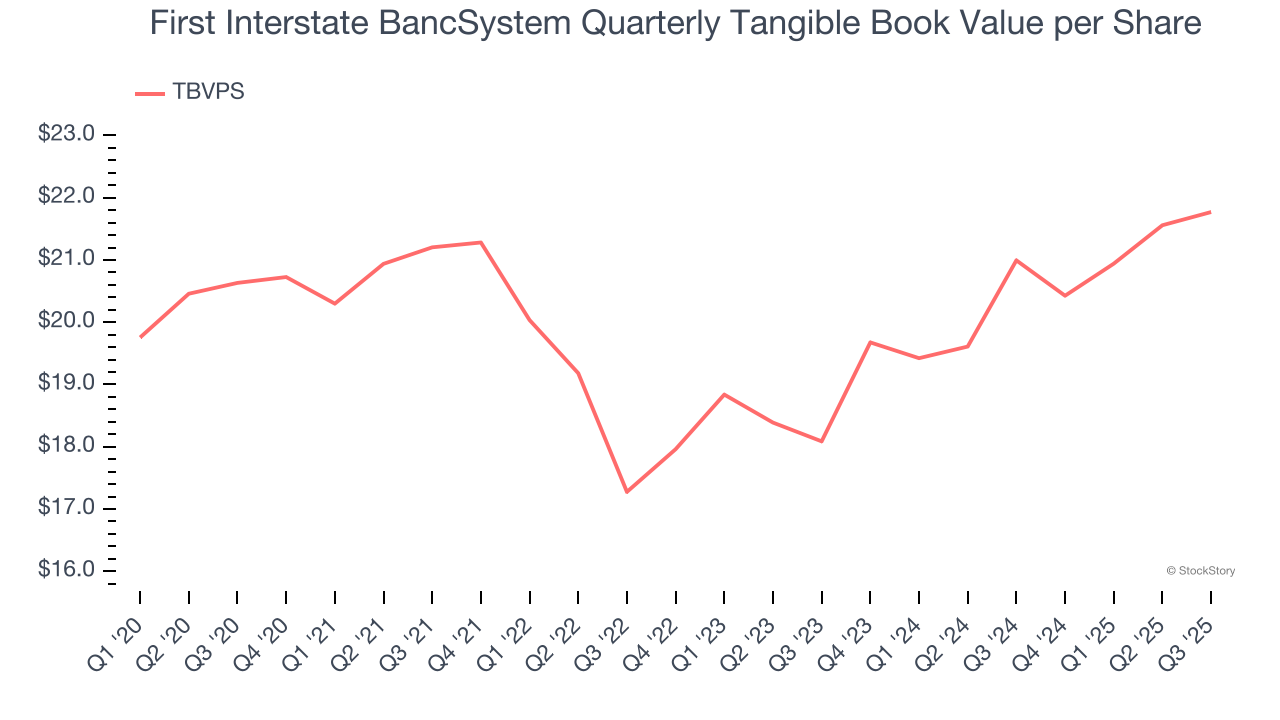

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

First Interstate BancSystem’s TBVPS grew at a sluggish 1.1% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 9.7% annually over the last two years from $18.09 to $21.77 per share.

Over the next 12 months, Consensus estimates call for First Interstate BancSystem’s TBVPS to grow by 4% to $22.65, paltry growth rate.

It was good to see First Interstate BancSystem beat analysts’ EPS expectations this quarter. We were also happy its tangible book value per share narrowly outperformed Wall Street’s estimates. On the other hand, its net interest income missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 1.2% to $32.47 immediately following the results.

So should you invest in First Interstate BancSystem right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-04 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-27 | |

| Jan-26 | |

| Jan-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite