|

|

|

|

|||||

|

|

Archer Daniels Midland Company ADM is slated to report third-quarter 2025 results on Nov. 4, before market open. The company is likely to report a bottom-line decline when it posts the quarterly results.

The Zacks Consensus Estimate for the company’s earnings is pegged at 88 cents per share, which indicates a plunge of 19.3% from the year-ago quarter’s reported figure. The consensus mark has moved up by a penny in the past 30 days. For revenues, the consensus mark is pegged at $20.7 billion, implying 3.6% growth from the year-ago quarter’s reported figure.

In the last reported quarter, the company delivered an earnings surprise of 5.7%. Its earnings beat the Zacks Consensus Estimate by 0.05%, on average, in the trailing four quarters.

Archer Daniels is grappling with tough market conditions. One of the key factors contributing to its underperformance is the sluggishness in its Ag Services and Oilseeds segment. The company has been affected by numerous headwinds in the agriculture cycle, with some market dislocations and increased cost inflation. Depressed vegetable oil demand and low prices, owing to biofuel and trade policy uncertainty, are likely to have hurt the Crushing sub-segment.

In Refined Products and Other, margins have been pressured by biofuel and trade policy uncertainties, which have hurt biodiesel margins. Weak oil demand and higher crush capacity are also expected to have affected refining margins in the to-be-reported quarter.

On the last reported quarter’s earnings call, management remained cautious about the second-half outlook for crush margin improvement, as present domestic crush replacement margins are below the company’s outlook. ADM has seen some signs of weakening customer demand, mainly in carb solutions and has cut its volume expectations for certain markets and products. In addition, the uncertainties associated with tariff policy and macroeconomic conditions are added deterrents.

Management anticipates soybean crush margins for the third quarter to be in a similar band to the second quarter. ADM projects Carb Solutions to continue to be hurt by softness in starch demand for paper and corrugated boxes, along with elevated corn costs in EMEA associated with the corn-quality issues. Robust industry-wide ethanol production is likely to sustain pressure on margins. These factors are expected to have hurt the top-line performance in the to-be-reported quarter.

Archer Daniels Midland Company price-eps-surprise | Archer Daniels Midland Company Quote

The Zacks Consensus Estimate for the Ag Services and Oilseeds segment’s revenues is pegged at $15.7 billion, suggesting 4.3% year-over-year growth. The consensus mark for the Carbohydrate Solutions segment is $2.9 billion, indicating a year-over-year rise of 0.5%.

However, ADM has been seeing a recovery in its Nutrition business for a while now, driven by its focus on optimizing the organizational and operational structure across Human and Animal Nutrition. The Zacks Consensus Estimate for the Nutrition segment’s revenues is pegged at $1.88 billion, suggesting 2.7% year-over-year growth.

The company has also been actively managing productivity and innovation, as well as aligning work to the interconnected trends in food security, health and wellbeing. Its processing capacities are improving across its production operations, which consist of the ramp-up of Green Bison to full capacity and growing production. Additionally, the company has been advancing key innovation initiatives in areas like biosolutions, and health and wellness, supporting increasing customer demand in these parts of the business. The company’s focus on strategic simplification is expected to have aided margins in the to-be-reported quarter.

Our proven model does not conclusively predict an earnings beat for Archer Daniels this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Archer Daniels currently has an Earnings ESP of +2.66% and a Zacks Rank #4 (Sell).

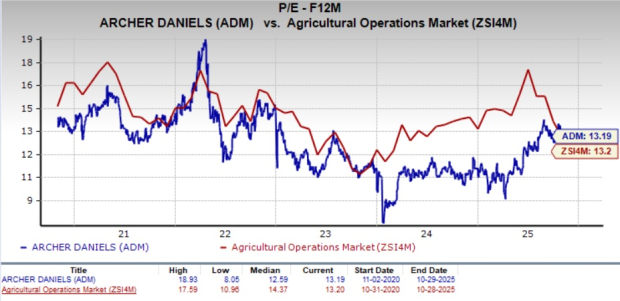

From a valuation perspective, Archer Daniels offers an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 13.19X, which is below the five-year high of 18.93X and almost at par with the Agriculture - Operations industry’s average of 13.2X, the stock offers compelling value for investors seeking exposure to the industry.

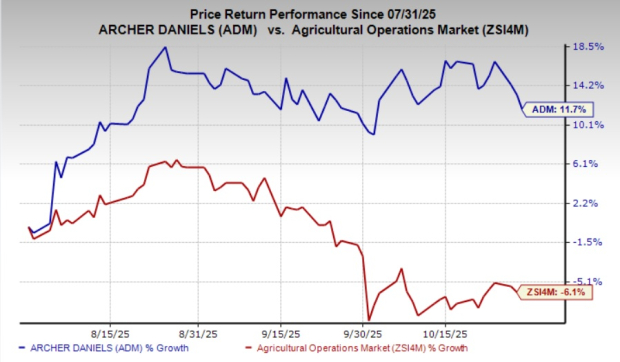

The recent market movements show that ADM shares have rallied 11.7% in the past three months against the industry's 6.1% decline.

Here are some companies, which, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

Vital Farms VITL has an Earnings ESP of +8.84% and currently flaunts a Zacks Rank of 1. VITL is anticipated to register increases in its top and bottom lines when it reports third-quarter 2025 results. The Zacks Consensus Estimate for Vital Farms’ quarterly revenues is pegged at $191 million, indicating growth of 31.7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vital Farms’ bottom line has been unchanged in the past 30 days at 29 cents per share. This implies a surge of 81.3% from the year-ago quarter’s reported figure. VITL delivered an earnings beat of 35.8%, on average, in the trailing four quarters.

Corteva CTVA has an Earnings ESP of +4.82% and a Zacks Rank of 3 at present. CTVA is likely to register growth in its top line when it releases third-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.5 billion, which implies growth of 7% from the figure in the prior-year quarter.

The consensus estimate for Corteva’s bottom line has been unchanged at a loss of 49 cents per share in the past 30 days. The estimate indicates the loss per share to be in line with the year-ago quarter’s actual. CTVA delivered a negative earnings surprise of 4.4%, on average, in the trailing four quarters.

Monster Beverage MNST currently has an Earnings ESP of +0.82% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2025 numbers. The Zacks Consensus Estimate for quarterly earnings per share is pegged at 48 cents, suggesting 20% growth from the year-ago period’s reported number. The consensus mark has been unchanged in the past 30 days.

The consensus estimate for Monster Beverage’s quarterly revenues is pegged at $2.1 billion, which indicates growth of 12.1% from the prior-year quarter’s actual. MNST has a trailing four-quarter earnings surprise of 0.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 13 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite