|

|

|

|

|||||

|

|

Global e-commerce giant Amazon.com Inc. AMZN reported third-quarter 2025 adjusted earnings of $1.95 per share, beating the Zacks Consensus Estimate of $1.58. This compares to earnings of $1.43 per share a year ago.

The company posted revenues of $180.17 billion, surpassing the Zacks Consensus Estimate by 1.29%. This compares to year-ago revenues of $158.88 billion. Operating income was flat year-over-year at $17.4 billion. AMZN’s top line has been benefiting from steady momentum in Prime and Amazon Web Services (AWS).

In the third quarter, AWS contributed $33.01 billion, up 20.2% year over year. Despite facing massive competition from Alphabet Inc. GOOGL and Microsoft Corp. MSFT, Amazon's cloud service has performed impressively.

Moreover, online sales and subscription revenues increased 9.8% and 11.5%, respectively, year over year. Similarly, advertising revenues climbed 23.5% year over year. Physical store sales increased 6.7% year over year.

CEO Andy Jassy said in a statement that AWS is, “Growing at a pace we haven’t seen since 2022. We continue to see strong demand in artificial intelligence (AI) and core infrastructure, and we’ve been focused on accelerating capacity — adding more than 3.8 gigawatts in the past 12 months.” Following this impressive result, the stock price of AMZN jumped 13.1% in yesterday’s after-market trade.

The chart below shows the price performance of AMZN, GOOGL and MSFT year to date.

Amazon is using the Claude chatbot of privately held Anthropic for AI exposure. The Trainium2 AI chip has become a lucrative opportunity for the company. In the reported quarter, this business jumped 150% sequentially. AMZN has invested $8 billion in this AI startup.

Anthropic has agreed to use 1 million custom Trainium2 chips from AMZN to run its AI applications by the end of 2025. On Oct. 29, AMZN unveiled its $11 billion AI data center called “Project Rainier.” This will run on Anthropic chatbot using 500,000 Trainium2 AI chips.

In February 2025, AMZN introduced Rufus, a shopping chatbot that can answer and suggest products as per customers’ queries. Management said more than 250 million individuals have already used this product. The e-commerce behemoth has also unveiled Q, a chatbot for businesses, and Bedrock, a generative AI service for cloud customers.

Amazon is extensively using generative AI applications in its retail, cloud, devices and advertisement businesses. Management raised its 2025 capex to $125 billion from $118 billion reported earlier. CFO Brian Olsavsky said capex is likely to increase next year.

AMZN’s AI is reshaping customer experiences across shopping and media. The company expanded Alexa+ Early Access to millions, and its AI shopping agent is used by millions of customers. AMZN rolled out features that turn product summaries and reviews into audio clips and launched tools to help sellers enhance listings.

AMZN’s Prime Video added live sports milestones, drawing approximately two million viewers per NASCAR race and unveiling a new NBA broadcast team. These data-driven, AI-infused surfaces deepen engagement, unlock monetization, and diversify growth drivers in the near term.

Amazon estimated that its fourth-quarter 2025 sales will be in the range of $206-213 billion, the midpoint of which is $209.5 billion. The current Zacks Consensus Estimate is pegged at $208.37 billion, suggesting an increase of 11% year over year.

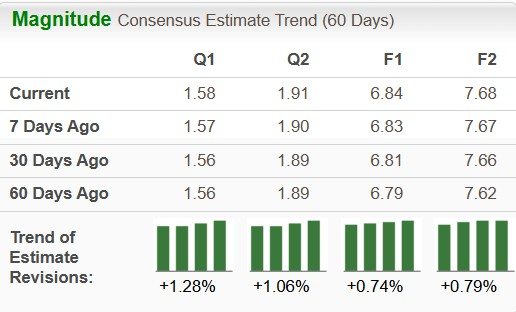

The Zacks Consensus Estimate of fourth-quarter EPS (earnings per share) is $1.91, indicating an increase of 2.75 year over year. AMZN has a long-term (3-5 years) earnings growth rate of 22.2%, higher than the S&P 500’s growth rate of 13.5%.

AMZN has an expected revenue and earnings growth rate of 10.l4% each and 12.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.1% over the last seven days.

Despite the after-market jump in stock price, AMZN has underperformed this year with respect to the S&P 500 as well as its closest cloud rivals — Alphabet and Microsoft. The short-term average price target of brokerage firms for the stock represents an increase of 20.6% from the last closing price of $222.86. The brokerage target price is currently in the range of $230-$305. This indicates a maximum upside of 36.9% and no downside.

AMZN currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 1 hour | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Workers Are Afraid AI Will Take Their Jobs. Theyre Missing the Bigger Danger.

MSFT

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite