|

|

|

|

|||||

|

|

Palantir Technologies Inc. PLTR once again showcased exceptional execution in its third-quarter 2025 results, combining strong top-line growth, expanding profitability, and impressive cash generation.

The company’s focus on accelerating commercial adoption in the United States, while maintaining its dominance in government contracts, continues to drive its overall success. Palantir’s results reaffirm its position as a leading AI-driven software provider, but after a substantial rally in its share price, investors may need to approach the stock with measured expectations.

Palantir reported third-quarter revenues of $1.18 billion, marking a 63% year-over-year and 18% sequential increase, beating the Zacks Consensus Estimate by 8%.

This performance reflects surging demand for the company’s Artificial Intelligence Platform (AIP) and analytics solutions across both commercial and government markets. The U.S. segment contributed $883 million, accounting for 75% of total revenues and highlighting the growing domestic customer base.

Palantir’s AI-based commercial solutions are becoming increasingly essential for businesses seeking to modernize data infrastructure, improve decision-making, and integrate automation into operations.

The company’s total contract value bookings reached $2.8 billion, a 151% increase year-over-year, representing its strongest quarter ever for deal signings. Palantir secured 204 contracts worth $1 million or more, reflecting deeper enterprise-level engagement. The customer count rose 45% year over year to 911, showcasing continued diversification and widening adoption across industries.

Moreover, the company’s net dollar retention rate climbed to 134%, a clear sign that existing clients are spending more on Palantir’s software platforms over time. This high retention ratio reinforces Palantir’s ability to deliver measurable value, leading to recurring revenue growth and expanding wallet share.

Beyond revenue growth, Palantir’s profitability metrics improved significantly. The company achieved its highest-ever adjusted operating margin of 51%, reflecting the scalability of its software business model and disciplined cost control. GAAP operating income reached $393 million, while GAAP net income came in at $476 million, translating to GAAP earnings per share (EPS) of 18 cents and adjusted EPS of 21 cents that beat the Zacks Consensus Estimate of 17 cents.

Gross margins remained robust at 82%, underscoring the company’s high-value, software-as-a-service (SaaS)-based operations. The strong profitability is complemented by healthy cash flows. Palantir generated $508 million in cash from operations and $540 million in adjusted free cash flow during the quarter. The company ended the quarter with a solid $6.4 billion in cash, cash equivalents and U.S. Treasury securities, providing ample liquidity for future investments, research, and acquisitions.

The company’s Rule of 40 score reached a record 114%, one of the highest ever achieved in the software industry, underscoring the rare combination of growth and profitability that Palantir has managed to sustain.

Looking ahead, Palantir provided upbeat guidance for both the fourth quarter and full-year 2025. The company expects fourth quarter revenue of $1.329 billion, indicating 13% sequential and 61% year-over-year growth.

For the full year, revenue guidance was raised to a midpoint of $4.398 billion, representing a 53% increase from 2024 and exceeding the previous guidance by $252 million. Palantir also raised expectations for adjusted income from operations to a range of $2.151-$2.155 billion and projected adjusted free cash flow between $1.9 billion and $2.1 billion. The company continues to anticipate GAAP operating income and net income in every quarter of 2025, reflecting consistent profitability and strong financial health.

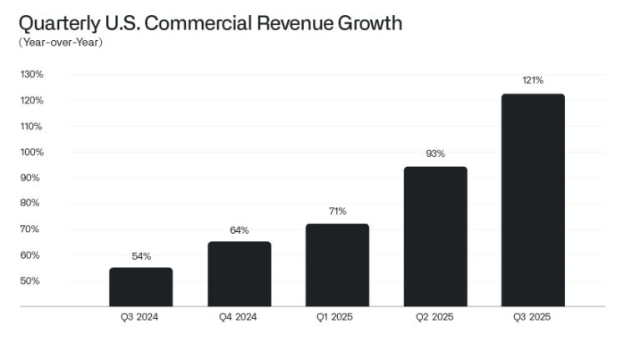

Importantly, U.S. commercial revenue guidance was revised upward to exceed $1.433 billion, implying at least 104% year-over-year growth. This projection reflects Palantir’s success in converting pilot projects into large-scale contracts as enterprises increasingly rely on AI-driven decision intelligence systems.

The expanding mix of commercial revenue, coupled with long-term government partnerships, positions Palantir to maintain steady growth while diversifying its revenue base. Its ability to balance innovation and financial discipline gives the company a unique competitive advantage in the enterprise AI landscape.

While the fundamentals and outlook remain strong, valuation remains an important consideration. Based on training 12-month EV-to-EBITDA, PLTR is currently trading at 1227X, way above the industry’s 14.43X. If we look at the forward 12-month Price/Earnings ratio, the company’s shares are currently trading at 249.37X forward earnings, well above the industry’s 36.77X.

Palantir’s stock has already priced in a significant portion of its near-term growth, following a sustained rally driven by investor enthusiasm for AI-related companies. The challenge now lies in maintaining its rapid growth rate while expanding into new industries and international markets.

Any slowdown in government spending or delay in large commercial contract conversions could create temporary volatility. However, the company’s long-term prospects in AI integration, automation and data-driven intelligence remain solid, supported by strong cash reserves and scalable software platforms.

Palantir’s third-quarter results highlight exceptional execution, record revenues, strong profitability and expanding commercial momentum. The company’s consistent free cash flow generation and raised outlook underline its financial resilience and growing market relevance in AI-powered enterprise solutions. However, given its elevated valuation and the need for sustained commercial expansion to justify further upside, PLTR currently appears best suited for a Hold rating. Investors may wait and watch how the company sustains growth over the next few quarters before adding new positions. Long-term holders, however, can remain confident in Palantir’s robust fundamentals and strong leadership in the AI software space.

PLTR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nvidia NVDA remains a cornerstone of the AI ecosystem, with its GPUs powering machine learning and data center growth. As enterprises accelerate AI deployment, NVDA’s technology is in constant demand. Nvidia continues to expand its product lineup and partnerships to stay ahead of competitors. For investors, Nvidia represents a long-term growth opportunity in the AI hardware and infrastructure market.

Microsoft MSFT continues to lead in AI integration through Azure and its productivity tools. With the rapid adoption of Copilot and strong cloud momentum, Microsoft is cementing its role as an enterprise AI leader. Microsoft’s investments in AI partnerships and infrastructure signal confidence in sustained demand. For investors seeking diversified AI exposure, MSFT remains a reliable long-term play.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 min | |

| 8 min | |

| 10 min | |

| 26 min | |

| 34 min | |

| 35 min | |

| 37 min | |

| 42 min | |

| 44 min | |

| 47 min | |

| 48 min | |

| 51 min | |

| 55 min | |

| 55 min |

Broadcom Stock, Fiber Optic Star Ciena Step Up To Earnings Plate After Nvidia Carnage

NVDA

Investor's Business Daily

|

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite