|

|

|

|

|||||

|

|

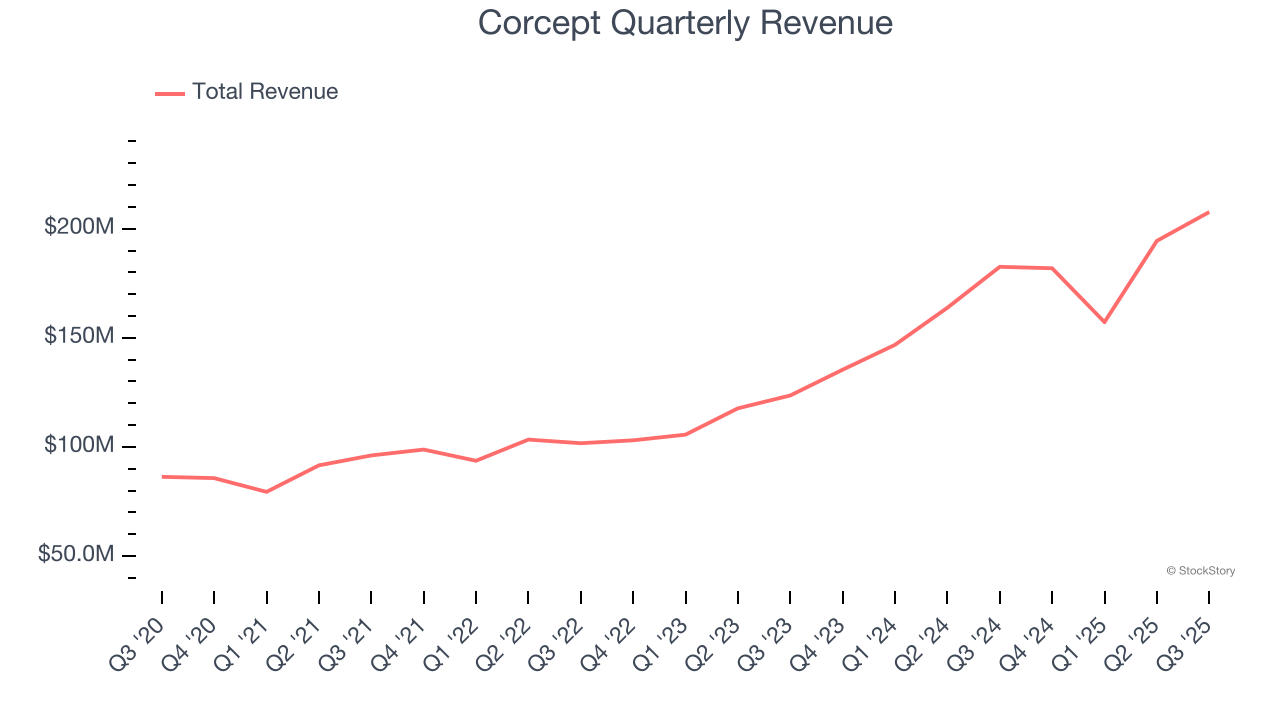

Biopharma company Corcept Therapeutics (NASDAQ:CORT) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 13.7% year on year to $207.6 million. The company’s full-year revenue guidance of $825 million at the midpoint came in 3.3% below analysts’ estimates. Its GAAP profit of $0.16 per share was 18.4% above analysts’ consensus estimates.

Is now the time to buy Corcept? Find out by accessing our full research report, it’s free for active Edge members.

“The third quarter marked another period of robust growth in our hypercortisolism business. Once again, we had a record number of new prescriptions written for Korlym® and continued to add to our base of prescribers. Growing recognition among physicians of hypercortisolism’s true prevalence and the necessity of appropriate treatment is driving higher rates of screening and diagnosis. Our financial results don’t fully reflect this surge in demand, given capacity constraints at our previous specialty pharmacy vendor. We have modified our 2025 revenue guidance to $800 – $850 million. We added a new specialty pharmacy on October 1st and will add others in the coming months. We are confident that these additions will allow us to meet the increasing demand that we now see every month,” said Joseph K. Belanoff, M.D., Corcept’s Chief Executive Officer.

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ:CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

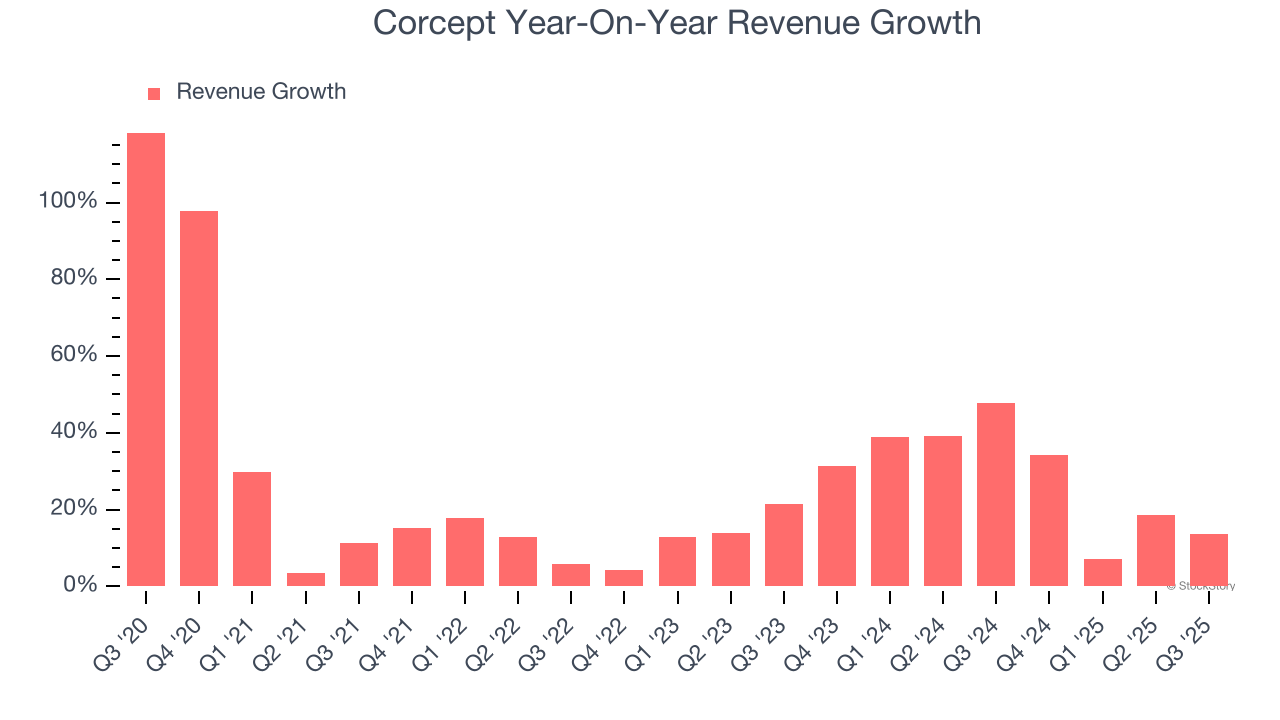

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Corcept’s sales grew at an excellent 21.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Corcept’s annualized revenue growth of 28.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Corcept’s revenue grew by 13.7% year on year to $207.6 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 43.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

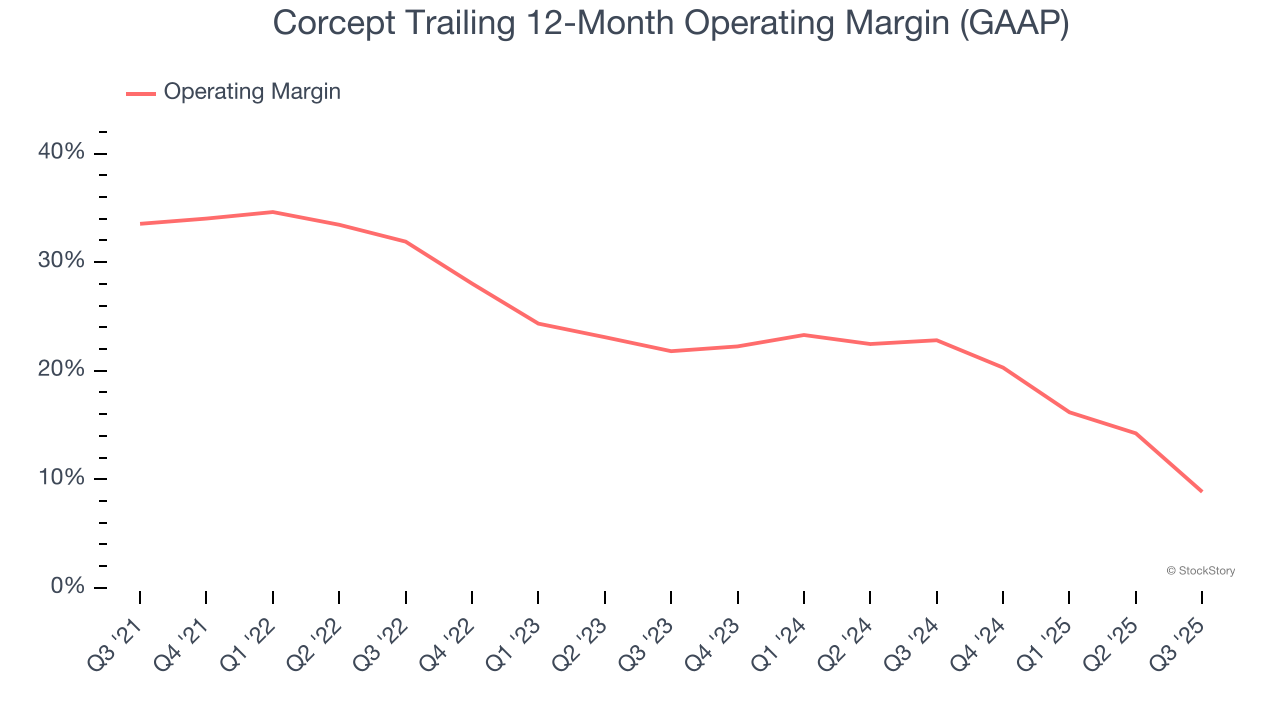

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Corcept has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 21.5%.

Looking at the trend in its profitability, Corcept’s operating margin decreased by 24.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 13 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Corcept generated an operating margin profit margin of 4.9%, down 20.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

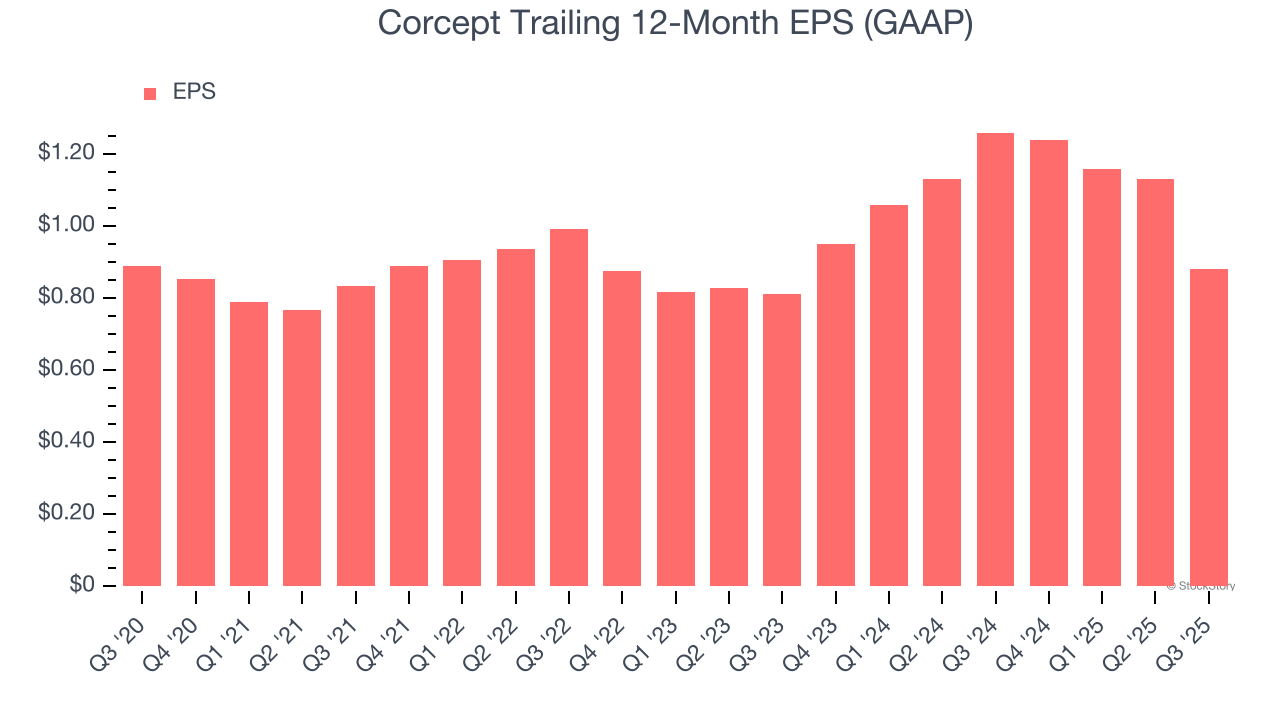

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Corcept’s flat EPS over the last five years was below its 21.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Corcept’s earnings can give us a better understanding of its performance. As we mentioned earlier, Corcept’s operating margin declined by 24.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Corcept reported EPS of $0.16, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Corcept’s full-year EPS of $0.88 to grow 59.4%.

It was good to see Corcept beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.1% to $68.95 immediately after reporting.

Corcept may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| 2 hours | |

| Feb-16 | |

| Feb-04 | |

| Jan-30 | |

| Jan-25 | |

| Jan-23 | |

| Jan-23 | |

| Jan-23 | |

| Jan-23 | |

| Jan-22 | |

| Jan-22 | |

| Jan-22 | |

| Jan-22 | |

| Jan-22 | |

| Jan-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite