|

|

|

|

|||||

|

|

Corcept Therapeutics CORT reported third-quarter 2025 earnings of 16 cents per share, which missed the Zacks Consensus Estimate of 18 cents. The company had reported earnings of 41 cents per share in the year-ago quarter.

Revenues in the third quarter increased around 14% year over year to $207.6 million. The figure, however, missed the Zacks Consensus Estimate of $219 million. The top line solely comprised product sales of the Cushing’s syndrome drug, Korlym.

Shares of Corcept were down 4.6% in after-hours trading on Nov. 4, owing to weaker-than-expected results and a lowered financial outlook for 2025.

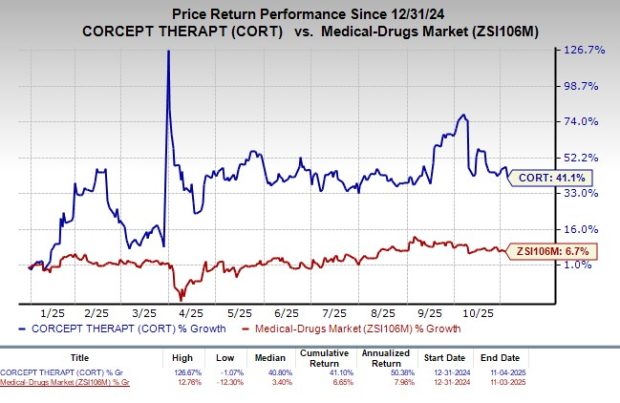

Year to date, shares of Corcept have rallied 41.1% compared with the industry’s rise of 6.7%.

Revenues from Korlym missed our model estimate of $222.6 million.

Research and development expenses rose 16% year over year to $68.8 million.

Selling, general and administrative expenses increased around 68.2% year over year to $124 million.

Consequently, operating expenses increased 30.8% year over year to $197.4 million in the third quarter.

Cash and investments, as of Sept 30, 2025, totaled $524.2 million compared with $515 million as of June 30, 2025.

Corcept lowered its total revenue guidance for 2025.

For the full-year 2025, the company now expects total revenues in the range of $800-$850 million compared with the earlier projection of $850-$900 million.

The Zacks Consensus Estimate for total revenues in 2025 is pegged at $852.2 million.

Corcept is developing its lead pipeline candidate, relacorilant, for treating Cushing's syndrome as well as certain cancer indications.

In December 2024, the company submitted a new drug application (NDA) for relacorilant to the FDA for the treatment of patients with hypercortisolism (Cushing's syndrome). The regulatory body has assigned a Prescription Drug User Fee Act target action date of Dec. 30, 2025.

The FDA accepted a new NDA seeking approval for relacorilant in combination with nab-paclitaxel for treating patients with platinum-resistant ovarian cancer in September 2025. A decision from the regulatory body is expected on July 11, 2026.

Last month, Corcept submitted a marketing authorization application (“MAA”) to the European Medicines Agency, seeking approval for relacorilant to treat patients with platinum-resistant ovarian cancer. A potential nod in Europe is expected by the end of 2026.

Corcept is also evaluating relacorilant plus nab-paclitaxel and Roche’s RHHBY Avastin (bevacizumab) in the phase II BELLA study for treating patients with platinum-resistant ovarian cancer.

Previously, management stated that the BELLA study would help in understanding whether combining relacorilant with two medicines — nab-paclitaxel and RHHBY’s Avastin — offers patients an additional treatment option or not.

A phase II study evaluating relacorilant plus nab-paclitaxel for treating cervical cancer in patients who have received one or two prior lines of therapy is expected to begin shortly.

Another phase II study evaluating relacorilant plus nab-paclitaxel and gemcitabine as first-line therapy in pancreatic cancer is expected to begin in the coming weeks.

The company is also evaluating relacorilant plus Xtandi (enzalutamide) in patients with early-stage prostate cancer. This phase II study is being conducted in collaboration with the University of Chicago.

Corcept is developing its other pipeline candidates, dazucorilant and miricorilant, in separate studies for treating amyotrophic lateral sclerosis and biopsy-confirmed or presumed metabolic dysfunction-associated steatohepatitis, respectively.

Corcept Therapeutics Incorporated price-consensus-eps-surprise-chart | Corcept Therapeutics Incorporated Quote

Corcept currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the biotech sector are ANI Pharmaceuticals ANIP and Arcutis Biotherapeutics ARQT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ earnings per share have increased from $7.25 to $7.29 for 2025. During the same time, earnings per share estimates for 2026 have increased from $7.74 to $7.81. Year to date, shares of ANIP have surged 71.1%.

ANI Pharmaceuticals' earnings beat estimates in each of the trailing four quarters, the average surprise being 22.66%.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 72.3%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 11 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite