|

|

|

|

|||||

|

|

Shares of Ventyx Biosciences VTYX have skyrocketed 156% in the past month. The massive surge in the stock price was primarily driven by the success of the company’s mid-stage study evaluating its investigational candidate, VTX3232, in patients with obesity and cardiovascular (CV) risk factors.

Ventyx Biosciences’ phase II study evaluated the safety and tolerability of VTX3232 compared to placebo, alone or in combination with Novo Nordisk’s NVO blockbuster GLP-1 drug for obesity, Wegovy (semaglutide).

Per the data readout, the phase II study met the primary endpoint as VTX3232 was safe and well-tolerated both as a monotherapy and as an add-on therapy to Wegovy in obese patients.

The study also met its secondary endpoint, demonstrating meaningful reductions in inflammation as measured by high-sensitivity C-reactive protein (hsCRP), which is a widely used metric of liver-derived inflammatory activity and an established indicator of CV risk.

Ventyx Biosciences reported that the VTX3232 monotherapy cut hsCRP by 78% in the modified analysis set (MAS) and by 64% in the full analysis set at week 12 compared to a 3% increase observed with placebo in both analysis sets. Notably, 69% of MAS patients reached target hsCRP levels below 2 mg/L, the critical threshold for determining residual inflammatory risk. Treatment with the candidate also demonstrated statistically significant IL-6 reductions to levels below the threshold for CV risk.

Additionally, the mid-stage study assessed VTX3232’s efficacy on additional inflammatory biomarkers linked to CV risk, on liver steatosis and inflammation, and on metabolic parameters, including lipid levels, glycemic control and weight loss. The drug delivered statistically significant reductions in key inflammatory biomarkers, including Lp(a), fibrinogen and ESR. The therapy also demonstrated a significant reduction in liver inflammation, independent of steatosis, as measured by cT1-corrected MRI.

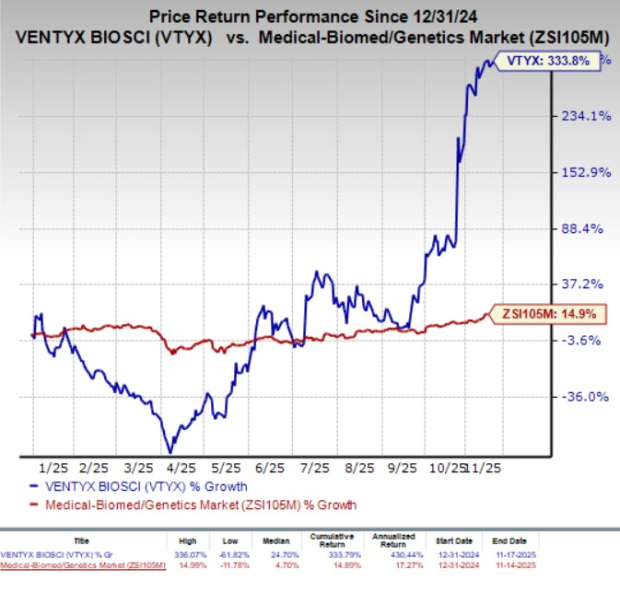

Year to date, Ventyx Biosciences’ shares have surged 333.8% compared with the industry’s 14.9% growth.

In the combination arm, VTX3232 and Novo Nordisk’s Wegovy demonstrated significant reductions in hsCRP, IL-6, fibrogen, ESR, Lp(a) and liver inflammation as compared to Wegovy alone. The combo therapy also demonstrated a statistically significant reduction in liver inflammation as measured by cT1 for patients with at least 5% baseline liver fat. However, VTX3232 did not drive weight loss on its own, and combining it with Novo Nordisk’s Wegovy did not enhance weight-loss outcomes beyond those achieved with Wegovy alone.

Given the encouraging clinical results to date, Ventyx Biosciences believes that combining VTX3232 with Wegovy could offer a compelling adjunct therapy for patients already receiving GLP-1 treatment. As an oral, once-daily pill, VTX3232 represents a potentially transformative opportunity in CV care, supported by growing evidence that directly reducing NLRP3 inflammasome can address core drivers of atherosclerosis, arrhythmias, heart failure, and related cardiometabolic disease. VTYX plans to outline its next steps for advancing VTX3232 in future updates.

Novo Nordisk markets its semaglutide-based drugs as Ozempic and oral Rybelsus (for diabetes) and Wegovy (for obesity). Ozempic and Wegovy are NVO’s key growth drivers, generating DKK 152.5 billion in the first nine months of 2025. In the third quarter of 2025, the drugs reported combined sales of DKK 51.1 billion, representing year-over-year growth of 9% and 23%, respectively.

Apart from the obesity and CV risk indication, Ventyx Biosciences is also developing VTX3232 in a separate mid-stage study for the treatment of patients with early-stage Parkinson’s disease, recently reporting positive top-line results from the same.

The company’s portfolio of NLRP3 inhibitors also includes VTX2735, a peripherally restricted NLRP3 inhibitor, which is currently undergoing mid-stage development for treating recurrent pericarditis, with interim top-line results expected by 2025 end.

Ventyx Biosciences’ inflammatory bowel disease portfolio comprises two investigational candidates, tamuzimod (VTX002), an S1P1R modulator, and cenacitinib (VTX958), a TYK2 inhibitor, being developed for ulcerative colitis and Crohn’s disease, respectively, in separate mid-stage studies.

Ventyx Biosciences, Inc. price-consensus-chart | Ventyx Biosciences, Inc. Quote

Ventyx Biosciences currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include Arcutis Biotherapeutics ARQT and ADMA Biologics ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 87.8%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ADMA Biologics’ earnings per share have increased from 57 cents to 58 cents for 2025. During the same time, earnings per share estimates for 2026 have improved from 88 cents to 90 cents. Year to date, shares of ADMA have lost 10.1%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite