|

|

|

|

|||||

|

|

Shares of Vanda Pharmaceuticals VNDA rallied 21.6% on Tuesday after the company reported positive top-line results from a mid-stage study evaluating tradipitant for the prevention of nausea and vomiting induced by Novo Nordisk’s NVO blockbuster GLP-1 RA for obesity, Wegovy (semaglutide), in overweight and obese adults.

Vanda Pharmaceuticals’ tradipitant is an investigational oral NK-1 RA. Novo Nordisk’s Wegovy injection is also approved for cardiovascular, HFpEF, liver and osteoarthritis indications.

The phase II study enrolled 116 healthy overweight or obese adults who had no prior exposure to GLP-1 agonists. The patients received a 1 mg dose of Wegovy — a level that typically requires nine weeks of titration under current guidelines. They were pretreated with either tradipitant 85 mg twice daily or placebo for one week, and continued the assigned treatment for an additional week after dosing. Study outcomes were tracked through daily patient-reported assessments.

Per the data readout, Vanda Pharmaceuticals’ phase II study was successful and met the primary endpoint, with only 29.3% of tradipitant-treated patients (17/58) experiencing vomiting compared with 58.6% on placebo (34/58), representing a 50% relative reduction.

Additionally, the study also met its key secondary endpoint of lowering the rate of vomiting paired with significant nausea to 22.4% in the tradipitant group (13/58) compared with 48.3% on placebo (28/58). Safety findings were consistent with prior studies, with no new concerns reported.

Vanda Pharmaceuticals highlighted the potential for tradipitant to address one of the most common reasons for early GLP-1 discontinuation – nausea and vomiting – which contribute to real-world dropout rates of 30-50%. Improving early tolerability could meaningfully enhance adherence, enabling more patients to reach and sustain therapeutic GLP-1 doses. The study’s results align with tradipitant’s previously demonstrated performance in multiple motion-sickness studies, involving more than 800 patients, where the therapy reduced vomiting by more than 50%.

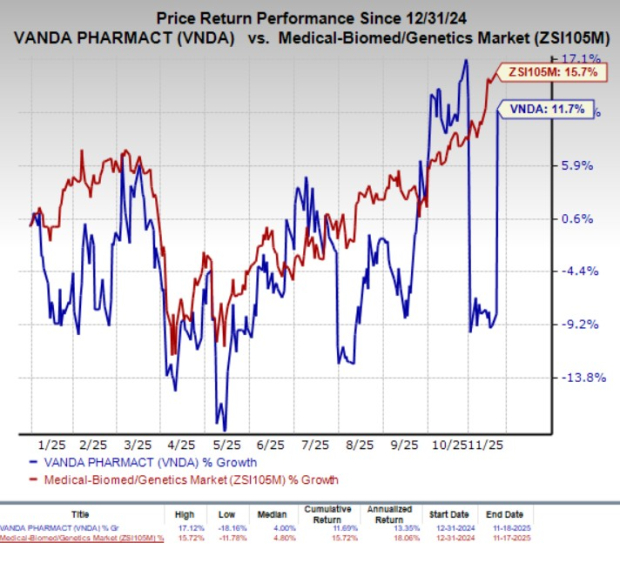

Year to date, VNDA shares have gained 11.7% compared with the industry’s 15.7% growth.

If validated in larger studies, Vanda Pharmaceuticals believes that tradipitant could emerge as a valuable adjunct within the rapidly expanding GLP-1 market, which exceeded $50 billion in the first nine months of 2025.

Early dropout from GLP-1 therapy due to gastrointestinal side effects carries significant consequences for both patients and payors. Patients miss out on the substantial, sustained weight loss benefits of these drugs, typically 15-20%, and lose the associated reductions in diabetes progression and cardiovascular risk. For payors, early discontinuation leads to wasted spending on prescriptions that provide no therapeutic benefit, while the ongoing burden of unmanaged obesity continues to drive higher medical costs, including hospitalizations.

Based on the positive phase II outcomes, Vanda Pharmaceuticals plans to pursue a streamlined development pathway for tradipitant to secure regulatory approval for this unmet need. The company expects to launch a phase III program in the first half of 2026, aiming to position tradipitant as an important adjunct therapy to enhance outcomes for patients on GLP-1 agonists.

Vanda Pharmaceuticals is also currently evaluating tradipitant for the treatment of gastroparesis, motion sickness, and atopic dermatitis. The phase II GLP-1 side-effect study results align with tradipitant’s previously demonstrated performance in multiple motion-sickness studies, involving more than 800 patients, where the therapy reduced vomiting by over 50%. A regulatory filing seeking the approval of the candidate for motion sickness is under review by the FDA, with a decision expected on Dec. 30, 2025.

Please note that Novo Nordisk also markets semaglutide as Ozempic injection and oral Rybelsus, both for diabetes. Ozempic and Wegovy are NVO’s key growth drivers, generating DKK 152.5 billion in the first nine months of 2025. In the third quarter of 2025, the drugs reported combined sales of DKK 51.1 billion, representing year-over-year growth of 9% and 23%, respectively.

Vanda Pharmaceuticals Inc. price-consensus-chart | Vanda Pharmaceuticals Inc. Quote

Vanda Pharmaceuticals currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include Arcutis Biotherapeutics ARQT and ADMA Biologics ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 98%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ADMA Biologics’ earnings per share have increased from 57 cents to 58 cents for 2025. During the same time, earnings per share estimates for 2026 have improved from 88 cents to 90 cents. Year to date, shares of ADMA have lost 8.5%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 |

Novo expands injectable Wegovy offering with European higher dose approval

NVO

Pharmaceutical Technology

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite